Can subsidies effectively tackle housing affordability?

Introduction

Across African cities, the costs of formal housing construction are far outstripping what ordinary residents can afford. Although a typical household in a large African city would struggle to afford a house of over $15,000, construction costs average at over $42,000. This affordability gap in the formal market has led to the growth of informal settlements that often lack the clear land ownership and infrastructure required for rising productivity and liveability. This brief discusses the costs and benefits of demand-side and supply-side housing subsidies in tackling this affordability gap[1][2].

- Demand-side housing subsidies aim to increase consumer purchasing power for housing, either in the form of rent subsidies, or home purchase subsidies. They are typically more efficient than supply-side subsidies as, all other things being equal, they do not cause distortions in the market related to where and how housing is provided.

- Supply-side housing subsidies are aimed at financing housing construction [3]. These subsidies can be a more useful mechanism to lower housing production costs, particularly where local construction industries are underdeveloped and subsidies are integrated into a policy package to grow the local construction industry over time. However, international experience has shown the challenges of incentivising developers to use these subsidies effectively to provide suitable housing in well-located areas.

Both demand and supply-side subsidies can be a useful policy tool to address targeted specific issues in the housing market; for example, where a certain section of the population’s incomes are just too low to afford housing or where the construction industry cannot quite supply a certain segment of the market profitably.

However, these subsidies do not tackle the root causes of the affordability gap. Frequently this gap is created by restrictions in land and construction markets; when subsidies are implemented in such a context, they are likely to be at best insufficient and at worst a hand-out to developers. This is because such restrictions (for example excessively stringent land-use regulations) typically result in a market where suppliers do not respond to price increases by increasing the quantity of housing available. In the presence of this housing supply inelasticity, demand-side subsidies are likely to simply result in price risesand supply-side subsidies are likely to crowd out the supply of unsubsidised housing.

Policy will therefore need to go beyond subsidies to tackle the fundamental constraints in land and construction markets behind an inelastic housing supply, and subsequent high housing production costs relative to incomes.

[1] Collier, P. and Venables, A. J.. (2014). “Housing and Urbanization in Africa : Unleashing a Formal Market Process.” Policy Research Working Paper;No. 6871. World Bank, Washington, DC.

[2] Centre for Affordable Housing Finance in Africa (CAHF website: http://housingfinanceafrica.org/dashboards/benchmarking-housing-construction-costs-africa/

[3] Policies aimed towards mortgage providers (e.g. credit insurance, or refinancing facilities) can be considered as supply-side in that they target suppliers of credit, or as demand-side in that they facilitate mortgaged purchases rather than housing construction. A discussion of mortgage finance is beyond the desired scope of this paper.

Key messages

- Subsidies can be a useful tool if used to target specific housing market segments, but can’t tackle the fundamental reason behind the affordability gap: high housing construction costs.

- High housing construction costs are often caused by artificial distortions in land and construction markets – reforming these can have a much deeper and sustainable impact than subsidies.

- If implementing subsidies, demand-side subsidies are more efficient, but well-targetted supply-side subsidies can enable profitable housing providers to emerge in the longer-term.

Demand-side subsidies

Demand-side subsidies are typically aimed at increasing the purchasing power of renters, or potential buyers. When targeted at renters, these typically take the form of a percentage contribution to rent, or a simple rent voucher. Either way, the subsidy can be altered with income levels to make the policy more or less progressive.

When demand-side subsidies are targeted at buyers, these typically subsidise either the mortgage down payment, or mortgage interest rate. Upfront subsidies for down payments are typically more useful for households who struggle to make large one-off payments, despite reasonably reliable income flows. They are also a relatively transparent and easily calculable subsidy. Interest rate subsidies tend to be more useful for households who are able to make large down payments through savings or access to social networks, but who struggle to afford mortgage payments over time. They are more difficult to calculate as the market real interest rate varies over time, so the extent of the subsidy varies with the real interest rate and the rate of inflation.

Aside from these more conventional subsidies, policymakers can also subsidise innovative rent-to-own schemes where tenants use a portion of their rent payments to contribute to the purchase price of the house they are currently renting. These schemes provide a more flexible purchasing option for households who struggle to save whilst at the same time paying rent. However, rent-to-own schemes are only likely to shift the decisions of households on the margin of being able to afford a home purchase; they are therefore unlikely to have a transformative impact on housing markets where the affordability gap is very large.

Demand-side subsidies are usually more efficient than supply-side ones as they do not create distortions in the market where housing is provided, who provides it, when it is built, and what type of housing is produced. They have been increasingly popular in more developed economies with better-functioning housing markets and higher-incomes; subsidies can therefore be targeted towards particular low-income households where purchasing power is their main barrier to affordable housing.

In many cities, however, the level of demand-side subsidies required to make up the affordability gap is too large and too widespread across the population for governments to finance. Subsidies cannot make up for the fact that incomes are not high enough to afford the type of housing currently being delivered. Delivering a fundamental increase in incomes is less within the scope of short-term housing subsidies, and more within the scope of longer-term infrastructural and educational investments. Furthermore, demand-side subsidies tend to be ineffective in cities where housing supply is constrained by stringent planning restrictions and limited land availability. When these restrictions prevent increases in the quantity of housing provided, demand-side subsidies simply translate into a rise in house prices.

Supply-side subsidies

Supply-side subsidies create more distortions in housing markets as they can affect where housing is built, who it is provided by, and when it is produced. However, they can be an important boost to developers, particularly where local construction industries are not quite developed enough to supply a particular market segment profitably, and subsidies are integrated into a policy package to grow the local construction industry over time. Subsidised housing construction can be implemented in a variety of ways including direct government provision, capital grants, government-subsidised loans, or tax breaks for developers. However, research in this area highlights two key considerations:

- Subsidies alone do not solve underlying cost problems. Bringing housing costs down requires reducing the cost of housing’s three key inputs: land, infrastructure and property construction. One way to do this is through government subsidies. However, these are generally insufficient to plug affordability gaps alone; a more sustainable solution is to tackle the factors that make the costs of these inputs so prohibitively high in the first place.

Furthermore, when implemented in the context of restrictions (e.g. on land supply) that create housing supply inelasticity, supply-side subsidies cannot increase the total housing stock, but rather serve to crowd out unsubsidised housing with housing built by subsidised developers (see technical annex).

- Transparent calculation of subsidy levels enables effective policy. Such calculations need to include hidden costs, such as the opportunity cost of lost tax revenues, and be expressed in terms of present values, as in the case of subsidies on future interest rates. Under-attention to the often complex calculations required for this has led to significant subsidy cost underestimates [4].

Where governments do subsidise developers, often in return for the construction of a certain level of housing at affordable prices, effective provision is aided by:

- Incentivising developers to build in well-located areas. This can be aided by ensuring that restrictions on infrastructure and property quality that accompany subsidies do not force developers to cut costs on land. South Africa’s housing subsidy programme for example, by fixing ceiling costs, minimum floor areas and land-use standards, establishes land as the only variable which developers have to reduce costs to make housing more affordable. Developers can be further incentivised to build in well-located areas by removing the constraints to often well-located and under-utilised public land being used for housing development.

- Reducing monopoly power of developers. This can be aided by an open and competitive bidding process for construction subsidies. However, open and competitive initial bidding processes are insufficient to tackle monopoly power. Monopoly power is reestablished once the government contracts with a particular developer and incurs initial sunk costs related to negotiation or to construction. This power can then be used to renegotiate the contract at government expense. In the transport sector in Latin America, 78% of public-private partnership contracts have been negotiated within 3 years, and typically cause cost increases of up to 3-15% of the initial investment [5]. Knowing this, many firms deliberately produce ‘low-ball’ bids for government contracts in order to later renegotiate.

Internationally, methods for mitigating the effects of costly renegotiations include the establishment of independent panels of experts to adjudicate proceedings; pre-emptively identifying and allocating risks in the initial contract; instituting a ‘freeze period’ of 3-5 years on contract renegotiations; and the preparation of alternative provision mechanisms to ensure the government can credibly allow projects to go bankrupt if they do not meet cost/revenue estimates [6].

- Effective risk sharing systems between public and private actors. When the public sector contracts out subsidised housing delivery, some of the uncertainties associated with costs and with revenues are transferred to the private sector. It is important not to shift all of these risks to the private sector, since they will demand a premium for taking on this risk, resulting in higher subsidies. Instead, it makes sense for contracts to allocate risk according to the ability of each actor to manage it. The private sector is often best placed to handle the risk of construction and operating cost overruns, except in the case of changes in construction regulations. The public sector is often better placed to cover some of the revenue risk the private sector faces in terms of consumer demand for housing.

- Targeting subsidies at alternative housing providers, particularly where formal-sector large-scale housing developers have little experience in providing housing at costs affordable to lower-income residents. Alternative providers could include semi-formal micro-developers who currently provide low-income housing, but have limited access to large-scale financial markets to scale up operations. In Porto Alegre, Brazil, the Social Urbanizer project has legalised and encouraged the activities of previously illegal developers and land subdividers by reforming land-use policies. This has enabled the delivery of fully-serviced land at US$25-28/m2 in contrast to US$42-57/m2 in the previously formal market [7].

Alternative housing providers could also include community-groups that finance home improvements. In Thailand’s 2003 Baan MankongHousing Programme, for example, community collectives were encouraged to pool together resources to negotiate formal land purchases or land-leases from official owners. The government supported this by issuing grants, and subsidised loans to collectives at 4% interest rates not only for land acquisition, but also for housing improvements and infrastructure costs. This enabled the effective upgrading of existing stock and the addition of second and third floors. The share of housing made from durable materials increased from 66% in 2000 to 84% in 2010 [8].

[4] Hoek-Smit, Marja C. (2008) “Housing Finance Subsidies”. in Housing Finance in Emerging Market Economies, Loic Chiquier and Michael Lea eds. Oxford University Press and Web edition, forthcoming , World Bank, Washington DC.

[5] Guasch, J., et al. (2014), “The Renegotiation of PPP Contracts: An Overview of its Recent Evolution in Latin America” International Transport Forum Discussion Papers, No. 2014/18, OECD Publishing, Paris.

[6] Guasch, J., et al. (2014)

[7] Smolka, M. and Damasio, C. (2005) “Porto Alegre’s Land Policy Experiment.” Land Lines, Lincoln Institute of Land Policy, Land Lines April 2005.

[8] Mattingly, M. (2013). “Property Rights and Development Briefing: Property Rights and Urban Household Welfare.” Overseas Development Institute, London.

Tackling fundamental housing market constraints

When the housing supply is inelastic and therefore does not respond to price increases with quantity increases, subsidies are ineffective in increasing the housing supply. In such cases, subsidies will not only be insufficient to address affordability gaps, but also risk simply transferring rents to housing suppliers. Unlocking a supply response therefore requires policy reforms to increase the elasticity of supply, by addressing the fundamental constraints behind high land and construction costs (see technical annex).

Unlocking land for housing requires removing the constraints to, and thus lowering the costs of, obtaining formal land that is well-connected to the city. These include:

- Stringent land-use regulation. Although land-use regulation is often essential for effective zoning and infrastructure rationing, it can hugely raise the cost of land. Land-use regulations in San Francisco for example have increased house prices 20-40% [9]. This can be even more problematic in the developing world where land-use restrictions are often a legacy of colonial planning laws, completely removed from the needs of ordinary citizens. In Dar es Salaam, the legal minimum size of a housing lot is 375m2as compared to approximately 30m2 in Philadelphia, US, at similar stages of economic development [10]. As a result, most urban residents cannot afford to comply with this regulation, frustrating the emergence of a large-scale formal sector housing market to serve this population.

- A lack of infrastructure provision to maintain a well-connected supply of urban land. In 19th century London, the underground and commuter-railway system ensured a constantly expanding supply of well-connected urban land for housing. This was key in meeting the city’s rapidly growing demand for housing. New York’s grid system, created in 1811, played a similar role in expanding the effective urban land supply.

- Challenges in securing well-located public land for housing can be overcome through reforms to public land management. This enables often under-utilised, and well-located government land to be used for housing development.

Construction sector reforms to increase supply elasticity can include:

- Reforming construction regulations. In many cities, regulations on local building materials or incremental housing restrict safe but low-cost construction [11]. In Kigali, reforms to legalise the use of local building materials have helped to bring large numbers of informal households into the formal sector.

- Streamlining permitting and compliance procedures. A recent study in South Africa showed that the township application process for affordable housing developments can last up to 157 months; this is important because a 24-month delay was found to increase development costs by 175%, translating into a 124% increase in sale price [12]. The uncertainty involved also means many investors consider housing to be too risky a sector to invest in.

- Reducing monopoly power which limits the competitive incentive of developers to respond to price rises with increases in quantity. Policy to tackle this is challenging, but reforming contractual procedures and stimulating the growth of alternative housing providers can be useful tools.

[9] Katz, L. and Rosen, K. (1987), “The Interjurisdictional Effects of Growth Controls on Housing Prices”. Journal of Law and Economics 30, 149.

[10] Lall, S. V., Henderson, J. V., and Venables, A. J. (2017), “Africa’s Cities: Opening Doors to the World.” Washington, DC: World Bank.

[11] Wainer, L, Ndengeingoma, B. and Murray, S. (2016). “Incremental housing and other design principles for low-cost housing.” International Growth Centre Final Report C-38400-RWA-1.

[12] Centre for Affordable Housing Finance in Africa (CAHF). (2015). “Understanding the challenges in South Africa’s Gap Housing Market and opportunities for the RDP Resale Market”.

The economics of subsidies: Supply and demand diagrams

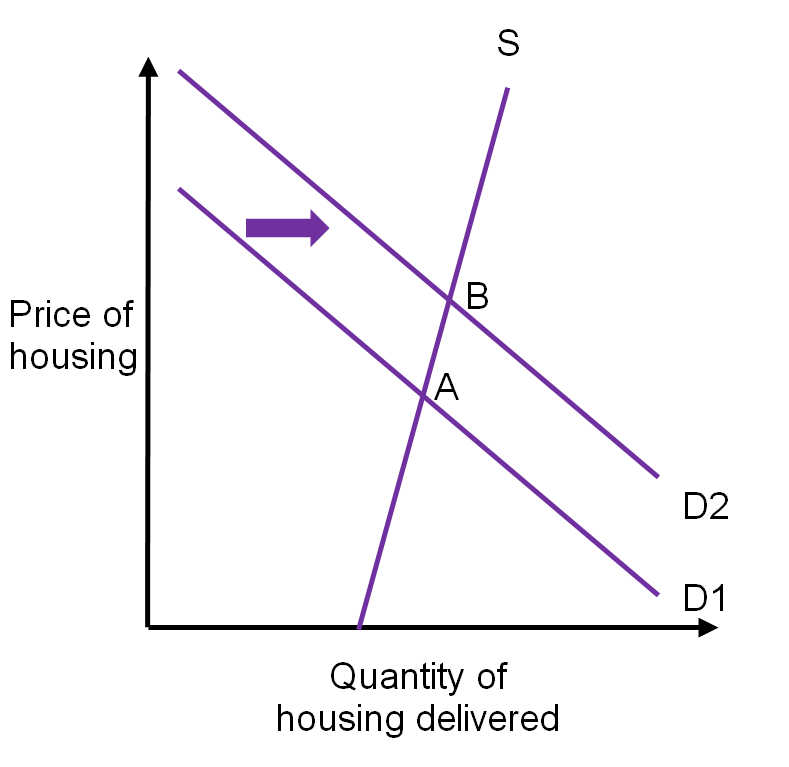

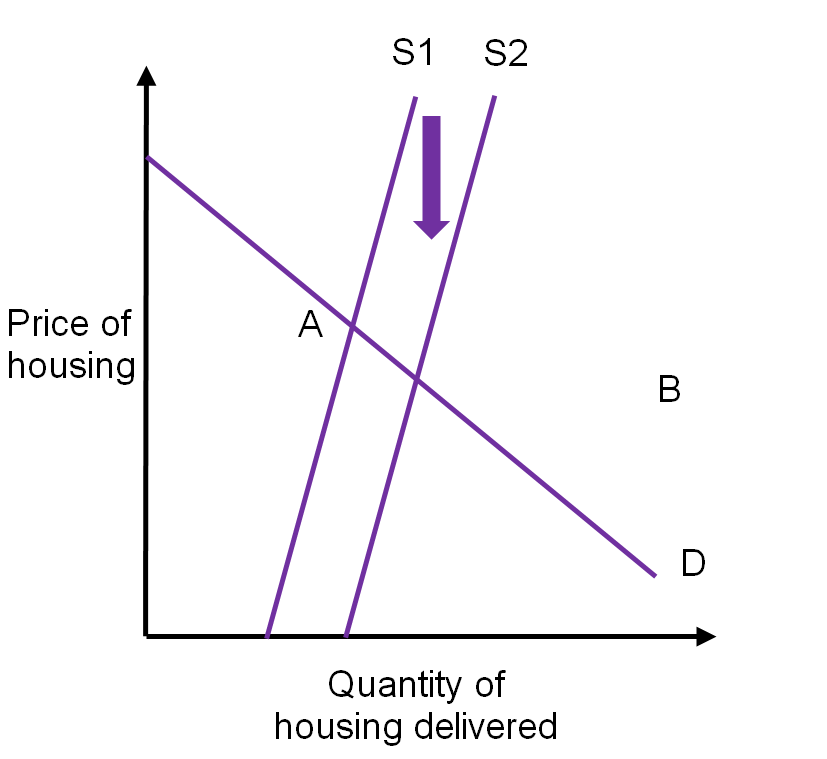

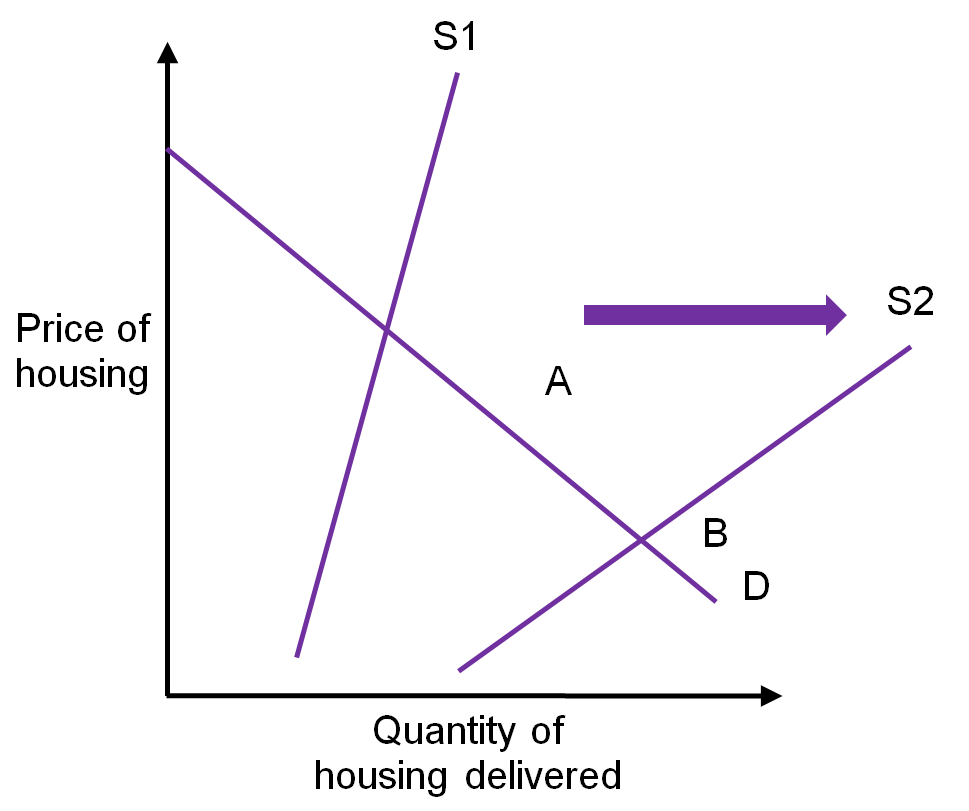

The effect of demand and supply-side subsidies on the housing market can be analysed through supply and demand graphs. This analysis illustrates that in the presence of an inelastic supply curve that prevents supply from responding to price rises, both subsidies are at best ineffective, and at worst a hand-out to developers.

1. Demand-side subsidies

When housing providers are unable to respond to price rises by supplying more housing (e.g. due to a limited supply of well-connected land), the supply curve S rises upwards steeply. This is referred to as an inelastic supply response to price rises.

When a demand-side subsidy acts to shift the demand curve from D1 to D2, the housing market equilibrium moves from point A to point B. The main effect of the demand-side subsidy is therefore an increase in price rather than an increase in the quantity of housing delivered. The price rise translates into increased profits for housing suppliers.

2. Supply-side subsidies

When a supply-side subsidy acts to reduce the price at which subsidised suppliers are willing to provide a certain quantity of housing, this shifts the supply curve downwards from S1 to S2. The housing market equilibrium moves from A to B, resulting in a decrease in price and increase in quantity delivered.

However, if the supply curve is inelastic as some inputs into housing production are relatively fixed in quantity (e.g. land) then these subsidies do not increase the total housing stock but rather serve to crowd out unsubsidised suppliers with subsidised suppliers. In the extreme case where the supply of land is completely fixed, the supply curve is vertical. The subsidy therefore has no effect on quantity, and simply serves to displace non-subsidised housing production.

3. Increasing supply elasticity

When policy acts to increase the elasticity of housing supply (e.g. through reforming land-use regulation or increasing the effective land supply) this enables the private sector to better respond to rises in price by supplying more housing in the market. This makes slope of the supply curve less steep such that the supply curve pivots from S1 to S2.

This movement in the supply curve reduces house prices and increases the quantity of housing delivered. It also has the corollary of making both demand and supply-side subsidies more effective if implemented.

Recommended further reading

Hoek-Smit, Marja C. (2008) “Housing Finance Subsidies” in Housing Finance in Emerging Market Economies, Loic Chiquier and Michael Lea eds. Oxford University Press and Web edition, forthcoming , World Bank, Washington DC.

Collier, P. and Venables, A. J.. (2014). “Housing and Urbanization in Africa : Unleashing a Formal Market Process.” Policy Research Working Paper;No. 6871. World Bank, Washington, DC.

Glaeser, E. (2017) “Reforming land-use regulations”, Brookings Centre on Regulation and Markets