Making the most of urban land

Land is a city’s most valuable resource, but is liable to be badly misused. As cities grow, land risks becoming occupied without coordination or supporting infrastructure, while a few lucky landowners enjoy rising values created by the entire city. Active policy can change this.

-

IGCJ5833-GrowthBrief-UrbanLand_Final_WEB-corrected.pdf

PDF document • 770.43 KB

Introduction

Urban policymakers face decision on land policy that will dramatically shape the future of cities. This brief examines how decisions over land tenure, planning, and taxation affect urban development.

Land use policy determines whether a city becomes an engine or an obstacle for national economic growth. Smart land use creates a platform on which firms and workers cluster together and individuals access basic services. Clustering makes workers much more productive: workers can specialise in a particular skill and form part of a larger-scale production process. But without active land policy, productive clusters are unable to form; instead land becomes occupied through an unplanned process of urban sprawl.

The more productive a city becomes, the more its land appreciates in value. But who captures this gain? The default option is that it gets captured by a few lucky individuals. In the 19th century, the Duke of Westminster became the richest man in Britain purely because he owned the land upon which the city of London developed. Smart public policy leads to a different outcome. In Hong Kong, public ownership and taxation of urban land meant that the government was able to recoup an estimated 80% of infrastructure investments between 1970 and 1991 (Hong, 1996). Public investment was able to finance itself through rising land values.

Land policy plays three crucial roles. By registering and recording ownership claims, it enables an active land market, a prerequisite for efficient land use. Through land use planning, it coordinates land use where the market is unable to. Either through taxation or public land ownership, it determines whether the appreciation of land value is captured by a few lucky individuals or by city governments for the public good.

Key messages

- Urban land rights need to be not only secure, but also marketable and legally enforceable.

Marketable land rights prevent land use from becoming frozen in place. Legally enforceable rights enable land taxation and planning. Making land rights marketable and enforceable typically requires formalisation, but this comes with political and administrative challenges. - Land policy is needed to coordinate firm investment and household settlement. The private sector cannot do this alone.

Without a credible plan for the future city, firms are unable to coordinate investments, whilst homes get built on land needed for vital infrastructure. Governments have three tools with which to coordinate land use: ‘master plans’, infrastructure, and regulation. - The city authority has a clear ethical right to capture some of the land value appreciation created by urbanisation.

Land values increase during urbanisation as a result of surrounding public investments and population growth. City authorities deserve to capture this appreciation, through public land ownership or taxation of private ownership, for the collective good.

Key message 1 – Urban land rights need to be not only secure, but also marketable and legally enforceable.

Effective use of urban land requires rights that are secure, marketable, and legally enforceable.

Secure

Secure land rights, provided formally or informally, ensure certainty over future ownership, which is essential for investment. However, in many developing cities, security of land tenure does not come from governments, but from costly private activity. Individuals are forced to spend resources and time guarding their property, whereas security can be provided more effectively and legitimately by the government. In Lima, for example, a largescale land titling programme increased the rate of housing investments by over 60%, whilst at the same time giving owners the security to leave their homes and travel to different parts of the city to find work (Field, 2005, 2007).

Whilst the importance of tenure security for investment has been well documented, marketable and legally enforceable land rights that allow for urban transformation are equally crucial for rapidly developing cities.

Marketable and legally enforceable land rights that allow for urban transformation are equally crucial for rapidly developing cities.

Marketable

Marketable land rights facilitate the transfer of land to its highest value use. This provides the foundation for urban transformation; farmland can be converted to housing blocks, and housing blocks to skyscrapers. Where land is exchanged for credit on financial markets, this also unlocks its use as collateral for large-scale loans and mortgage markets (De Soto, 2000). Currently however, in many low-income cities, land rights are not easily marketable. This is largely due to the absence of formalised land records that allow legal recognition of new owners and generate publicly available information on land prices. Without marketable land rights, cities sprawl outwards while prime central land remains either vacant or underdeveloped. In Harare and Maputo, for example, more than 30% of land within five kilometers of the central business district is unbuilt (Lall et al., 2017).

A recent estimate prices the welfare cost of poorly functioning informal land markets in central Nairobi at $16,000 – 17,000 per household.

A recent estimate prices the welfare cost of poorly functioning informal land markets in central Nairobi at $16,000 – 17,000 per household (Henderson et al., 2017).

Legally enforceable

For security and marketability to work in practice, land rights must be legally enforceable by courts, police, and public records. Without this, there is significant scope for corruption. In Nairobi, unclear property rights in the Kibera slum area have left a vacuum for a minority of well-connected bureaucrats to claim ownership over much of this land. Making land rights legally enforceable does not just benefit the private sector; it also enables governments to impose obligations on landowners for the public good through taxation and planning requirements.

Informal systems of land rights can provide an important degree of tenure security, particularly where they are based on long-standing ownership claims. However, they struggle to generate open land markets and are challenging for governments to enforce. Delivering marketability and enforceability often requires a stronger role for the government in formalising land rights. Freehold or long-term leasehold titles are the gold standard for this.

Participatory land mapping helps overcome competing claims over land rights in Jalalabad, Afghanistan. Photo: USAID Flickr

Overcoming challenges to formalising land rights

Shifting to formalised tenure systems is a financially and politically costly process. In Tanzania, for example, complex surveying processes inflate titling costs to over $3,000 per individual land parcel – well above average annual per capita incomes (Ali et al., 2014). Unsurprisingly, many low-income residents choose not to follow this process. Simultaneously, the same piece of land is often claimed by a number of different occupants and quasi-legal owners, making registration subject to strong resistance from those who stand to lose out.

Rwanda’s 2009 – 13 Land Tenure Regularisation Programme offers a useful example of how countries can grapple with these challenges. To survey land, local para-surveyors demarcated plot boundaries in the presence of the whole community, and recorded plots using satellite and aerial photographs. Almost all land in the country was formally registered in one large-scale process, at a cost of only $6 per parcel. By encouraging entire communities to participate in resolving boundary disputes, competing claims were resolved openly and cost-effectively. Such low-cost programmes may be less precise in establishing exact plot boundaries, but can provide a decent basis for taxation, planning, and land sales.

Even once registers are established, effective legal institutions and administrative systems are needed to govern and maintain them. In Buenos Aires, even though a large-scale land titling programme in the 1980s unlocked significant investment and property tax revenues, 78% of property transfers since registration have taken place informally. This is the result of high costs involved in registering transfers (Galiani and Schargrodsky, 2016).

Overcoming the challenges of land right formalisation is an investment in the future of a city. By formalising land, the government can leverage rising land values to finance urban infrastructure, and the private sector can use land as a platform for the city’s productivity. Formal registration of land in Rwanda meant that the government was able to increase its land-related revenues five-fold from 2011 – 13 (World Bank, 2014), and significantly enhance its investment environment.

Key message 2 – Land policy is needed to coordinate investment and settlement. The private sector cannot do this alone.

Land markets alone do not ensure efficient land use in a city. There is an essential role for government coordination to provide an anchor for private activity. This is particularly important in developing cities. At early stages of urban development, private firms face a coordination problem: often no one firm is willing to make risky large-scale investments without assurance that others will do the same. Where investments are made, they can also have significant negative effects on surrounding activity. Households face a similar coordination problem: unplanned settlements regularly obstruct the provision of public infrastructure that could provide connectivity and services for residents. When built on floodplains, these settlements can put whole cities at risk.

Governments have three tools with which to achieve coordination: urban ‘master plans’, infrastructure investment, and land use regulation.

Urban ‘Master Plans’

Spatial planning for a city is essential so that both city authorities and firms know what to expect for future development. Yet in many low-income contexts, the pace of urbanisation has far outstripped the city authority’s planning capacity. This is particularly severe in sub-Saharan African cities. For example, settlement without planning has resulted in only 10% of urban land being devoted to roads – compared to around 30% in cities in other parts of the world (Collier and Venables, 2016). Poor planning today stores up costly problems for the future. Retrofitting infrastructure after settlement has already occurred is up to three times more expensive than installation alongside housing construction (Fernandes, 2011). Also, it is difficult to retrofit infrastructure on a large scale without significant slum clearance.

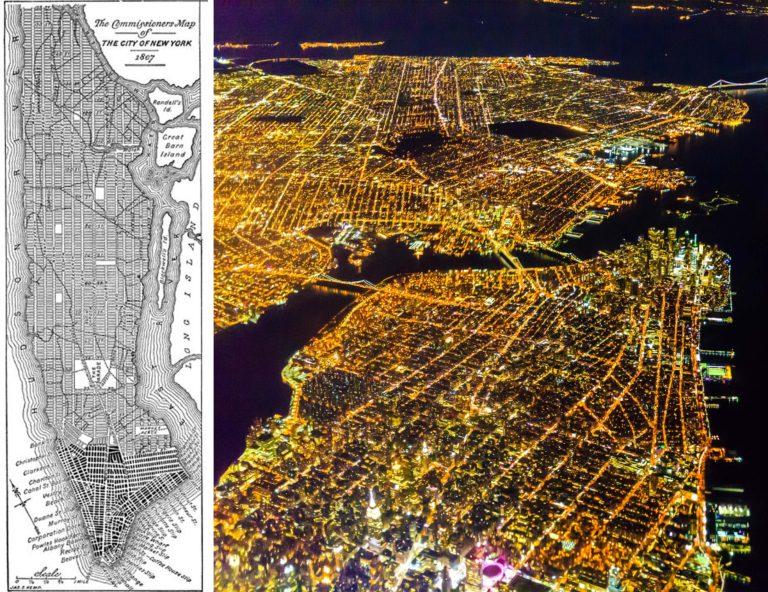

Proactively planning for the rapid growth of cities can prevent them from becoming locked in low trajectory growth patterns. One low-cost way of doing this is through demarcating land for arterial roads and other core infrastructure on the urban periphery before settlement occurs. This was the approach adopted by the City of New York in their 1811 Commissioners Plan. This plan mapped and demarcated a grid system of roads on undeveloped agricultural land in Manhattan, anticipating a seven-fold expansion of the city’s footprint. As the city expanded, demarcated land was acquired for roads, enabling structured and connected urban development. The same grid system created by these plans carries New York’s traffic today, with water and sewerage infrastructure built underneath.

However, for firms and households to use them as a basis for long-term investments, plans need to be credible and realistic. This is not the case in many developing cities. Proposals are regularly based on imported designs or colonial land use, and include plans for multistorey buildings and wide roads unfit for current purposes. In Harare, for example, urban land use plans were originally designed for families with a much higher level of income than was realistic. The result is that these plans are largely ignored.

Infrastructure investment

Beyond planning on paper, city authorities often need to go a step further in anchoring expectations by actually building the key infrastructure that defines the shape of a city. By putting in place the roads, electricity grids, and water supply that firms and households need to operate and survive, governments can effectively incentivise activity according to urban plans. Infrastructure as a signal for future development is particularly important for large firms making risky investment decisions. Concentrating large-scale infrastructure for transport and power in high-connectivity industrial zones not only supports the process of firm clustering, but also enables effective use of limited resources to build such infrastructure.

Signalling these investments can be done in a way that doesn’t require significant resources and time. In the Colombian city of Valledupar, for example, a future grid system has been demarcated by planting trees on acquired land, along the sides of future roads. This provides a visible and popular signal of future transport links to limit costly and disruptive resettlement in the future.

The grid system laid down by the 1811 Commissioners Plan (left) is still in place in New York to this day (right). Left source: History of Architecture CCA, 2009. Right source: Getty

Land use regulations

Regulation can be a powerful tool to address some of the negative externalities that result from development. Zoning regulations, for example, are often needed to prevent households from settling in unsafe areas, and to prevent polluting industrial firms from locating near households that could be adversely affected.

However, in many cases, land use regulations can do more harm than good, particularly where they seek to restrict density levels in a city. Regulations on minimum lot sizes or maximum floor area ratios are widespread in developing cities. In theory, these can be useful in coordinating land use for firms and households with their infrastructural needs. In practice, however, density regulations are often too stringent, paralysing the formal property market. In Dar es Salaam, for instance, the minimum lot size is 375 square metres – as compared to 30 square metres in Philadelphia’s early stages of development (Lall et al., 2017). As a result, the vast majority of the city cannot afford to comply with such a regulation, and so are priced out of the formal market. Low-income housing is effectively criminalised. The result is informal, unplanned urban sprawl. Evidence suggests that lifting height restrictions in Bangalore, India, would result in a 17% reduction in city size, reduce commuting costs, and increase household savings by between 1.5% and 4.5% of earnings (Bertaud and Brueckner, 2005).

Key message 3 – The city authority has the right to capture land value appreciation created by urbanisation.

Urban land value capture offers an ethical and efficient source of revenue for cities to fund themselves. Increased land values in a city are not generated primarily by the actions of the landowner, but by increased demand for land that comes from population growth and rising incomes, as well as nearby public investments. In Accra, for example, properties serviced with tarred roads and concrete drains are 1.8 times more valuable that those without (Awuah et al., 2013). Harnessing the value of land enables a virtuous cycle where appreciating urban land and property values finance the public investments which make the city more productive.

There are two key mechanisms for land-value capture: the taxation of private ownership, and public ownership of land.

Taxation of private ownership

Annual taxation of urban land values has long been proposed by economists as an efficient and fair form of revenue generation. Taxing land is efficient because the supply of land is fixed, so taxation does not reduce the amount produced. It is fair because the rising value of land is primarily created by public investment and population growth, rather than the private actions of the owner.

Although only taxing land is the most efficient option, often governments tax the value of properties built on land as well. This is administratively easier and allows policymakers to progressively tax individuals with higher value property at a higher rate. In Lagos, successive land and property tax reforms have increased state revenues from taxes five-fold to over $1 billion in 2011 (Paice, 2015). Strong resistance to these taxes from property owners has been overcome in part by combining taxation with visible improvements in local infrastructure.

One-time fees offer an additional source of underutilised land value capture for many developing cities. These are levied based on increases in land values that result from the granting of planning permissions or nearby public investments. In Bogota, up to half of the city’s arterial road network has been funded by ‘betterment’ levies charged to land owners on the basis of rising land values (Uribe, 2009). Similarly, development fees can be levied on property developers in exchange for public infrastructure investments to be made or planning permissions to be granted. This pre-agreement is likely to make them politically easier to collect. In Latin America, simply converting a piece of land from being officially ‘rural’ to ‘urban’ increases its value five-fold (Smolka, 2013) – cities can negotiate fees for such conversions to enable a win-win for the city and the landowner.

Public ownership of land

Governments can also capture increases in the value of urban land by owning land in the city themselves. In Hong Kong, where almost all land is government-owned and leased to private holders, charging lease fee payments and land rents (as well as property taxes) has enabled the government to recoup 80% of annual infrastructure investments through land-related revenues (Hong, 1996).

However, for government land ownership to work well, transparent institutions are needed to manage land lease allocation. Without these, the result can be inefficient allocation of land based on political patronage (Moyo et al., 2015). Furthermore, in contexts where land is not currently owned by the government, it can be highly politically challenging for the government to establish ownership.

Where governments do need to acquire land, this is best facilitated through land markets. However, voluntary transactions are not always able to provide governments with the particular land needed for vital infrastructure projects such as roads and railways. In many cities, the announcement of an infrastructure project actually fuels investors to speculatively invest in the land the government is about to acquire, driving up land prices to unaffordable levels. Governments have to pay for the increased land value that their own planned investments create. Payment to landowners at the market value of their land and property before redevelopment projects are announced prevents this. It also enables adequate compensation to be paid to those tenants and businesses displaced by acquisition who are not landowners.

Singapore adopted an even more uncompromising attitude to landowner compensation in the 1970s to facilitate large-scale urban transformation with limited public funding. By fixing future compensation payments at the value of land in 1973, Prime Minister Lee Kuan Yew paved the way for extensive land acquisition, and enabled the government to capture massive land value appreciation as the city developed.

“I saw no reason why private landowners should profit from an increase in land value brought about by economic development and the infrastructure paid for with public funds.” -Singapore Prime Minister Lee Kuan Yew, 2000

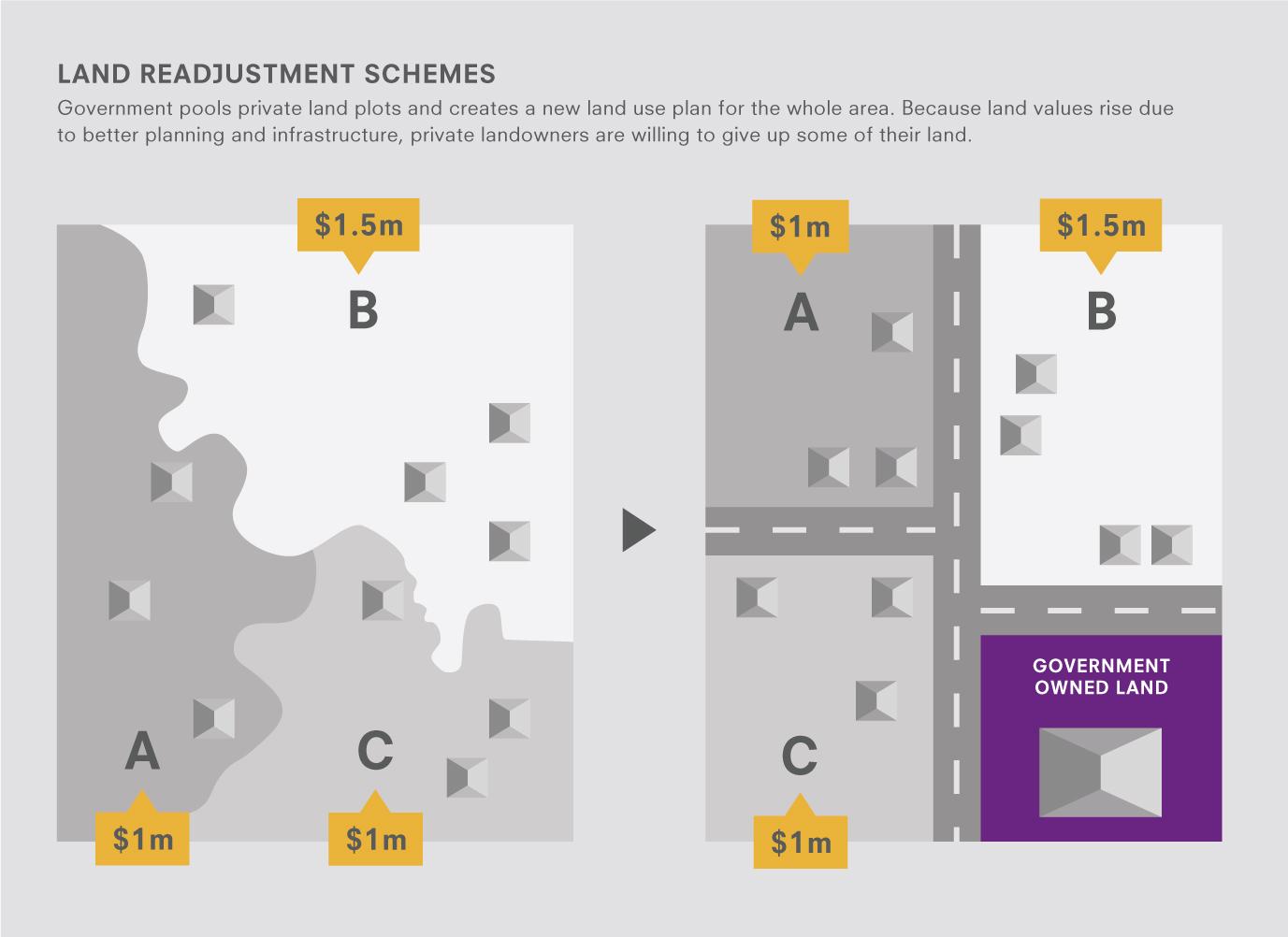

Where compulsory land acquisition is too politically or financially costly, land readjustment can provide a more attractive way to increase efficiency of land use and transfer some ownership of land to governments. Under readjustment schemes, governments pool together privately-held land plots and create a new land use plan for the whole area. These plans include new infrastructure provided by the government, which increases the value of each surrounding plot. Because land values rise due to better planning and infrastructure provision, private landowners are willing to give up some of their land to the government. Land value capture happens through the exchange of land itself. Governments are able to acquire selected, strategic land parcels which can either be used for the planned infrastructure investments, or leased or sold to recover the costs of delivering infrastructure. In South Korea, landowners agreed to release up to half of their land under land readjustment schemes in the 1940s. These enabled public investments in infrastructure and public spaces to be largely self- financing (Lozano-Gracia et al., 2013).

Such schemes require effective institutional structures. Angola offers a striking example of two diverging experiences with land readjustment based on different institutional structures. In one successful scheme, the local government that implemented the project directly received the land payments required to finance this. However, in a second scheme, the municipal authority was not able to collect land payments itself. The latter scheme was therefore underfunded, and ultimately led to corruption as wealthy landowners gained control over the replotting process, and used it simply to increase their landholdings.

Figure 1: Land readjustment schemes

Some practical policies

Unlocking the potential for the city’s most valuable asset entails addressing dysfunctional land markets, realistic planning, and using appropriate instruments for capturing rising land values for the public good. Below are four key policies which can enable cities to use their land more effectively.

- Large scale, participatory land registration schemes significantly reduce the cost of moving towards formalised tenure. City authorities can learn from the successes of other programmes in establishing land rights that are secure, marketable, and enforceable.

- Forward-looking and realistic plans, backed by anchoring infrastructure investments, establish the coordination required for well-functioning cities. Without such coordination, firms do not cluster and settlement sprawls.

- Policymakers should be careful of imposing excessively stringent land use regulations, which can have severe unintended consequences on house prices and push ordinary residents into informal housing. By revising these, city authorities can bring households into the formal sector at limited costs.

- Land value capture is a means for urbanisation to finance itself. Public ownership of land and taxation of private ownership are both useful and legitimate means of achieving this.

References

Bertaud, Alain, and Jan K. Brueckner. 2005. “Analyzing Building-Height Restrictions: Predicted Impacts and Welfare Costs.” Regional Science and Urban Economics 35 (2): 109–25.

Fernandes, Edesio. 2011. “Regularization of Informal Settlements in Latin America.” Lincoln Institute of Land Policy.

Field, Erica. 2005. “Property Rights and Investment in Urban Slums.” Journal of the European Economic Association 3 (2–3): 279–90.

Field, Erica. 2007. “Entitled to Work: Urban Property Rights and Labor Supply in Peru.” The Quarterly Journal of Economics 122 (4): 1561–1602.

Galiani, S, and E Schargrodsky. 2016. “The Deregularisation of Land Titles.” NBER Working Paper No. 22482.

Henderson, J. V., Anthony J. Venables, and Tanner Regan. 2017. “Building the City: Urban Transition and Institutional Frictions.” LSE Research Paper.

Hong, Yu-Hung. 1996. “Can Leasing Public Land Be an Alternative Source of Local Public Finance?” Working Paper. Lincoln Institute of Land Policy.

Lall, Somik V., Vernon Henderson, and Tony Venables. 2017. “Africa’s Cities: Opening Doors to the World.” Washington, DC: World Bank.

Lozano-Gracia, Nancy, Somik V. Lall, Cheryl Young, and Tara Vishwanath. 2013. “Leveraging Land to Enable Urban Transformation: Lessons from Global Experience.” World Bank Policy Research Working Paper, no. 6312.

Moyo, S., T Dzodzi, and D Yakham. 2015. “Land in the Struggles for Citizenship in Africa.” Dakar: Council for the Development of Social Research in Africa.

Paice, Edward. 2015. “Lagos Proves Africa’s Property Tax Potential.” The Africa Report, 2015.

Smolka. 2013. “Implementing Value Capture in Latin America: Policies and Tools for Urban Development.” Policy Focus Report Series. Lincoln Institute for Land Policy.

Uribe, Maria Camila. 2009. “Lessons from the Betterment Levy of Bogotá.”

World Bank, Rwanda Land Governance indicators, April 2014.

Yew, Lee Kuan. 2000. From Third World to First: The Singapore Story: 1965 – 2000. Harper Collins.

Citation

Collier, P., Blake, M. and Manwaring, P. (2018). Making the most of urban land. IGC Growth Brief Series 013. London: International Growth Centre.