Regulating mobile money to support scale-up

High transaction costs are one of the most significant barriers to financial access in developing countries. Mobile money has dramatically reduced transaction costs and has extended a more affordable payments system to historically unbanked households, beginning to integrate them into the wider financial system.

-

Synthesis brief: Regulating mobile money to support scale-up

PDF document • 662.82 KB

Introduction

This brief looks at how mobile money can broaden and deepen financial inclusion in developing countries, increasing financial resilience and reducing poverty. It will also discuss the benefits of government adoption of mobile payment services and the critical role for government in appropriately regulating mobile money. The scope of this brief is limited to factors within the remit of policymakers; as such, it does not delve into business model decisions of mobile network operators (MNOs).

Efficient financial systems and broad-based financial access are crucial for economic growth and reducing poverty and inequality (Beck et al, 2007). Yet access to the formal financial system remains limited across much of the developing world. Some 70% of adults in sub-Saharan Africa and 55% of adults in South Asia are outside the traditional banking system (WDI), with the majority of those excluded being poor and/or living in rural areas. Prohibitive distances to the nearest financial services point, high costs of account maintenance, and fees for effecting transactions all exclude the poor from the formal banking system. Mobile money allows users to deposit, withdraw, and transfer funds on their mobile phones without holding an account at a formal financial institution, reducing transaction costs. Affordable, broad-based access to financial services has the potential to benefit both individuals and firms, with positive spillover effects driving broader economic growth.

This brief looks at how mobile money can broaden and deepen financial inclusion in developing countries, increasing financial resilience and reducing poverty. It will also discuss the benefits of government adoption of mobile payment services and the critical role for government in appropriately regulating mobile money. The scope of this brief is limited to factors within the remit of policymakers; as such, it does not delve into business model decisions of mobile network operators (MNOs).

Key messages

1. Mobile money improves financial inclusion and resilience, reducing poverty and furthering economic growth

Mobile money has lowered transaction costs and enabled users to improve their financial wellbeing through improved management of existing financial resources and more effective risk-sharing. It has also influenced job choices and reduced poverty, particularly in female-headed households

2. Government usage of mobile payments services offers significant benefits

Governments can use mobile money to effect social transfers and pay civil servant salaries with reduced leakage and lower delivery costs, and collect tax payments using mobile money which may eventually increase formality and expand the tax base.

3. A flexible regulatory framework that is appropriate to the risk posed by mobile money services works best

To strike the right regulatory balance, the component systems of mobile money should be unbundled from one another, with regulation being developed for each component that is proportional to the level of risk posed by different services.

Key message 1 – Mobile money improves financial inclusion and resilience, reducing poverty and furthering economic growth

The advent of mobile money has allowed for the transfer of resources more cheaply, securely, quickly, and over far greater distances than ever before, reducing transaction costs for low-income and rural households. For example, M-PESA, Safaricom’s mobile payments system in Kenya, has significantly reduced transaction costs for users in terms of distance to the nearest agent, with the average Kenyan household being within 1.4 km of a mobile money agent in 2015, down from some 9.2 km away from the nearest bank branch in 2007 (Suri, 2017).

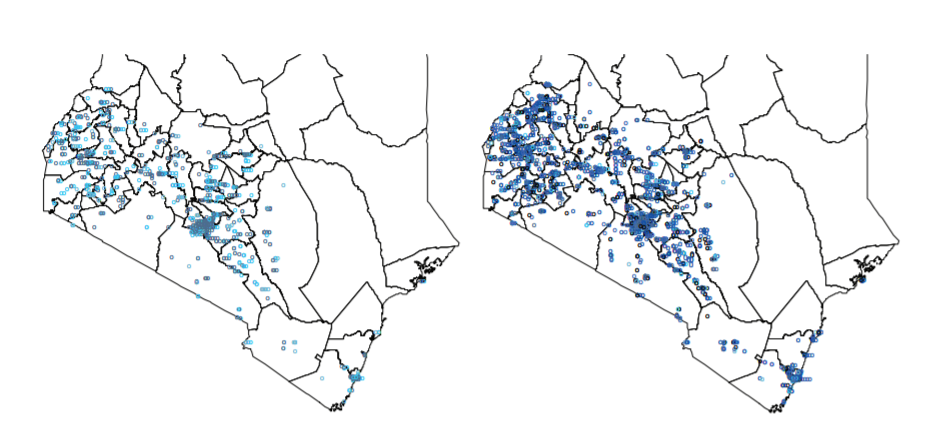

Figure 1: Roll-out of M-PESA agents across Kenya, June 2008 and March 2010

Source: Jack & Suri, 2014. Note: darker dots represent newer waves of agents

The increased resource mobilisation enabled by mobile money has raised consumption and kick-started growth in communities. Mobile money has improved allocations of savings and labour, both in firms and households, and enabled more efficient investment decisions (Aron, 2015).

In Kenya, mobile money access has resulted in an estimated 194,000 households, or 2% of Kenyan households, being lifted out of extreme poverty, with poor female-headed households experiencing a pronounced effect (Suri & Jack, 2016). This appears to be from improved financial behaviour – easier and safer savings, and changes in occupational choice. M-PESA access has empowered an estimated 185,000 women to move out of subsistence farming and into business and retail (Suri & Jack, 2016).

In Kenya, mobile money access has resulted in an estimated 194,000 households, or 2% of Kenyan households, being lifted out of extreme poverty, with poor female-headed households experiencing a pronounced effect.

The benefits of mobile money usage accrue and become more visible as usage increases. The findings in this brief pertain mainly to Kenya, where usage exceeds that of other developing countries (WDI); smaller impacts would be expected for countries with lower usage rates. Transfer fees levied by mobile network operators have a large effect on usage, and flat fees that apply regardless of transaction size, such as the $0.05 levied on every mobile money transaction in Zimbabwe, have a disproportionate impact on low income users and discourage usage.

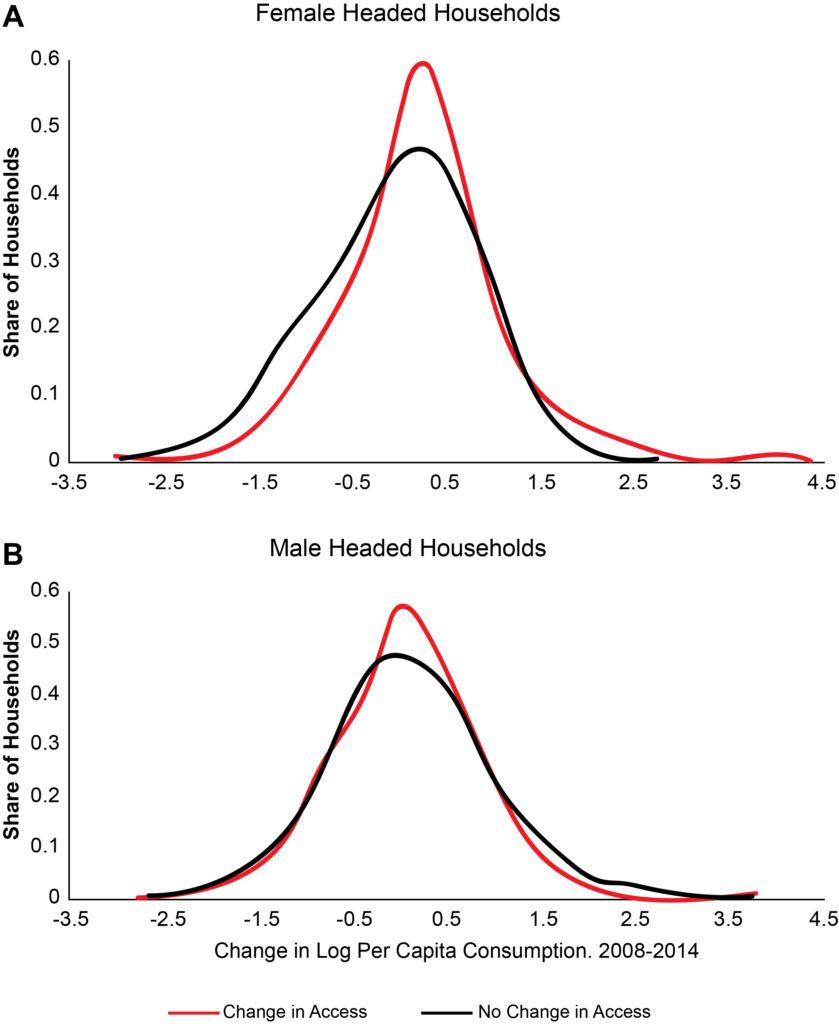

Figure 2: Change in log (per capita consumption) by gender, for households with and without improvements in agent access (growth in agent density), 2008 to 2014

Source: Suri & Jack, 2016.. Note: A) Data for female-headed households; (B) data for male-headed households.

Increasing financial resilience

A core component of financial wellbeing is resilience – the ability to respond to unexpected economic shocks. Households that lack access to formal financial services must rely on informal networks for access to credit, risk-sharing, and insurance. In the past, high transaction costs have meant that households in informal credit and savings networks have tended to be within close proximity to one another. This leaves them vulnerable to experiencing the same economic shocks, including droughts, fires, crop and livestock disease, and flooding, which reduces the risk-sharing potential of the network.

Using mobile money, households can transfer resources across a wider, more diverse network that is less prone to experiencing the same shocks at the same time and can better share risk, allowing informal networks to function more effectively. Evidence shows households with mobile money accounts receive a greater number and value of remittances in the face of a negative shock than households without mobile money accounts (Jack & Suri, 2014). In the face of a medical health shock, for example, mobile money users have been able to spend more on medical expenses while also increasing expenditure on food and keeping children in school (Jack, Stoker & Suri, 2012).

Mobile money products that offer savings and credit facilities, such as M-Pawa in Tanzania, MoKash in Uganda and Rwanda, and M-Shwari in Kenya, further provide users with a buffer against economic shocks or seasonal fluctuations in income. Users can save for rainy days and draw on short-term, uncollateralised micro-loans when needed. Savings and credit access also raises users’ income generation potential by giving them access to finance for productive investments. Recent findings show that the loan component of M-Shwari has improved resilience and increased propensity to spend on education (Bharadwaj, Jack & Suri, 2017).

Such credit facilities would be expected to be beneficial for small firms as micro-loans could ease temporary financing constraints, and firms’ business opportunities may be increased through facilitating transactions with customers. However, take-up rates of M-Shwari micro-loans have been lower than anticipated, suggesting that the loan size on offer may be unattractive (Aron, 2015). More generally, studies on the impacts of micro-financing (not facilitated by mobile money products) have found no transformative effects on the average borrower in terms of income, consumption, health, or schooling expenditure(Banerjee, 2015)1. It remains unclear whether mobile money products offering micro-loans will achieve better outcomes.

Key message 2 – Government usage of mobile payments services offers significant benefits

Tax revenue authorities that allow tax payments to be made using mobile money report higher revenue collection. For example, Mauritius reported a 12% increase in tax revenues in the year after mobile payment facilities were adopted, and in Tanzania, adoption of mobile money tax payments has resulted in less tax avoidance, with users who had no history of paying taxes starting to pay property and personal income taxes for the first time (Scharwatt, 2014). It’s possible that government adoption of mobile payments could expand their tax base.

Mauritius reported a 12% increase in tax revenues in the year after mobile payment facilities were adopted, and in Tanzania, adoption of mobile money tax payments has resulted in less tax avoidance, with users who had no history of paying taxes starting to pay property and personal income taxes for the first time.

Government use of mobile money for social transfers and payment of civil servant salaries would both reduce leakage and recurrent costs of delivery. Scope for leakage is limited through digitisation of transactions and verification of necessary recipient identification that removes ‘ghost recipients’2. Delivery costs are lowered by, among other things, eliminating the need to transport cash to recipients who do not have bank accounts, a delivery system that is inefficient, unsafe, and prone to delay.

In Pakistan, bi-monthly social transfers to low-income households under the Benazir Income Support Programme are made using mobile money, as are Save the Children and World Food Programme subsidies in Malawi. In Afghanistan, teachers and members of the Afghan National Police force now receive their monthly salaries from government via mobile money (Blumenstock et al, 2013).

Government-to-Person (G2P) payments using mobile money are not without their challenges, however, as these transfer programmes indicate. They have found that, for social transfer recipients, using tiered due diligence requirements and being flexible with identification documentation are important to ease customer registration (Almazan, 2013). Working with bank partners is necessary to ensure that agents have sufficient cash float to cater for spikes in demand for cash shortly after transfers or salaries are made, particularly since these payments tend to be lumpy and recipients often withdraw the entire amount in one transaction (Almazan, 2013). Staggering payments throughout the month could ease pressure on agents for cash, as was done with mobile money payments to Ebola response workers in Sierra Leone during the Ebola outbreak.

Governments have also seen the potential of using mobile money platforms to sell products. A frontier innovation of this kind is M-Akiba, a mobile-based product that allows M-PESA users in Kenya to buy and sell a specific government security using their mobile phones.

M-Akiba in Kenya

M-Akiba was developed by the Nairobi Securities Exchange, the Capital Markets Authority, and the National Treasury, among others, to enable M-PESA users to buy and sell a government security on their mobile phones. Users can open central depository accounts using their mobile phone and purchase securities using their mobile wallets in increments as low as KES 3,000 ($28.84). The bonds pay interest into users’ mobile wallets every six months, with interest rates expected to remain higher than market inflation and standard bank interest rates. M-Akiba was designed to offer low-income households access to transformative, low-cost, secure savings instruments that remain highly liquid, and they may become tradable over the secondary market (Aglionby, 2015).

A pilot bond issue was launched in March 2017, with a larger follow up launched in July 2017. Data from the pilot sale shows that, of the 102,600 people registered for M-Akiba at the time, only 5.5% (some 5,700 people) made bond purchases – the average investment was KES 26,359 ($255) and the sale appeared dominated by larger buyers rather than the small mass market that M-Akiba had been intended to serve (Okoth, 2017).

Key message 3 – A flexible regulatory framework that is appropriate to the risk posed by mobile money services works best

A conducive regulatory environment is absolutely critical for sector growth as it affects the design and viability of mobile money services (Aron, 2015). Overly stringent regulation of emerging mobile money sectors drives up compliance costs and hampers sector growth and innovation.

Authorities need to balance adequate risk management against a light-touch approach that encourages innovation and greater access to financial services. This is likely to require unbundling of the component systems of mobile money, separating customer registration from e-money storage, and cross-border transfers from agent management, for example, and then developing appropriate regulation for each component (Aron, 2015). In this way, regulators can regulate each component in proportion to its level of risk (GEG, 2016). The regulatory framework should develop in line with the mobile money sector, becoming more sophisticated as the sector becomes larger and more robust. To achieve this requires ongoing dialogue between regulators and industry actors (GEG, 2016).

It is vital that the roles and responsibilities of the various regulatory authorities involved in the sector are clearly delineated and aligned in order to ensure regulation is coordinated and sufficiently comprehensive. Common aspects of enabling regulatory frameworks include appropriate policies to govern competition policy concerns, reporting requirements, financial protection, and customer protection.

Competition policy concerns. Interoperability and agent non-exclusivity are key competition issues with mobile money. Interoperability allows customers to transact using mobile money across different mobile network operator (MNO) platforms, and agent non-exclusivity allows agents to serve more than one MNO. Where first movers have established sector infrastructure and agent networks, interoperability and agent non-exclusivity would require them to open their infrastructure and agents for use by competitors. Requiring interoperability and agent non-exclusivity arguably promotes competition and yields advantages for customers and new market entrants. However, this impacts MNOs’ ability to recoup their investment costs, making the sector unattractive for investors, and reduced investment would stifle sector growth. A balance, therefore, needs to be achieved by regulators, bearing in mind the market context in question. In this vein, some argue that, as the market matures, regulators should shift from facilitating investment to ensuring adequate competition (GEG, 2016).

Reporting requirements. Mobile money reporting requirements are focused primarily on guarding against platforms being used for illegal activities. Know Your Customer (KYC) due diligence procedures, and anti-money laundering and combating the financing of terrorism (AML/CFT) regulations are required. Tiered registration requirements for customers are recommended to ensure financial inclusion can be realised without undermining financial integrity where usage is higher (Aron, 2015). There are generally limits on both transaction size and the amount that can be held in a mobile money account, and MNOs and banks are required to report regularly on aggregate transaction data, as well as any suspicious activity. Given that mobile money is a very narrow form of banking, these regulations tend to be less stringent for MNOs than regulations applicable to financial institutions (GEG, 2016).

Financial protection. The bank accounts that hold aggregate funds are generally also directly regulated, with mobile money deposits being held in trust or escrow and ring-fenced from the MNO’s other funds to protect against both bank and MNO insolvency. MNOs may choose, or be required, to divide users’ deposits between different banks to mitigate the risk of bank insolvency. Deposit insurance for these pooled accounts may also be an option in some countries, and regulation should provide protection for each customer up to the insurance limit (rather than just protection on the aggregate account) to further protect customers from the risk of bank failure.

There are frequently also rules on whether interest can be earned on the aggregate funds (allowed in Kenya, Afghanistan, and Malawi) or if funds must be kept in 100% cash reserve (as in the Philippines). If interest is earned, the rules should clearly state what is to be done with the interest, such as disbursement to customers (as in Tanzania) or donation to charity (as in Kenya) (Suri, 2017).

Customer protection. Consumer protection concerns include matters of privacy and data protection. MNOs must provide simple and easily understood contracts outlining users’ rights and obligations and be transparent with the fee rates that they charge, both at the time of account opening and at the time of transacting. This is particularly important where the market is new, where customers have low financial literacy, for new products being built over mobile money platforms, and where fee rates change regularly.

Policy recommendations

Mobile phone ownership has increased across much of the developing world in recent years, reaching over 75% of the population in sub-Saharan Africa and South Asia (WDI). This raises the potential for mobile money to be a key tool to broaden and deepen financial access.

However, the mobile money sector continues to face a number of challenges, notably a struggle to achieve operational profitability and regulation that is often stifling to innovation and disproportionately onerous compared to the low risk posed by mobile money functions. Few deployments have reached sufficient scale to become profitable. A major barrier to achieving scale is that transaction fees remain too high for small retail payments (Suri, 2017).

Despite these difficulties, and contrary to the lacklustre results seen under previous micro-financing programmes, mobile money is undoubtedly having positive impacts on economic outcomes, particularly for women. Study findings on the economic impacts of M-PESA may reveal something significant – that the route out of poverty for women may not be an increase in access to financial resources (through credit or grants), but financial inclusion that allows them to better manage existing financial resources (Suri & Jack, 2016).

This brief proposes four policy recommendations:

- As the market matures, governments should ensure adequate competition in the sector.

- Tiered regulation should be used, ensuring that regulation is flexible and proportional to the level of risk posed by different mobile money services and the value of transactions.

- Government should act as a catalyst for sector growth, effecting social transfers and payment of civil servant salaries by mobile money in order to reduce leakage and lower recurrent delivery costs. Government should also develop the platforms needed for tax and other payments to be paid using mobile money, to raise revenues through an expanded tax base.

- To drive continued growth in the sector, innovation in new product development is vital, whether undertaken within MNOs or through opening up platforms to entrepreneurs. New products offer additional benefits for users, and government has a role in designing regulation that supports (rather than stifles) innovation.

References

Aglionby, J. (2015, Sept 28) Kenya launches bond sale via mobile phone. Financial Times.

Almazan, H. (2013) G2P payments and mobile money: Opportunity or red herring? GSMA.

Aron, J. (2015) ‘Leapfrogging’: A survey of the nature and economic implications of mobile money.

Banerjee, A., D. Karlan & J. Zinman (2015) Six randomised evaluations of microcredit: Introduction and further steps. American Economic Journal: Applied Economics 7(1): 1-21.

Beck, T., A. Demirguc-Kunt & R. Levine (2007) Finance, inequality and the poor. Journal of Economic Growth,12(1): 27-49.

Blumenstock, J., M. Callen & T. Ghani (2013) Mobile salary payments in Afghanistan: Policy implications and lessons learned. PEDL Research Papers.

Global Economic Governance (GEG) Programme, Consolidating Africa’s Mobile Banking Revolution Conference Report, Oxford, May 2016.

Jack, W., T.M. Stoker & T. Suri (2012) Documenting the birth of a financial economy. Proceedings of the National Academy of Sciences, Vol. 109(26): 10257-62.

Jack, W. & T. Suri (2014) Risk sharing and transaction costs: Evidence from Kenya’s mobile money revolution. American Economic Review, 104(1): 183-223.

Lonie, S. (2013) The mobile money paradox – If everyone wants it, why is it doing so badly? Consult Hyperion.

Muralidharan, K., P. Niehaus & S. Sukhtankar (2016) Building state capacity: Evidence from biometric smartcards in India. American Economic Review, 106(10): 2895-2929.

Okoth, E. (2017, April 5) M-Akiba hits target with 5000 buyers. Business Daily.

Scharwatt, C. (2014) Paying taxes through mobile money: Initial insights into P2G and B2G payments. GSMA.

Suri, T. & W. Jack (2016) The long-run poverty and gender impacts of mobile money. Science, 354(6317): 1288-1292.

Suri, T. (2017) Mobile money. Annual Review of Economics, 9: 497-520.

World Development Indicators (WDI), World Bank.