How can improvements to revenue collection & administration boost municipal finances?

Introduction

In many developing cities, municipal revenues are insufficient to finance the necessary investments in public infrastructure, services and well targeted policies that can deliver long term growth and rising living standards for a city. A key reason for this in many developing cities is poor revenue administration that limits own source revenues.

Key challenges include:

- Poor database management. Data is often recorded manually and therefore subject to revisions, lacking the transparency and consistency across systems.

- Limited success with revenue outsourcing. The impact of private collection of local government revenues has been mixed across cities. In some, revenues from tax collection increased and became more predictable, in others, outsourcing collection has been accompanied by high levels of corruption and large profit margins for private collectors at the cost of government revenues.1

- Limited taxpayer compliance. This is partly due to limited awareness of tax liabilities, but also due to taxpayers’ negative perceptions of tax administration and the limited local investment in public services. For example, survey data from Tanzania suggests that the perceived lack of spending on public services is the main reason behind most citizens’ unwillingness to comply with taxation. 2

Reforms to tax administration involve measures to better identify taxpayers and expand the tax base, improve transparency in assessing tax liabilities, implement effective systems for billing and collection, and facilitate compliance. These reforms can be as important as tax policy to raise revenues and in most cases do not require changes to national legislation. One major success story in this area is the Kampala Capital City Authority (KCCA): by focusing on revenue administration reforms, it managed to increase its own source revenue by more than 100% between 2011 and 2015. 3

Reforms to improve revenue administration can increase finances for public investment as well as specifically enhance own source revenues for cities. Providing public services with locally generated revenues enhances the local government’s social contract with its citizens. This in turn helps build a culture of tax compliance as the price paid for a well-functioning local government.

Key messages

- Reforms to revenue administration can be as important as tax policy in improving municipal revenues.

- Key areas for reform are investments in staff and appropriate technologies, careful cost benefit analysis of outsourced revenue collection as well as treating the taxpayer as a client. These reforms in Kampala resulted in significant and sustainable increases in revenue generation.

- Effective reforms to revenue administration require significant, but recoupable, initial investments, strong political will at national and city levels, as well as realistic reforms focused on main revenue sources.

A write-up of Kampala’s successful experience transforming its revenue collection practices to drive municipal revenue growth can be found here.

Case study: Revenue administration reform in Kampala

In Kampala, an Act of Parliament in 2010 replaced the Kampala City Council (KCC) with the current Kampala Capital City Authority (KCCA), with an independent Directorate of Revenue Collection (DRC). The position of the Executive Director (ED), appointed directly by the President, was created as part of the legislation. The appointed ED, Dr Jennifer Musisi, had previously worked as part of the senior management in the Uganda Revenue Authority (URA) and therefore brought with her a solid understanding of tax administration and its necessity for supporting revenue collection efforts in the city.

Like many local authorities, the KCCA faced a number of constraints in undertaking large-scale legislative reform to support its effort in raising more own-source revenue. Therefore, the KCCA decided to start by focusing on the areas that it could influence and that could bring short term results. The DRC analysed the challenges to increasing revenues for the city, and found that there were significant administrative impediments, including:

- Unreliable databases

- Poor technology

- Unclear procedures

- Narrow tax base

- Poor collection procedures

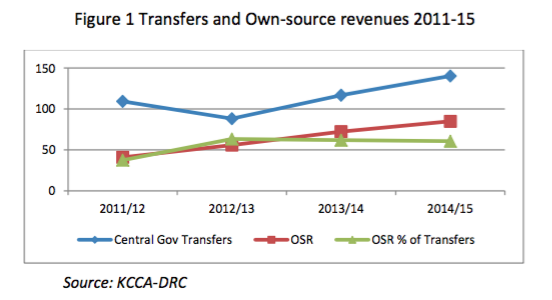

By focusing on tackling these issues through short term administrative reforms, the Kampala Capital City Authority (KCCA) managed to increase its own-source revenue by more than 100% from USh 41 billion to USh 85 billion between 2011/12 and 2014/15 fiscal year 4.

Transfers and own-source revenues

Own-source revenues have continued to grow steadily, resulting in a sustainable improvement in municipal revenue.

Case study: Revenue administration reform in Kampala – Areas of reform

Reforms to address these problems focused on three key areas:

-

Investments in staff recruitment, training, and digitised updated databases

For the DRC to operate effectively, it had to be staffed with a critical mass of qualified staff 5. When the KCCA was initially founded, the ED was given the opportunity to recruit a number of staff to build the foundation of the organisation. Given her previous work in the URA, she appointed a number of staff who had worked with her in the same agency. Other staff were recruited from a number of technical directorates in other ministries, departments, and agencies. In addition, all the Directorate’s staff receive monthly training and refresher courses on tax and operational guidelines, and changes in tax laws are incorporated as part of this training. The development of a cadre of competent and skilled staff thus provided the groundwork to introduce further reforms in the municipal tax administration. At the same time, the KCCA decided to introduce digitisation alongside an overall effort to improve service delivery through automation of revenue collection. To do this, they implemented an electronic revenue management system, eCitie, that allowed for automatic billing, reconciliation, and generation of receipts, and that sent out a reminder to taxpayers when they needed to pay their bills. As part of the system, the city rolled out its own taxpayer identification numbers (TIN) that allowed them to expand the tax base beyond that captured by the national tax identification system. The KCCA estimates that through the TIN reform alone, it was able to double its revenues from Commercial road user fees from USh 800 million UGX (over USD 222,000) to over USh 1.6 billion (over USD 444,000).

-

In-house revenue collection

In Kampala, the lack of oversight of outsourced private contractors coupled with poorly enforced contracts was a major source of leakage in revenue. High levels of corruption and wide private profit margins meant that limited revenues reached the government. As a result, the KCCA decided to bring collection back in-house, with collection having previously been outsourced to individual contracting firms. To effect this from the outset, the Directorate decided to cancel all existing out-sourced contracts. This was made possible because of well-trained and qualified internal staff. This played a significant role in improving revenue collection in Kampala. After tax collection was brought back in house, revenues from road user fees from minibus taxis, for example, doubled in one year 6.

-

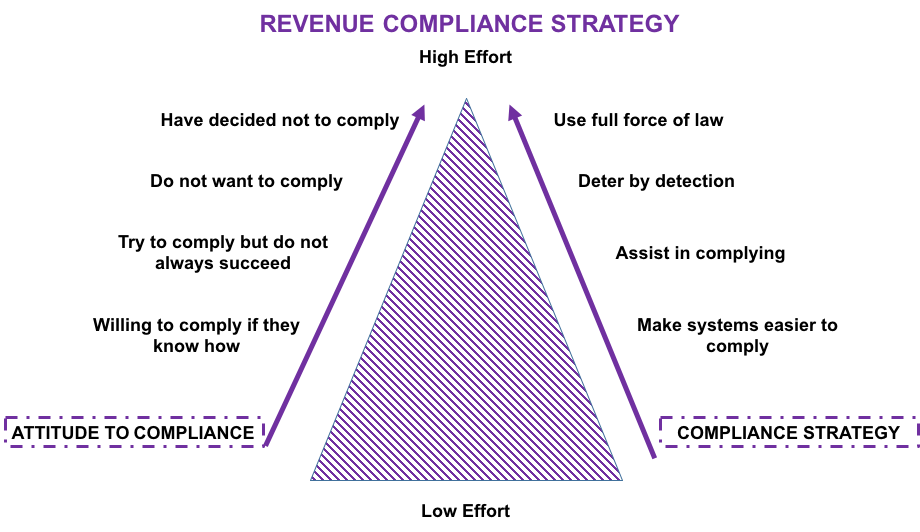

The taxpayer as a client: Communication and convenience for taxpayers

Crucially, administration reforms focused on viewing the taxpayer as a clientwho requires good services. This was based on the idea that the better the service provision, in the form of simple and transparent payment mechanisms, the more likely taxpayers are to comply, as it becomes more convenient for them to do so. This included:

- Improved convenience of payment: The KCCA implemented services that included being able to pay taxes through installments, which made it more affordable to some of their clients. Through a review of their data, they noted that approximately 70% of their revenue was actually being generated by 20% of their clients. Therefore, to support them, they set up a dedicated office for large taxpayers that provide premium services. This office provides dedicated relationship managers for each of the payers.

- Communication campaigns: To widen their tax base, the Directorate of Revenue Collection has also instituted a number of communication campaigns. These focus on helping the taxpayer understand why paying taxes is important to the city and how their taxes are being spent. After seeing an increase in voluntary compliance, these targeted communications and overall taxpayer engagement have been streamlined within the Directorate’s annual plans. (It is difficult, however, to discern exactly what percentage of the overall increase in revenue can be attributed to improved communication with taxpayers.)

Revenue compliance strategy

Case study: Revenue administration reform in Kampala – Enabling conditions

Similar reforms have been attempted by many local governments across the developing world, but often with limited success. So what made these so successful in Kampala? These areas of reform crucially depended on three key conditions for success:

A strong enabling political environment for reform

From the outset, implementing any reform will require sufficient political buy-in. The newly established structure of the KCCA provided this necessary enabling environment for reform. In particular:

- Executive Director (ED) Jennifer Musisi brought with her a solid understanding of the importance of tax administration, how it could be improved, and its necessity for supporting revenue collection efforts in the city. This appreciation was needed in order to justify the substantial investments in improving administration.

- The ED also appreciated the need for seeing the taxpayer as a client, and reforms were based on a motivating understanding of the taxpayer as a client who requires good services, and who is legitimate in demanding these in exchange for tax payment.

- The decision to split the functions of revenue collection and expenditure, and create an independent Directorate of Revenue Collection (DRC) meant that the Directorate could concentrate solely on its mandate of revenue collection.

Adequate resources for cost-effective administrative reform

Substantial investments have been required in Kampala to raise administrative capacity, bring collection in-house, and invest in new systems. However, these up-front capital investments to increase collection have been largely recovered through higher revenues within one year (Kopanyi 2015).

At the same time, the DRC’s costs of operation increased from 1.1% in 2011 to 11.21% of collection by 2014 (Kopnayi 2015). Though this is an extremely large increase in costs and further reforms are still needed to reduce costs of collection, resultant improvements in revenue collection mean that the KCCA has now moved from a low cost but unsustainable revenue collection to a higher cost, sustainable system.

Realistic reforms: A focus on main revenue sources and incremental reforms

Key to the success of these reforms was the focus of the DRC on reforms to a short list of the largest revenue-generating sources for the city, as well as large taxpayers and large defaults. This was likely to make the most impact – with each new fee and tax, the overall system becomes more complex for the authorities to administer but also for the user to understand and comply with. This in itself can have adverse effects on revenue collection as it creates more avenues for potential corrupt practices and may contribute to a general decline in compliance. As a result, by 2014/15, the five largest local revenue sources accounted for over 80% of total revenues.

Incremental introduction of reforms such as digitisation of revenue systems played an important role in building administrative capacity from a low base and in addressing any problems with new reforms from the outset.

Should governments outsource revenue collection?

In order to improve the efficiency of tax collection, local governments in many developing cities are looking to outsourcing tax collection to private companies. This is seen across a number of different revenue sources, including property taxes, parking fees and market fees. In Mwanza, Tanzania, for example, over a third of council revenues in 2006 were privately collected 7.

There are a number of potential advantages to local governments to outsourcing tax collection to private companies. Private managers are likely to have greater incentives and potential means with which to motivate tax collectors to expand tax revenues. If private firms have higher staffing and financial capacity than local governments, this can also expand their tax collection potential. Where tax collection is implemented under ‘tax farming’ contracts, which specify a particular level of revenue to be paid to governments by private partners each month regardless of actual collection revenues, outsourcing collection also comes with more predictable streams of revenue for governments.

However, privatising tax collection also comes with significant potential disadvantages. These include:

- Local governments can face inflated or uncompetitive costs of private collection, particularly if there are significant sunk costs associated with switching to new systems of collection, or if private collectors have a strong monopoly position in providing collection services.

- Private firms also charge a private premium on collection in the form of retained revenues, which can far exceed costs.

- Private collection can undermine the legitimacy of local government and damage the necessary social compact between citizen and state for tax compliance.

As such, for private outsourcing of collection to be effective in expanding local government revenues and enhancing tax compliance requires very specific conditions:

- Competitive and transparent tendering processes to reduce opportunities for corruption.

- Investments in detailed revenue projections to reduce private premiums.

- Shorter term, smaller scale and enforceable collection contracts to encourage competitive performance.

- Monitoring systems to prevent overzealous collection, inefficiency and corruption of private collection.

Without these enabling conditions, capacity development to facilitate internal tax collection by government departments may be the best option for developing cities.

An extended Cities that Work synthesis paper on private vs. public revenue collection is available here.

Recommended further reading

- Bird, Richard (2010) “Smart Tax Administration.” Economic Premise No 36. Washington D.C.: World Bank

- Freire, Maria Emelia, and Garzon, Hernando (2014) “Chapter 4: Managing Local Revenues.” In Farvacque-Vitkovic, Catherine and Kopanyi, Mihaly Municipal Finances – A Handbook for Local Governments. Washington D.C.: World Bank

- Kopanyi, Mihaly (2015) Local Revenue Reform – Kampala Capital City Authority. London: International Growth Centre

- Boex, Jamie. “Final Report: Development of a Strategic Framework for the Financing of Local Governments in Tanzania.” Georgia State University, 2005.

- Fjeldstad, Odd-Helge. “To Pay or Not to Pay; Citizens’ Views on Taxation in Local Authorities in Tanzania,” 2004.

- Fjeldstad, Odd-Helge, Lucas Katera, and Erasto Ngalewa. “Outsourcing Revenue Collection: Experiences from Local Government Authorities in Tanzania.” Research on Poverty Alleviation, 2008.

- Kopanyi, Mihaly and Franzsen, Riël (2018). “Property Taxation in Kampala, Uganda: An Analytic Case Study on a Successful Reform”

A write-up of Kampala’s successful experience transforming its revenue collection practices to drive municipal revenue growth can be found here.