The prospects for manufacturing-led growth in Africa’s cities

Many African countries are urbanising rapidly despite limited growth in manufacturing. Although other sectors could spur job creation and development, much like manufacturing, they need active public policy to support urban connectivity and business scale.

Although the growth of cities in Africa has been closely linked to rising incomes across the continent, many countries have rapidly urbanised without the same gains in economic growth and poverty reduction that have been seen elsewhere.

One potential reason is that urbanisation in Africa has not promoted a sustained period of structural transformation: shifting from growth dominated by agriculture and small-scale local services towards growth led by manufacturing and knowledge-intensive industries. This has led some observers to question Africa’s long-term prospects for development.

This growth brief explores the prospects for manufacturing-led growth in Africa’s cities

-

IGCJ7709-IGC-Growth-Brief-1911-WEBFinal.pdf

PDF document • 3.72 MB

Introduction

For many countries, manufacturing has played the dominant role in the early stages of structural transformation. However, these historical patterns do not certify manufacturing as the only pathway to development. Recently, it’s been recognised that several non-industrial sectors – such as food processing, tourism and information communication technologies (ICT), among others – share many of the positive growth characteristics of manufacturing, as well as other economic and societal advantages (Newfarmer et al., 2019).

Manufacturing might still play a crucial role in the future growth of Africa’s cities; in fact, several countries, such as Nigeria, Ethiopia, and Rwanda are pursuing ambitious city-led industrial strategies. However, policy should recognise high-value job creation – not just limited to manufacturing employment – as the essential step in the growth process.

Improving the connectivity of cities would be a crucial first step allowing businesses across all sectors to grow and increase productivity.

Key messages

- Africa’s urbanisation has not gone hand-in-hand with structural transformation.The limited growth of urban industry −

manufacturing in particular − has caused most observers to question why Africa is urbanising so quickly and what kind of jobs its cities offer. - Despite the lack of large industrial sectors in urban Africa, moving to cities still offers substantial gains over rural life. Average incomes are much higher in African cities compared to rural areas and these incomes are not offset by the extra costs of living typically associated with urban density.

- There are a growing number of successful sectors outside of manufacturing that could offer a new growth path for Africa. Many other industries share the same characteristics as manufacturing: in that they create higher-value jobs for low-to-medium skill workers and they are innovative and scalable. African cities should harness their growth potential.

- Policies to promote urban connectivity are critical to supporting high value job creation. As well as traditional, non-spatial policies that influence industry competitiveness, spatial policies around land use, transport, and energy infrastructure are critical for firm growth and investment.

Key message 1 – Africa’s urbanisation has not gone hand-in-hand with structural transformation.

Much of the literature on economic growth focuses on structural transformation from agriculture to industry, and by extension, the transition from the countryside to cities (Lewis, 1954; Kuznets and Murphy, 1966). Productivity gains in agriculture are thought to push excess workers out of farming, while emerging urban industries pull labour towards cities.

Cross-country evidence of these patterns is clear (Herrendorf et al., 2014). Take China for example: Structural reforms and the opening up of markets after 1978, brought massive increases in agricultural and manufacturing productivity. In turn, this gave rise to the country’s rapid urban and economic growth. By 2009, the urban population had grown by 700 million people and per capita gross domestic product (GDP) was 13 times larger than it was in 1978 (Angang, 2011).

Typically, manufacturing booms in the largest cities and then diffuses as production techniques become standardised and firms have less to gain from close proximity to workers and markets. Manufacturing relocates to smaller cities, where land and labour are cheaper, while large cities specialise in traded services, where clustering advantages are very strong (Arzaghi & Henderson, 2008; Desmet and Henderson, 2015).

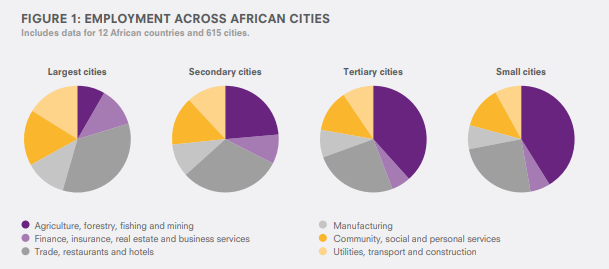

African urbanisation does not conform neatly to these patterns. Many African countries have urbanised without a ‘Green Revolution’, nor the growth of large industrial sectors. As Figure 1 shows, census data suggests there is a high degree of primary sector employment in African cities, regardless of size (Henderson & Kriticos, 2018).1 Even among the largest cities there is a small role for manufacturing and high-value tradable services despite the fact these cities should offer large advantages from economic clustering.

Figure 1: Employment across African cities

Key message 2 – Despite the lack of large industrial sectors in urban Africa, moving to cities still offers substantial gains over rural life.

Urbanisation without industrialisation could be a lost opportunity for Africa. Cities are often touted as engines of growth because they offer scale and specialisation economies, which result in more available and diverse job opportunities beyond the primary sector.

These productivity advantages may translate into higher earning possibilities for urban jobseekers (Combes & Gobillon 2015), or may themselves reflect higher productivity individuals choosing to live in cities over rural areas (Young, 2013; Hicks et al., 2017).

Although a lot of research has measured the size and sources of urban income premiums elsewhere, it is only recently that evidence has come to light on urban incomes in Africa. Estimates by Henderson and Kriticos (2018) suggest that urban incomes in Africa tend to be on average between 8–23% larger than rural. Such numbers are in line with previous estimates for the US (23–32%) and the UK (9%) (Glaeser & Mare, 2001; D’Costa & Overman, 2014).

For the largest cities, the income premium ranges from between 11–89% higher than in rural areas, similar to estimates in France and Spain, where the largest city premium over rural areas has been estimated at 55% (De la Rocha & Puga, 2017) and 60% (Combes et al. 2008), respectively.

Urban income premiums are also much larger at the household rather than individual level, likely because living in cities expands occupational choice for the entire household – an important point for structural transformation.

One question is whether these positive income differences outweigh the extra costs of living associated with high-density urban environments.

Recent research shows that for most quality of life measures – looking across health, housing quality, crime, and environmental conditions – outcomes are either better or no different as population density increases across African cities (Gollin et al., 2017).

This owes to the fact that cities are not just engines of productivity, but areas of potentially much greater liveability, since it becomes much cheaper to provide services at scale when people are clustered closely together.

These results suggest that on average cities in Africa offer higher wages and quality of life than rural areas. A very positive reflection for the continent’s development prospects. This leaves us with an important question: If Africa’s cities are net income enhancing, should we be concerned with their relative lack of manufacturing?

Although gross national incomes are still much lower than other regions at similar levels of urbanisation, it is plausible that other sectors could pave the way towards higher income growth in Africa.

Key message 3 – There are a growing number of successful sectors outside of manufacturing that could offer a new growth path for Africa.

There are several reasons why growth theory has emphasised the manufacturing stage as crucial for development:

Key advantages of the manufacturing sector

- Manufacturing can employ large numbers of low-to-medium skilled workers.

- Its processes can be easily standardised and scaled, which complements economic clustering in cities.

- The sector benefits from technological change and productivity growth, thus exhibiting positive learning and process development opportunities.

- It is tradable, allowing developing countries to tap into global value chains as well as new markets for buying and selling goods.

The question is whether manufacturing is the only sector that exhibits these positive growth externalities. According to recent research coordinated by the United Nations University World Institute for Development Economics Research (UNU-WIDER) and the Brookings Institution, technological change over the last two decades has generated a wide range of new service industries that have many features in common with manufacturing (Newfarmer et al., 2019).

The UNU-WIDER research identifies three sectors that are showing great promise for structural transformation in Africa: Agro-industrial and horticultural value chains; business and traded services (e.g. telecommunications); and tourism.

These are referred to as ‘industries without smokestacks’ (IWSS), given they share the positives of manufacturing but are not associated with the fabrication of tangible goods and its requisite environmental impacts. Preliminary evidence shows that in several African countries, these industries grew more rapidly than non-mineral exports between 2002–2015, gaining prominence in Africa’s export portfolio. This research sits interestingly within an unresolved debate on African development: the question whether certain countries could leapfrog the manufacturing stage altogether. Technological advances have been key support cases for such arguments in the past. For instance, Kenya’s ICT and mobile internet growth over the last 15 years has led to the emergence of globally competitive service markets, even in the face of a relatively low and declining role of manufacturing. Business process outsourcing (KenCall), telecommunications, and mobile payment services (M-Pesa) are prime examples of Kenya’s success across a range of advanced service industries (Hoekman, 2019).

Such cases offer inspiration for African growth, but they shouldn’t be taken to downplay the potential importance of manufacturing (Juma, 2017). Instead, we should recognise that certain services can offer a complementary growth path that also supports broader industrialisation.

For instance, improvements in communications, transport, and energy services make it increasingly possible to trade and deliver services digitally through ICT networks, but they also lower transaction costs and create knowledge spill-overs, which support the manufacturing sector. Similarly, business services, such as accountancy and finance, can improve budgeting and accountability in manufacturing, leading to increased foreign direct investment (FDI).

It’s clearly important to take a broader look at industry and not overemphasise one sector. Another example is the tendency to overemphasise global tradables at the expense of industries that can support regional or domestic trade. As shown by IGC research, the bulk of trade transactions actually happen domestically rather than internationally, so policy would be remiss to neglect internal trade barriers (Donaldson et al., 2017).

Moreover, even low-tech, non-tradable sectors – such as retail, transport, construction, and food services – could have very high growth potential if African businesses adopt the right technologies and production processes needed to increase labour productivity. In this sense, we may have to get past the notion that productivity growth is limited to services that are highly tradable.

Finally, we should note that the distinction between sectors is becoming increasingly blurred. Many industries, such as food processing and distribution, now entail elements along the value chain that are distinctly reminiscent of manufacturing, such as the production and packaging line, as well as those more commonly associated with service delivery, such as the preparation of food in restaurants.

The boundaries between, and the unique features of, industries are often poorly distinguished, affecting not only how sector productivity is recorded but also whether policy is appropriately targeted to support different sectors.

One concern for African cities is that most service industries are nascent, at small-scale, and relatively local in scope, thus neither tradable globally nor regionally. Many of the same factors that stall manufacturing are likely to also stall the development of higher-value service industries. This is the subject of our closing section.

Key message 4 – Policies to promote urban connectivity are critical to supporting high value job creation.

Being competitive is not just about diversifying activity. As well as moving towards higher-value emerging sectors, African cities need active public policy to provide the infrastructure, markets, and institutions that enable them to grow and generate the jobs and incomes that fuel long-term development.

A key issue is that many African cities have gaps in critical infrastructures – such as roads, ports, and power grids – which lower the cost competitiveness of businesses and limit the growth of private enterprise. In transport, it is estimated that Africa has less than one quarter of the density of paved roads in other low-income regions. In energy, Africa has half the generating capacity per person of South Asia (Donaldson et al., 2017; Collier, 2016).

Work by IGC researchers has shown that investments to lower commuting costs, such as Bus Rapid Transit (BRT), could improve access to markets and facilitate the growth of productive business clusters in Africa (Tsivanidis, 2018; Otunola et al., 2019). Similarly, access to reliable energy could lower production costs and support economic specialisation (Lipscomb et al., 2013).

Land and property are other critical inputs for firm growth and urban development. The World Bank’s Doing Business Report (2017) finds that it takes on average 60 days to transfer a fully-registered property in sub-Saharan Africa, compared to only 22 days in high-income OECD countries. Such challenges represent a major constraint to firm growth because they exacerbate spatial frictions and constrain goods and services to be small-scale and local in scope. Grocery services, for example, are dominated by small stalls and local vendors on every street in African cities. However, lower spatial frictions could open the possibility for larger service markets by realising scale economies through capital investments and new technologies – for example, larger supermarkets with parking, storage, and refrigeration.

Lastly, institutional and non-spatial policies may impede firm development. IGC research shows that regulatory barriers – such as administrative costs, compliance procedures, registration fees, and punitive taxes – can hold back manufacturing and service providers in informality (Eissa et al., 2017). These regulatory hurdles could be particularly onerous for the tradable service sector given the high costs of travel (e.g., related to visas and work permits), the different qualifications criteria across Africa for licensing professional services, and other matters such as barriers to FDI in the service sector (Dihel et al., 2016).

Businesses also need ancillary support from finance, insurance and legal institutions to help them deal with regulatory procedures and advise them on how to grow. Addressing some of these challenges could help many enterprises join the formal economy, generating greater interactions and linkages as they integrate into the economy and supporting structural transformation.

Policy recommendations

The growth of cities offers a huge opportunity for Africa’s economic development. To date, however, urbanisation has contributed much less to poverty reduction in Africa than in other developing regions historically – in part because much of the labour transitioning from agriculture over the last half century has moved into smallscale services, rather than industry.

While new service sectors are emerging that offer great promise for future growth, active public policy is required to support them, as well as the continued promotion of manufacturing industries.

- Policy must recognise high-value job creation as the essential step in the growth process, focusing on the development of sectors that share the advantages of manufacturing.

- Policymakers should focus on reforms that offer linkages across sectors within the city system, rather than just change at the individual sector level.

- Spatial policies must focus on enhancing connectivity through investments in transport and energy as well as efforts to improve urban land markets. This could help firms to access the quality infrastructure and markets that are needed to be productive.

- Regulatory changes to bring more enterprises into the formal economy could be a useful step towards structural transformation.

- Policy should look for opportunities from regional trade and trade in services and not give undue emphasis on global manufacturers at their expense.

References

African Union (2015). Agenda 2063: The Africa we want, African Union Commission. Arzaghi, M. & Henderson, J.V. (2008). “Networking off Madison Avenue”, The Review of Economic Studies, 75(4), pp.1011–1038.

Collier, P. (2016). African Urbanisation: An Analytical Policy Guide, Policy paper, International Growth Centre, London. Accessible: www.theigc.org/wp-content/uploads/2016/01/AfricanUrbanizationJan2016_Collier_Formatted-1.pdf

Combes, P. P., Duranton, G., & Gobillon, L. (2008). “Spatial wage disparities: Sorting matters!”, Journal of Urban Economic, 63(2):723– 42.

Combes, P.P. & Gobillon, L. (2015). “The empirics of agglomeration effects”, Handbook of Regional and Urban Economics, Vol. 5A, ed. Duranton, G., Henderson,V. & Strange, W., pp. 247–348, Amsterdam: North-Holland.

D’Costa, S. & Overman, H. G. (2014). “The urban wage growth premium: sorting or learning?”, Regional Science Urban Economics, 48:168–79.

De la Rocha, J. & Puga, D. (2017). “Learning by working in big cities”, Review of Economic

Studies, 84:106–42. Dihel, N. & Goswami, A. G. (2016). The unexplored potential of trade in services in Africa, World Bank.

Donaldson, D., Jinhage, A. & Verhoogen, E. (2017). Beyond borders: Making transport work for African trade, International Growth Centre Growth Brief Series, 9.

Duranton, G. & Puga, D. (2004). “Micro-foundations of urban agglomeration economies”, Handbook of Regional and Urban Economics, Vol.4, ed., Henderson, V. & Thisse, F., pp. 2063–3073, Amsterdam: North-Holland.

Eissa, N., Murray, S. & Zietlin, A. (2017). Fiscal Impacts of a Presumptive Tax for Microenterprises in Rwanda, International Growth Centre. Accessible: www.theigc.org/ publication/fiscal-impacts-presumptive-taxmicroenterprises-rwanda

Glaeser, E. L. & Mare, D.C. (2001). “Cities and skills”, Journal of Labour Economics, 19(2), pp.316–342.

Gollin, D., Jedwab, R. & Vollrath, D. (2016). “Urbanisation with and without industrialisation”, Journal of Economic Growth, 21(1):35–70.

Gollin, D., Kirchberger, M. & Lagakos, D. (2017). “In search of a spatial equilibrium in the developing world”, Working Paper, Centre for Economic Policy Research, Washington DC. Accessible: www.cepr.org/sites/default/files/Kirchberger%2C%20Martina.pdf

Henderson, J.V. & Kriticos, S. (2018). “The development of the African system of cities”, Annual Review of Economics, 10, pp.287–314.

Herrendorf, B., Rogerson, R. & Valentinyi, Á. (2014). “Growth and structural transformation”,

Handbook of Economic Growth, Vol. 2, pp. 855–941, Elsevier.

Hicks, J. H., Kleemans, M., Li, N.Y. & Miguel, E. (2017). “Reevaluating agricultural productivity gaps with longitudinal microdata”, No. w23253, National Bureau of Economic Research.

Hoekman, B. (2017). Trade in services, WIDER Working Paper 2017/31, p.151.

Hu, A. (2011). China in 2020: A new type of superpower, Brookings Institution Press.

Juma, C. (2017). “Leapfrogging Progress – The Misplaced Promise of Africa’s Mobile Revolution”, The Breakthrough Journal.

Kuznets, S. & Murphy, J. T. (1966). Modern economic growth: Rate, structure, and spread (Vol. 2), New Haven: Yale University Press.

Lall, S. V., Henderson, J. V. & Venables, A. J. (2017). Africa’s cities: Opening doors to the world, the World Bank.

Lewis, W. A. (1954). Economic development with unlimited supplies of labour, Manch. School, 22(2): 139–91.

Lipscomb, M., Mobarak, A. M. & Barham, T. (2013). “Development effects of electrification: Evidence from the topographic placement of hydropower plants in Brazil”, American Economic Journal: Applied Economics, 5(2), pp. 200–231.

Newfarmer, R., Page, J. & Tarp, F. eds. (2019). Industries without Smokestacks: Industrialization in Africa Reconsidered, Oxford University Press.

Otunola, B., Kriticos, S. & Harman O. (2019). The BRT and the Danfo: A case study of Lagos’ urban transport reforms from 1999–2019, International Growth Centre online.

Tsivanidis, N. (2018). The Aggregate and Distributional Effects of Urban Transit Infrastructure: Evidence from Bogotá’s TransMilenio, Unpublished manuscript.

UNECA (2015). Leveraging urbanization for Africa’s structural transformation, ECA’s Contribution, United Nations Economic Commission for Africa, Online.

Young, A. (2013). “Inequality, the urban-rural gap, and migration”, the Quarterly Journal of Economics, 128(4):1727–85.

Note: Bolded text denotes IGC-funded studies.

Citation

Kriticos, S. and Henderson, V. (2019). The prospects for manufacturing-led growth in Africa’s cities. IGC Growth Brief Series 020. London: International Growth Centre.