Value Added Tax in developing countries: Lessons from recent research

The Value Added Tax has become one of the most important instruments of revenue mobilisation in the developing world. A recent and growing body of research highlights its strengths and some of the challenges it faces.

-

IGCJ6046-VAT-Tax-180521_WEB.pdf

PDF document • 408.59 KB

Introduction

Today, Value Added Taxes (VAT) exist in more than 160 countries, including in many developing countries that have modernised their tax systems in the past decades. Eighty percent of countries in sub-Saharan Africa have adopted the VAT, and it is now responsible for typically raising around one-quarter of all tax revenue (Keen, 2016). Moreover, countries continue to adapt and reform their VAT systems, sometimes substantially, such as India and Ghana did in 2017.

In principle, a VAT has several advantages compared to other tax instruments prevalent in developing countries, which arguably explains its widespread adoption around the world. It is seen as superior to an import tax or a turnover tax in terms of ‘production efficiency’ (Keen, 2016). This means it can avoid the typical distortions to firms’ production decisions caused by these tax instruments. It is also seen as superior to a retail sales tax in terms of revenue mobilisation (Kopczuk and Slemrod, 2006), as it features compliance incentives for business-to-business transactions (B2B), and can generate revenue earlier in the supply chain, even if retailers fully evade their tax liabilities.

Until recently, there was limited empirical work using administrative microdata on the functioning of the VAT in developing countries. Yet in the last few years, there has been an exciting and rapidly growing body of empirical research on tax policy in developing countries using data from detailed tax records. This is attributable, in part, to the information and communications technology (ICT) revolution, which has led to substantial improvements in data availability and quality.

This brief discusses lessons from several of these studies, which have shed new light on the strengths and weaknesses of VAT systems. It also highlights important topics that could benefit from better evidence.

Key messages

- VAT systems incentivise accurate reporting on B2B transactions, but evasion and administration challenges still exist. VATs aid revenue mobilisation, as they create incentives for firms to report accurate information in B2B transactions. But they still present opportunities for evasion, production inefficiencies, and administrative difficulties.

- VAT administration faces a last-mile problem. Retailers often fail to report sales to final consumers. This non-compliance could be transmitted upstream along the supply chain, hampering revenue mobilisation. Several countries have introduced policies incentivising consumers to ask for receipts to improve compliance at the last-mile.

- ICTs present enforcement opportunities to strengthen VAT systems but also new challenges. Electronic filing and receipts provide new enforcement opportunities to strengthen VAT systems, but collecting detailed receipt data creates new tax administration and data management challenges.

- Exemptions in VAT systems can negatively affect supply chains and revenue mobilisation. VAT systems where all firms must register would be costly to enforce and comply with. However, exemptions can weaken VAT compliance and distort firms’ choices along the supply chain.

Key message 1 – VAT systems incentivise accurate reporting on B2B transactions, but evasion and administration challenges still exist.

THE VAT SYSTEM

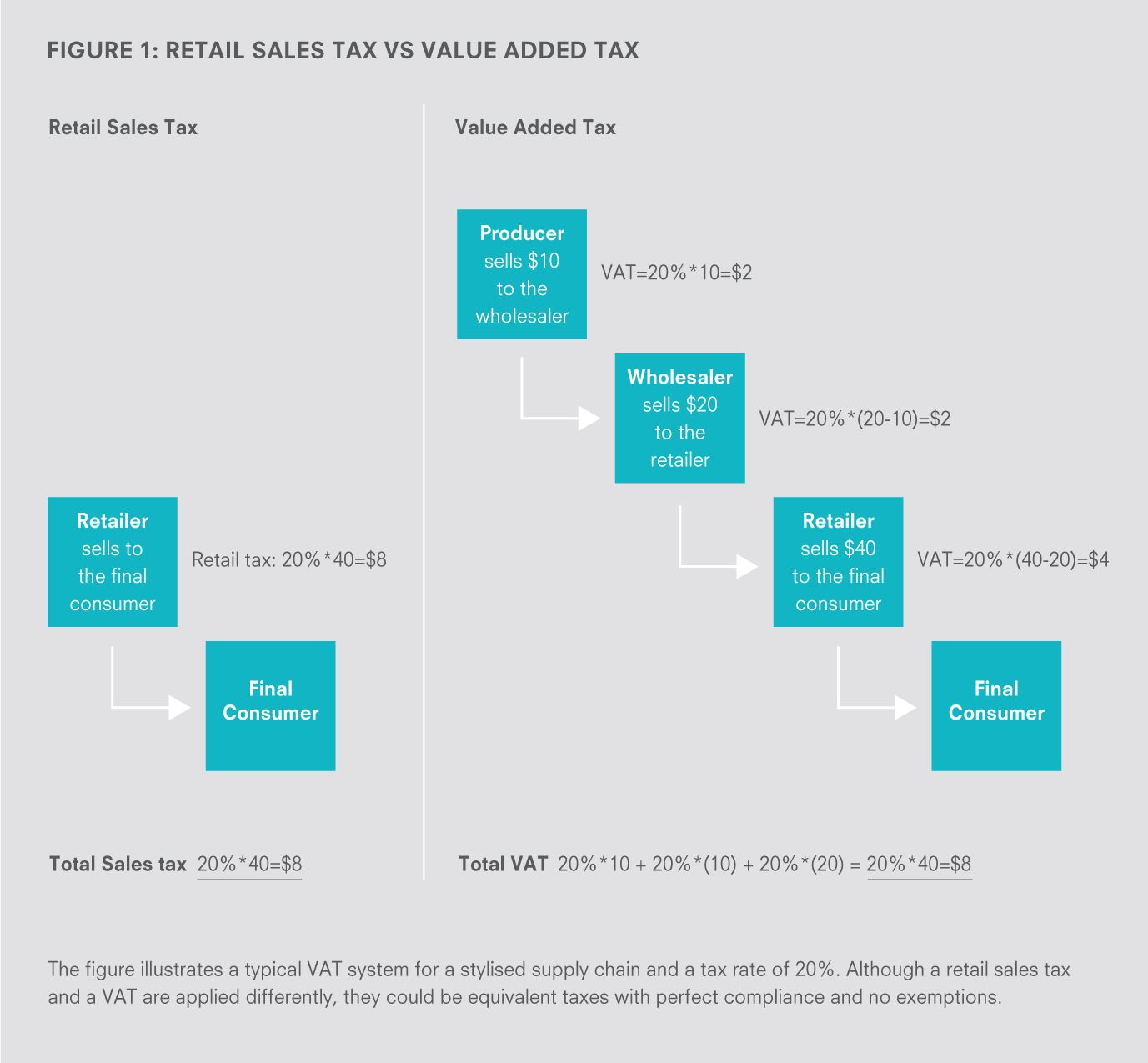

In a typical VAT system, firms remit the tax on their sales, while being allowed to deduct the taxes paid on their purchases. As a result of this invoice method, the tax is effectively levied on the firms’ value added, which is the difference between their output and their input. This is illustrated in Figure 1 for the case of a stylised supply chain.

Such a VAT system has a ‘production efficiency’ advantage as compared to other tax systems in developing countries. For instance, because the tax applies similarly to goods that are imported as to those produced domestically, VAT does not distort a firm’s production choices towards the use of domestic inputs, in contrast to an import duty.

Moreover, because of the deductibility of taxes paid on inputs, the total tax burden for a supply chain is the same irrespective of the number of stages in the chain. In contrast, the total tax burden of a turnover tax, which applies at each stage without any deductibility, increases with the length of the chain. This distorts a firm’s production choices towards the use of inputs from short supply chains or causes firms to vertically integrate.

ENFORCEMENT AND EVASION

As shown in Figure 1, a uniform VAT system – applying the same tax rate to all firms – and a retail sales tax would be equivalent consumption taxes with perfect compliance. However, in the real world, compliance is likely to be imperfect, and a VAT presents advantages in terms of revenue mobilisation due to its ‘self-enforcing’ properties along the supply chain (Kopczuk and Slemrod, 2006).

Firms must report both sales and inputs in VAT systems and keep receipts of these transactions in their books. To minimise tax liability, firms would like to under-report sales, and to over-report inputs. This asymmetry between the reporting incentives of suppliers and clients should limit the room for ‘collusive evasion’. The existence of a paper trail should also deter ‘unilateral evasion’, i.e., firms unilaterally misreporting transaction values, as the tax authority could crosscheck the values reported by a firm with records from suppliers and clients upon an audit.

Moreover, compliance can spill over upstream and downstream in the supply chain. Firms whose clients ask for accurate receipts would be likely to report their sales more accurately and in turn ask for accurate receipts from their own suppliers to minimise tax liability. Firms whose suppliers apply the tax and report sales accurately have an incentive to formalise to deduct the taxes paid on their inputs and because of a higher risk of detection with the existence of a paper trail on their activity. As a result, in contrast to a retail sales tax, a VAT could generate revenue from compliant firms in the supply chain, even if retailers fully evade their own tax liabilities.

Until recently, there was little evidence of how these ‘self-enforcing’ properties of a VAT would play out in the real world. Pomeranz (2015) conducted a randomised control trial in partnership with the Chilean tax authority to test these self-enforcing properties:

1. She found that tax evasion was smaller among firms selling to other businesses, suggesting that the paper trail for B2B transactions can indeed deter evasion.

2. She found evidence of enforcement spillovers along the supply chain: firms not only started to remit more taxes after learning about an upcoming audit, but their suppliers increased their VAT payments as well.

ADMINISTRATIVE AND COMPLIANCE COSTS

Despite the fact that the VAT has these self-enforcing incentives along the supply chain, there are still evasion opportunities for B2B transactions in real world VAT systems.

Despite the presence of transaction receipts, limited enforcement capacity may prevent tax authorities from efficiently cross-checking what firms report against records from third parties, and thus VAT systems limit unilateral evasion. For instance, despite the fact that firms in Uganda are required to electronically report all their transactions to the tax authority, Almunia et al. (2017) found substantial mismatches of the same transactions reported by different firms.

In addition, the ability of a VAT to raise revenue is reduced by opportunities for tax credit fraud if receipts can be easily forged or if fly-by-night firms can produce legitimate receipts that generate tax credit and then disappear without remitting taxes (Alexeev and Chibuye, 2016).

In part because of the above concerns, many governments do not provide timely refunds when firms declare negative tax liabilities, or sharply increase the threat of audits in such cases. However, this creates opportunities for collusive evasion. Firms in such circumstances may be willing to sell receipts to other firms instead of seeking tax refunds, and to collude with their trade partners to under-report an input transaction. Such limits on the deductibility of inputs can also reduce the production efficiency properties of a VAT, as it effectively becomes an input tax.

Furthermore, it is not clear that all firms should be part of the VAT system. VAT declarations arguably imply high compliance costs through detailed bookkeeping and complex filing if compared to a turnover tax. These costs, intensified by the fact that VATs are often implemented with many exceptions and different rates across goods, can be particularly burdensome for small firms.

For a tax authority, there are also important administrative costs, particularly since enforcing compliance among many small firms is challenging (e.g., managing tax credit refunds). Therefore, allowing smaller firms to be outside the VAT system could save on administrative and compliance costs, and avoid pushing firms to the informal economy. In practice, many countries apply a VAT threshold based on turnover below which firms can choose not to be part of the VAT system (Keen and Mintz, 2004) and typically pay a turnover tax, leading us back to the problems of such ] taxes. In addition, the exemption thresholds present their own challenges as we discuss further in this brief.

Figure 1: Retail Sales Tax vs Value Added Tax

Key message 2 – VAT administration faces a last-mile problem.

The self-enforcing properties of VAT systems for B2B transactions rest on the incentives that they create for buyers to ask sellers for receipts in order to claim tax credits. Final consumers do not have similar incentives to ask for receipts. The lack of paper trail allows firms to more-easily under-report sales, potentially reducing revenue mobilisation at the retail stage, as documented by Pomeranz (2015) in the Chilean context.

This ‘last-mile problem’ of VAT systems is an important flaw because, in principle, the noncompliance could also be transmitted upstream in the supply chain through collusive evasion: retailers under-reporting their sales may be especially willing to under-report their inputs to remain under the radar of the tax authority, which in turn allows their suppliers to under-report their own sales, etc. The sheer number of small taxpayers also complicates enforcement at the retail stage.

IMPROVED MONITORING

A first step towards better monitoring retail sales is to improve the technology used to issue receipts to final consumers. For instance, requiring retailers to issue standardised receipts (e.g., with time stamps and serial numbers) increases the costs of concealing their sales. More recently, electronic billing machines (EBMs), which retailers are now required to use in a number of countries, have made the tampering of receipts more difficult and increased the amount of information the tax authority has available over final sales. Eissa et al. (2014) show that the recent roll-out of EBMs improved compliance in Rwanda.

However, EBMs are only useful if receipts are issued to final consumers. Ensuring that receipts are issued is costly for consumers in terms of both time and effort. EBMs are thus unlikely to resolve the last-mile problem by themselves. For instance, Eissa et al. (2014) find that receipts were only issued in 21% of a sample of retail transactions. Moreover, in a recent survey in the same country, 33% of consumers were worried that retailers would increase prices if they asked for receipts (Campbell et al., 2017).

Consumers as tax auditors in Brazil

A case that has been studied in detail is the policy implemented in the state of São Paulo, Brazil, in 2007 (Naritomi, 2016). Consumers have the option of providing their taxpayer identification number (ID) to retailers for it to be recorded on receipts, and retailers are required to submit the information for all their receipts, including consumers’ ID numbers, to the tax authority. Consumers then earn lottery tickets and tax rebates based on the total value of the receipts featuring their ID number and can set up an online account to collect their rewards. The online account also opens a direct communication channel with the tax authority for consumers to blow the whistle on noncompliant retailers.

Naritomi (2016) shows that consumers responded strongly to the incentives: more than 15 million consumers actively participated and consumers increased their participation following lottery wins. This new consumer monitoring resulted in an improvement in compliance: the policy increased reported revenue by retail firms by more than 20% over four years. This is despite opportunities for collusive evasion between consumers and retailers, as the rewards for consumers remained smaller than the tax burden for retailers. In addition, firms increased their reported revenue after being reported as non-compliant, showing that the diffused monitoring tool enables the whistleblower channel to generate a credible threat.

INCENTIVISING COMPLIANCE

To address this problem, tax authorities around the world have been looking for ways to incentivise consumers to ask for receipts from as early as in the 1960s, although such incentives have been adopted more widely only recently. Incentive bundles vary across countries and typically include a combination of lotteries and tax rebates based on consumers’ receipts, as well as appeals to civic duty or ‘tax morale’ (Campbell and Naritomi, in progress). See the box on page 4 for an example of an effective incentive policy implemented in Brazil.

IMPLEMENTING COMPLIANCE INCENTIVES

Consumer incentives are quite costly to implement, as they equally reward transactions that would be reported in the absence of any incentives and transactions that would otherwise be evaded. Thus, consumer participation (i.e., programme take-up) and its impact on tax evasion must be high for such incentives to generate new revenue.

The experience in other countries is in fact mixed, arguably due to policy design problems and high participation costs for consumers. This suggests that careful attention must be devoted to their design and to the local environment for such schemes to effectively address the last-mile problem of VAT systems.

Delivery in a retail shop. Photo: Godong | Philippe Lissac.

Key message 3 – ICTs present enforcement opportunities to strengthen VAT systems but also new challenges.

The rapid innovation in ICTs is changing public administration in many ways and has provided tax authorities with new enforcement tools to improve the functioning of VAT systems. Some prominent examples include:

- In Uganda, and many other countries, business taxpayers are required to electronically file their VAT returns and report itemised B2B transactions.

- In Brazil, electronic invoices for B2B transactions have a unique key and are sent in real-timeto the tax authority (Gerard, Naritomi, and Seibold, 2018).

- More broadly, EBMs, which are being adopted by tax authorities across the developing world, capture data on firms’ sales in real time using unique taxpayer ID numbers of buyers and sellers.

ENFORCEMENT

These innovations substantially increase the amount of information that can be utilised by the government for tax enforcement. For instance, they enable the systematic cross-checking of reports of sellers and buyers to limit unilateral evasion (as in the Uganda case), and they even prevent sellers and buyers from reporting the same transaction differently (as in the Brazilian case). Fan et al. (2018) find that computerisation of the Chinese VAT allowed for more systematic cross-checks and an increase in tax payments by large manufacturing firms.

This enhanced access to information and data also provides new opportunities to limit tax credit fraud: receipts issued by EBMs are difficult to forge and the availability of transaction records in real time creates the possibility of identifying fly-by-night firms more quickly. In turn, by relaxing fraud and evasion concerns, these innovations could prompt tax authorities to refund tax credit more easily and improve the production efficiency of VAT systems more rapidly. They also have the potential to help enforce other taxes and relax the ‘revenue efficiency vs production efficiency’ trade-off discussed in the IGC growth brief on ‘third-best taxation’ (Kleven, Khan, and Kaul, 2016).

Consumer monitoring policies that aim to mitigate the last-mile problem of VAT systems are also increasingly leveraging technology. Lower-tech versions of such policies can impose quite high participation costs, as consumers have to collect receipts to be submitted to a government branch, and claiming rewards can be time consuming (Campbell and Naritomi, in progress). Recent versions of such programmes use online accounts and mobile money to reduce participation costs to increase programme take-up.

Further, as discussed in the box on page 4, web and mobile tools also allow tax authorities to build a direct communication channel with taxpayers for credible whistleblower threats. As a result, firms may become more reluctant to try to collude with consumers by offering them discounts to circumvent the rewards programme.

Although ICTs can open up new enforcement opportunities, they are far from providing a silver bullet. ICTs require complementary investments

to increase the ability of the tax administration to process the information it receives, and to follow-up with notifications and audits (Steenbergen, 2017). The technical and human resources needed for such tasks are not trivial in developing countries. In Uganda, for instance, Almunia et al. (2017) found large mismatches in the same transaction data reported by firms electronically, which could indicate that taxpayers do not believe that the government will follow up on their unilateral misreporting. Perhaps this issue would be worse without the technology, but the technology does not, in itself, close the compliance gap.

BEYOND ENFORCEMENT

From the taxpayer perspective, while e-filing and EBMs can eventually reduce compliance costs (e.g., pre-populating tax returns with receipts information), their adoption can be initially costly. Many countries mandate the use of EBMs, and it is often expensive for businesses to procure and maintain them.

High set-up costs and poor connectivity can further increase taxpayers’ compliance costs. Note, though, that the use of ICTs in VAT systems can also have unintended benefits. For instance, electronic filing and receipt systems generate rich information about the economy that policymakers and academics are starting to use to shed new light on many important policy debates for the design of VAT systems (Gerard, Naritomi, and Seibold, 2018). In addition, as the quality of detailed receipt data such as prices, quantities, and product information increases, the government may be able to create new real-time price indices, richer input-output tables, and other analytical tools to inform policymaking beyond tax policy.

At the same time, the amount of information that governments can capture in VAT data can generate confidentiality concerns in contexts where there is little trust in governments. Detailed receipts can contain information about the production technology of firms and the timing and composition of transactions that could create fears of extortion and of leakage of strategic business decisions. The volume of information captured by tax authorities can also create an enforcement burden as many small mismatches may raise an excessive number of red flags. This may require changes in legal frameworks to facilitate amendments, protect sensitive data from taxpayers, and prioritise mismatches in order to screen likely mistakes from intentional misreporting.

A cashier at a supermarket in Côte d’Ivoire. Photo: Getty | AFP | Sia Kambou.

Key message 4 – Exemptions in VAT systems can negatively affect supply chains and revenue mobilisation.

An important feature of real world VAT systems is that many firms are typically exempt from participating. In developing countries, there are large informal sectors and firms that belong to the informal economy that are exempt de facto because they are not even registered with the tax authority. In addition, many firms are often exempt de jure(legally). For instance, small firms with revenue below a certain threshold are usually exempt, though they can register voluntarily. Specific firms or sectors of activity are also sometimes exempt or face a reduced VAT rate.

The prevalence of exemptions often results from valid policy rationale. Enforcing universal registration with the tax authority (i.e., closing

the informal economy) would likely be too costly. Since the VAT is a complex tax to comply with and administer relative to a turnover tax, high registration thresholds, below which firms can voluntarily register or pay a simpler turnover tax, are often viewed as essential for the design of an effective VAT system in developing countries (Ebrill et. al., 2002). Exemptions for specific firms or sectors are sometimes motivated by redistribution or industrial policy objectives.

However, these exemptions may come with unintended effects on revenue mobilisation and production efficiency, in addition to the direct loss in tax revenue from exempt firms.1

POTENTIAL UNINTENDED EFFECTS: THE CASE OF THE VAT THRESHOLD

Consider the VAT threshold exemption, for instance. First, like the last-mile problem discussed earlier, exempt firms often have no incentives to ask for receipts, weakening the self-enforcing properties of a VAT before the retail stage of the supply chain. This is an important issue because exempt firms may exist at various stages of the supply chain (retail, wholesale, manufacturing), and because the lack of enforcement at any stage of the chain can again, in principle, be transmitted across the rest of the chain through collusive evasion.

Second, there may be spillover effects along the supply chain (de Paula and Scheinkman, 2010). Given the debit-and-credit system for VAT, it is often beneficial for firms to trade with other firms in the same tax regime, e.g., for exempt firms to trade with other exempt firms. Therefore, a firm may choose its tax regime, e.g. choose to become informal or remain small enough to fall below the registration threshold, based on the tax regime of its main trade partners. As a result, the exemption of a single firm (de jure or de facto) may result in the exemption of additional firms, with further losses in tax revenues. Naturally, this spillover effect is likely to be particularly relevant if the exempt firms are important trade partners for many firms.

Relatedly, the VAT debit-and-credit system may not only affect firms’ choice of tax regime, but also their choice of trade partners given their tax regime. For a given tax regime, firms would likely have a stronger incentive to trade with other firms in the same tax regime. As a result, firms may not necessarily choose the best supplier for their products, and such distortions of their production decisions may reduce the overall efficiency of an economy.

VAT THRESHOLDS: A CASE STUDY

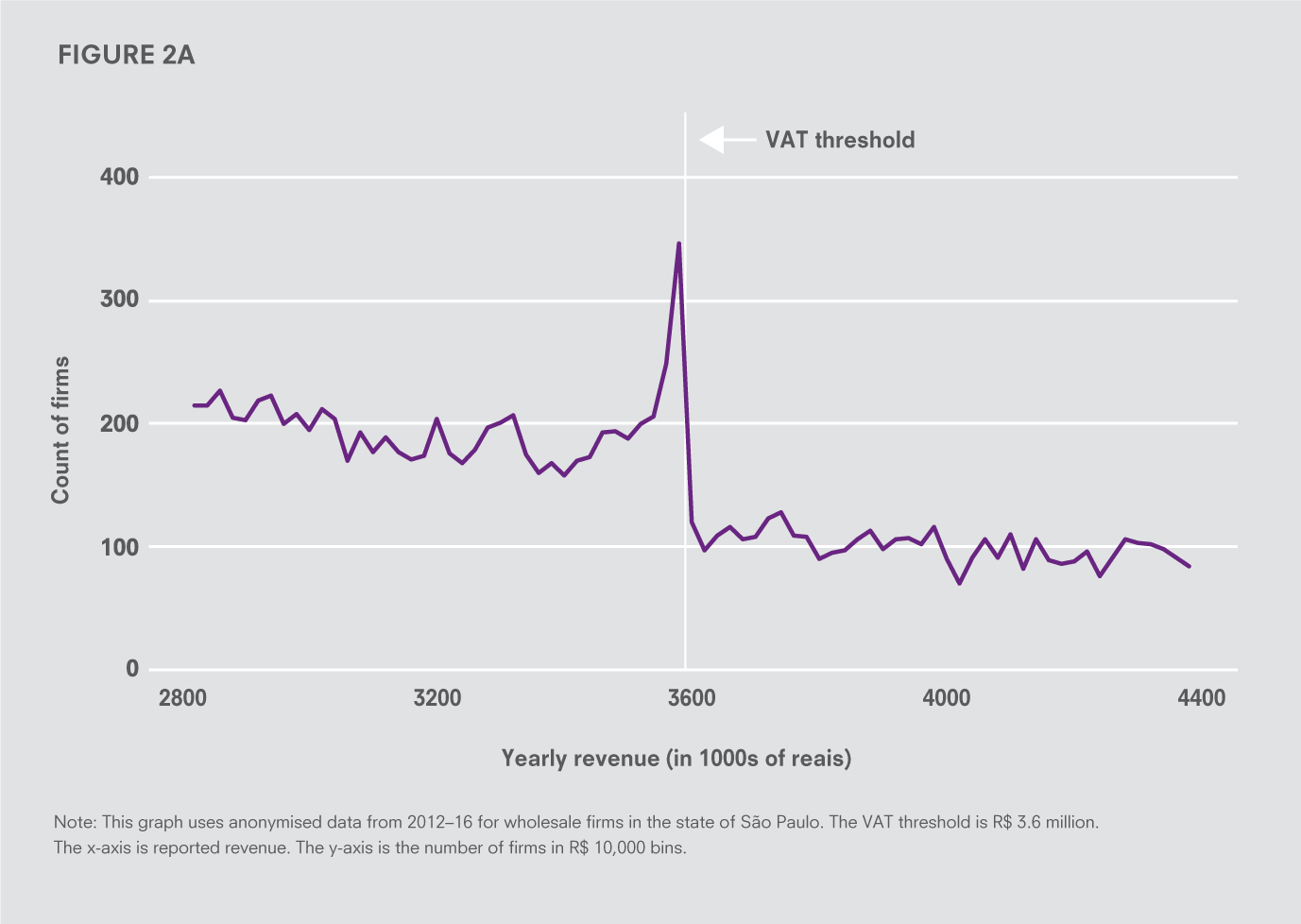

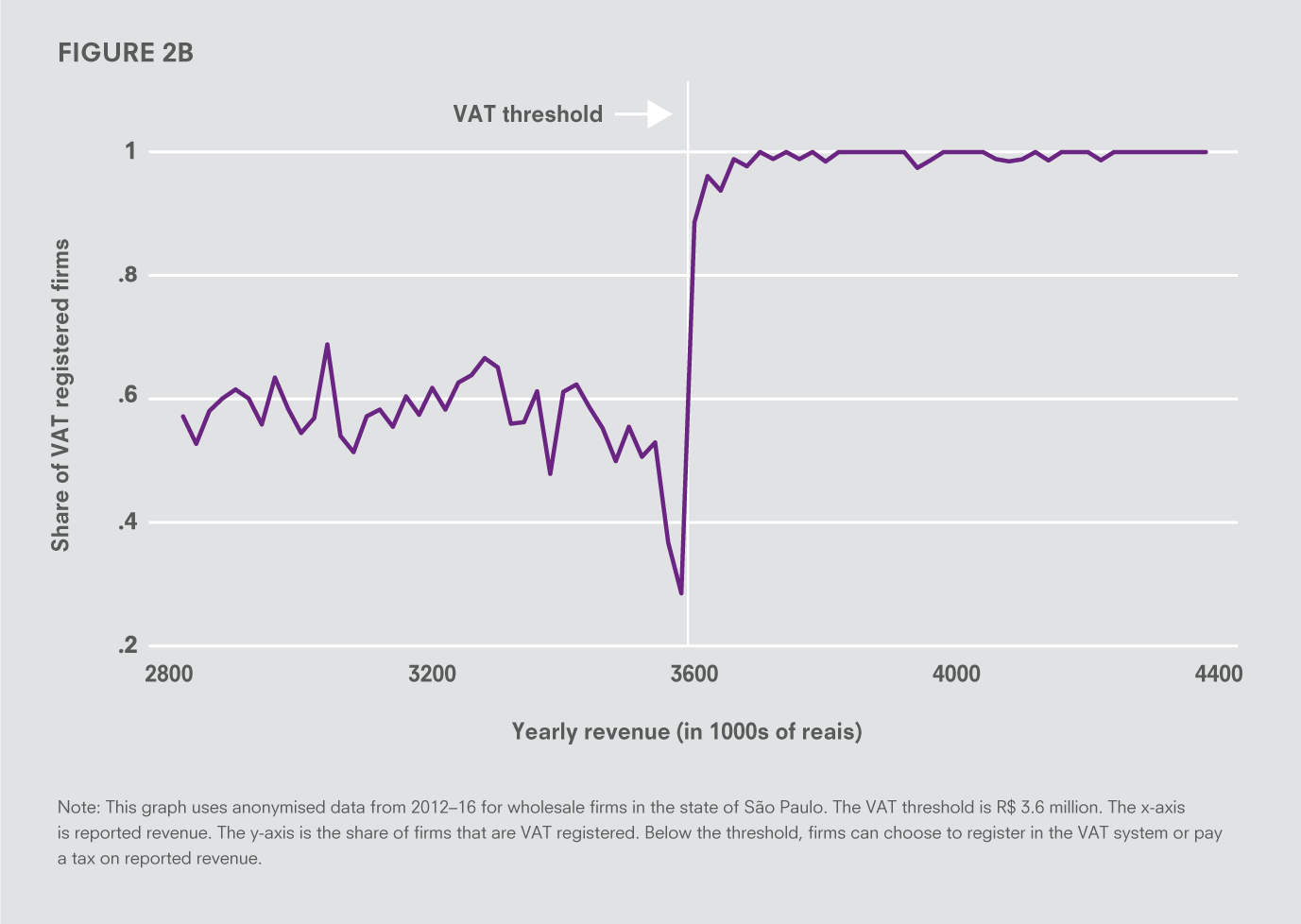

In an ongoing project funded by the IGC, Gerard, Naritomi and Seibold (2018) provide new evidence on the effects of VAT exemptions along the supply chain using anonymised administrative data from the tax authority of São Paulo, where VAT is a state-level tax. Brazil has recently required electronic invoicing of B2B transactions for all firms – including for transactions among de jure VAT-exempt firms – providing a great opportunity for studying chain effects when firms with revenue below a certain threshold are allowed to opt out of the VAT system.2 First, the project documents two facts:

- Figure 2a below suggests that the distribution of firms’ yearly revenue features clear bunching (abnormal group of firms) to the left of the

VAT registration threshold. This shows that some firms actively choose their reported revenue to avoid mandatory registration. - At the same time, Figure 2b shows that below the VAT registration threshold, many firms voluntarily register in the VAT system. The sudden drop before the threshold is driven by the bunching firms in 2a: they want to avoid having to register in the VAT system.

The co-existence of these two facts could be driven by chain effects: firms trading with exempt firms avoid registration; firms trading with VAT-registered firms voluntarily register.3 Using B2B anonymised data from electronic invoicing, the researchers indeed find that firms are relatively more likely to trade with firms in their own tax regime.

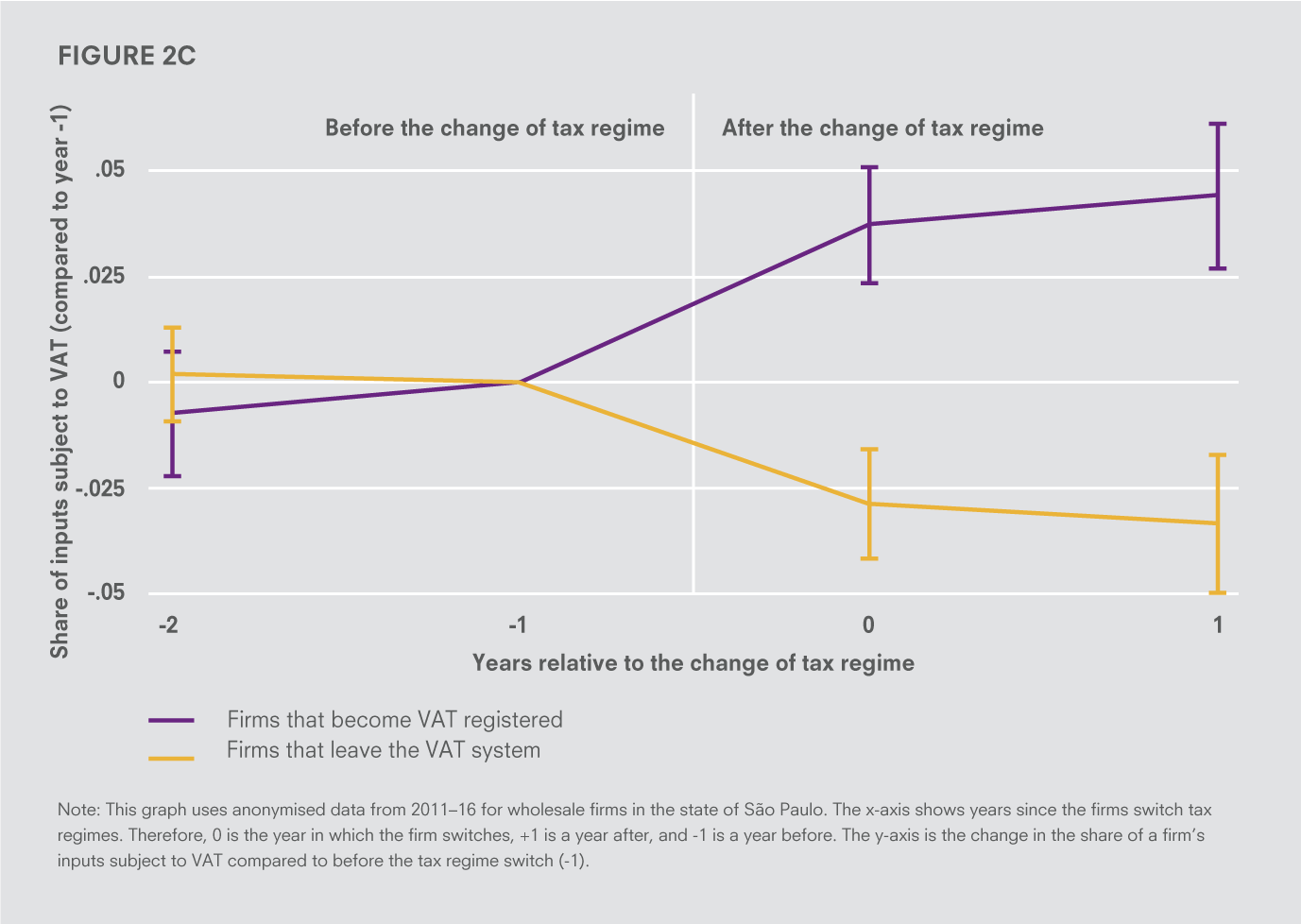

Moreover, as Figure 2c below shows, the share of a firm’s input coming from VAT-registered suppliers discontinuously increases when it becomes VAT-registered. Similarly, the share of a firm’s input coming from VAT-registered suppliers drops when it chooses to leave the VAT system. This pattern rests on changes in tax regime within firms across time, and thus cannot be explained by differences in fixed firm characteristics.4 As a result, it suggests a causal relationship between the respective tax regimes of potential trade partners and their actual choice of trading together. This causal relationship can go in two directions:

- Firms may choose their tax regime based on the tax regime of their trading partners, highlighting the revenue mobilisation concern. The patterns in Figure 2c could be due to firms switching tax regime because they anticipate trading with firms in the other tax regime.

- It could also be due to firms switching trade partners because of their new tax regime and the tax regime of potential trade partners, highlighting the production efficiency concern.

IMPLICATIONS

Although this work is still in progress, it indicates that supply chain effects are real, and thus should be considered when designing VAT exemptions, among the costs to be weighed against the policy rationale. It also shows how new data sources can be fruitful for collaborations between tax authorities and academics to create new evidence on VAT policy in developing country contexts.

Figure 2A

Figure 2B

Figure 2C

Policy recommendations

POLICYMAKERS

- The key strengths of VAT systems are their self-enforcing properties, but it is important to also consider their weaknesses (e.g., remaining opportunities for credit fraud and refund management), which can be particularly challenging to address in contexts where tax authorities have limited resources.

- ICTs provide new enforcement opportunities to improve the effectiveness of VAT systems. However, the design of new policies should carefully consider ‘take-up’ costs in the local context, for consumers (e.g., the costs of participating in consumer monitoring), firms(e.g., the costs of adopting EBMs), and tax administrations (e.g., the costs of effectively processing information from EBMs).

- Moreover, the legal system may need to be adapted to adequately support the new levels of information flowing into tax authorities(e.g., by facilitating taxpayers’ amendment of their records in case of data inconsistencies and protecting sensitive business information captured by electronic receipts).

- Policymakers should consider repercussions along supply chains when designing VAT exemptions or enforcement strategies. Exempting firms or sectors that are important trade partners for many taxpayers (or allowing them to be de facto exempt) may have sizable implications for revenue mobilisation and production efficiency.

- Relatedly, it may be best to address different policy goals (e.g., industrial policy) by using different policy instruments.

RESEARCHERS

- Researchers should further investigate the detailed activities of tax administration. Reforms of VAT systems can have important implications for the cost of audits and information processing, and there are often organisational decisions (e.g., large taxpayer units, decentralised auditing) that could be informed by better evidence. Okunogbe and Pouliquen (2017), provide an interesting example of how ICT and corruption by officials can interact.

- Researchers should try to quantify compliance costs of VAT systems and consider how specific reforms may affect these costs. Some exemptions (e.g., VAT thresholds) are motivated by such costs, but little is known about their magnitude. Measuring them is challenging but crucial to assess the total welfare effect of potential reforms. The case of Finland in Harju et al. (2018) isan interesting example of evidence suggesting that compliance costs can affect firm growth, even in a more developed country context.

- The management of tax credit and export refunds is an important issue given the uncertainty it creates for both firms and the government. However, the aggregate implications of existing policies regarding tax refunds is unclear, as are the potential improvements that alternative policies could bring about.

- Evidence on the incidence of a VAT in contexts of limited enforcement and high informality would be very important to shed light on the distributional consequences of VATs in developing countries. Singhal (2013) discusses some of these issues in the context of Bihar.

- The earlier studies in this new wave of VAT research uses administrative data from developing countries that are in the middle- to high-income range. More research is needed to understand how VAT works in lower income countries where some of the concerns highlighted in this brief could be particularly relevant. Recent IGC projects in sub-Saharan Africa, as well as the TaxDev programme of the Institute for Fiscal Studies in Ghana and Ethiopia, present a great step in this direction.

References

Alexeev, M. and Chibuye, B. (2016). “Estimating the Value Added Tax (VAT) gap in Zambia: 2009–2011”, International Growth Centre Policy Brief 41204.

Almunia, M., Gerard, F., Hjort, J., Knebelmann, J., Nakyambadde, D., Raisaro, C., and Tian, L. (2017). “An Analysis of Discrepancies in Tax Declarations submitted Under Value-Added Tax in Uganda”, International Growth Centre Project Report.

Best, M., Brockmeyer, A., Kleven, H., Spinnewijn, J., and Waseem, M. (2015). “Production versus Revenue Efficiency with Limited Tax Capacity: Theory and Evidence from Pakistan”, Journal of Political Economy 123, no. 6: 1311–1355.

Campbell, S., Gerard, F., Jensen, A., Naritomi, J., Zeitlin, A., and Tourek, G. (2017). “Strengthening consumers’ participation in VAT compliance strategies in Rwanda”, International Growth Centre Project Report.

Campbell, S. and Naritomi, J. (2018). “Enlisting Citizens in Tax Enforcement: A Policy Review”, Working Paper.

de Paula, A. and Scheinkman, J. (2010). “Value-Added Taxes, Chain Effects, and Informality”, American Economic Journal: Macroeconomics

2: 195–221.

Ebrill, L., Keen, M., Bodin, J., and Summers, V. (2002). “The Allure of the Value-Added Tax”, Finance and Development Quarterly Magazine

of the International Monetary Fund, Volume 39, Number 2.

Eissa, N., Zeitlin, A., Karpe, S. and Murray, S. (2014). “Incidence and Impact of Electronic Billing Machines for VAT in Rwanda,” International Growth Centre Project Report.

Fan, H., Liu, Y., Qian, N. and Wen, J. (2018). “The Dynamic Effects of Computerized VAT Invoices on Chinese Manufacturing Firms”, NBER Working paper 24414.

Gadenne, L., Nandi, T. and Rathelot, R. (2018), “Taxation and Supplier Networks: Evidence from India”, Working Paper.

Gerard, F., Naritomi, J. and Seibold, A. (2018). “Tax Systems and Inter-firm Trade: Evidence From the VAT in Brazil”, Working Paper.

Harju, J., Matikka, t. and Rauhanen, T. (2018) “Compliance Costs vs. Tax Incentives: Why Small Firms Respond to Size-based Regulations?”, Working Paper.

Kleven, H., Khan, A., and Kaul, U. (2016). “Taxing to develop: When ‘third-best’ is best”, International Growth Centre Growth Brief Series 005.

Keen, M. (2016). “Taxation and Development—Again”, International Monetary Fund Working Paper, Fiscal Affairs Department.

Keen, M., and Mintz, J. (2004). “The Optimal Threshold for a Value-Added Tax”, Journal of Public Economics 88.3–4: 559–576, Science Direct.

Kopczuk, W., and Slemrod, J. (2006) “Putting firms into optimal tax theory”, American Economic Review 96.2: 130-134.

Naritomi, J. (2016). “Consumers as Tax Auditors”, Working Paper.

Okunogbe, O. and Pouliquen, V. (2017). “Impact Evaluation of the Introduction of Electronic Filing in Tajikistan”, World Bank Endline Report.

Pomeranz, D. (2015). “No Taxation without Information: Deterrence and Self-Enforcement in the Value Added Tax”, American Economic Review, 105(8): 2539–69.

Rios, J. and Setharam, I. (2018). “Propagating Formality via Value Added Tax Networks: Evidence from India”. Working Paper.

Singhal, M. (2013). “Commodity Taxation in Bihar, 1994–2012”, International Growth Centre Working Paper, Impact Evaluation of the Introduction of Electronic Tax.

Waseem, M. (2017). “Information, Asymmetric Incentives, or Withholding? Understanding the Self-Enforcement of Value-Added Tax”, Working Paper.

Citation

Gerard, F., and Naritomi, J. (2018). Value Added Tax in developing countries: Lessons from recent research. IGC Growth Brief Series 015. London: International Growth Centre.