Mitigating welfare losses for workers after a layoff: Evidence from Brazil

Across the development path, social insurance programs become an increasingly important part of governments’ role, and the SDGs have highlighted the importance of such social protection schemes for development. Informality and low state capacity, however, impose challenges for policy design that may have consequences for the insurance value of such programs, and there is a need for more evidence-based policy discussion.

François Gerard (Columbia University) and Joana Naritomi (LSE)’s research funded by the International Growth Centre (IGC) and the National Science Foundation (NSF) provide new evidence on the extent to which government-mandated job displacement insurance schemes in developing countries can mitigate welfare losses for workers after a layoff, and how the design of such policies can affect their insurance value. Based on country-level data collected for 139 countries as well as detailed microdata from São Paulo, Brazil, they find that:

- Social insurance programs, such as job displacement insurance schemes, become an increasingly important part of governments’ role as countries develop, and the prevalence of different policies varies systematically across countries.

- In practice, government-mandated job displacement insurance can only cover formal workers, but many developing countries have high levels of labor market informality. Thus, the need for such insurance could be smaller in developing countries if formal employment is not workers’ usual employment status or if informal jobs are easy to find and close substitutes for formal jobs. The results of the study indicate, however, that the need for job displacement insurance is sizable, even in context of high informality.

- The results also indicate that the capacity of these programs to mitigate welfare losses for displaced workers depends greatly on the timing of the disbursement of benefits to workers. This is because they find that consumption – a proxy for workers’ welfare – is very sensitive to cash-on-hand, even in the context of a relevant and salient negative shock: the loss of a formal job. These findings are particularly relevant for job displacement insurance schemes that are relatively more common in developing countries, i.e, lump-sum transfers from government-mandated Severance Pay.

Policy relevance

Currently, 12% of the labor force in Brazil is unemployed and 40% is informally employed. Therefore, government policies to tackle unemployment shocks and informality are a high priority, and likely relevant to other developing countries that face similar challenges.

Using unique administrative data from São Paulo, Brazil, the authors study the insurance value of the two most common forms of government-mandated job displacement insurance available across countries: Severance Pay (SP) – lump-sum payments at layoff – and Unemployment Insurance (UI) – periodic payments contingent on non-employment.

Both programs are quite prevalent and often coexist, but while UI programs are mostly found in richer countries, SP programs exist across levels of development and are thus relatively more common in developing countries.

In practice, job displacement insurance can only cover formal workers and benefit payout schemes can only be made contingent on non-formal-employment in developing countries, which typically have high levels of informality. Much of the existing debate between UI and SP in that context focuses on mitigating the moral hazard problem with UI. Displaced workers may have lower incentives to find a new formal job while eligible for UI benefits.

This concern exists in all countries, but it could be aggravated in developing countries because of the possibility to work informally and the limited state capacity to monitor workers’ reemployment status (Gerard and Gonzaga 2016). SP has the advantage that it does not generate such moral hazard and requires less administrative capacity, as it shifts to firms the mandate to provide payments upon layoff and does not require government offices to monitor workers’ reemployment status.

Overview of the results

The results show that these advantages of SP over UI under low state capacity may come at a cost. The insurance value of SP programs relies critically on workers' ability to “dis-save” their lump-sum amount progressively after layoff. However, the authors find that displaced workers’ consumption is excessively sensitive to cash-on-hand, which hinders the insurance value of SP program.

Taking advantage of a rare combination of high-frequency expenditure data and matched employee-employer data for more than 400,000 workers over five years in the state of São Paulo, Brazil, where displaced workers are eligible for both UI and SP, they find that:

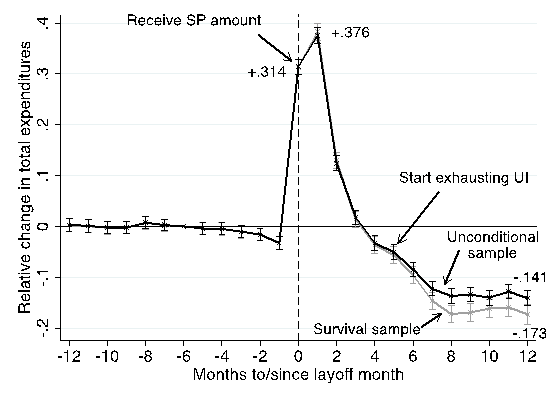

- Workers increase consumption at layoff by 35% despite experiencing a long-term consumption loss of 17% when they stop receiving any benefits (see Figure 1). These patterns are robust across expenditure categories and are not driven by durable goods.

- Expenditures spike by 20% in the week that workers receive their monthly UI paycheck.

- Workers fail to smooth consumption in anticipation of the (expected) drop in income when UI benefits are exhausted, which is associated with a 10% drop in consumption.

Taken together, the results suggest that consumption is very sensitive to cash-on-hand, even in the context of a relevant and salient negative shock, i.e., the loss of a formal job. These findings highlight the importance of the different “disbursement” policy between SP and UI – beyond their different “contingency” policy – because the timing of benefit payment may affect the ability of workers to smooth their consumption after layoff.

Policy recommendations

- Job displacement insurance can lead to substantial welfare gains for workers, even in a context of high informality: The long-term loss in consumption after the loss of a formal job is comparable to estimates from developed countries, despite the high labor market informality in the setting of this study.

- Disbursement policies matter and should be considered carefully: Consumption is very sensitive to cash-on-hand, even in the context of a relevant and salient negative shock, such as the loss of a formal job. The trenched disbursement of UI due to its contingency policy may help workers better smooth consumption in that case, thus increasing the insurance value of UI compared to SP. The associated welfare gains for workers could partially mitigate concerns related to the moral hazard problem with UI programs.

- Disbursement of benefits in a lump-sum can be relevant for other policy objectives: Our results do not imply that the lump-sum disbursement of benefits should generally be avoided. The same reasons that may prevent workers from dissaving their SP amount more slowly may justify the existence of forced savings to mobilize the resources necessary for lumpy investments that workers may not be able to make otherwise. The key implication of our findings is that, if the goal of a policy is to provide insurance to displaced workers, a lump-sum disbursement could undermine this goal.

References

GERARD, FRANÇOIS & GONZAGA, GUSTAVO. 2016. Informal Labor and the Efficiency Cost of Social Programs: Evidence from the Brazilian Unemployment Insurance Program. NBER Working Paper 22608.

GERARD, FRANÇOIS & NARITOMI, JOANA. 2019. Job Displacement Insurance and (the Lack of) Consumption-Smoothing. Working Paper.

Figure: Consumer spending profile before and after the loss of a formal job

The figure presents difference-in-differences results (point estimates and 95% confidence intervals) for relative changes in total expenditures before and after the displacement event (the vertical line indicates the displacement month). The black line displays estimates using all displaced workers (“unconditional” sample), including those who find a new formal job in the months after layoff. The red line displays estimates restricting the sample to displaced workers who remain without a formal job in each month after layoff (“survival” sample). The pattern around UI exhaustion is fuzzy because workers exhaust UI benefits between months 5 and 7 after layoff, but we present the results of an event analysis centered around UI exhaustion (rather than displacement) in the paper, showing that workers fail to smooth consumption in anticipation of the drop in income at UI exhaustion.

The figure presents difference-in-differences results (point estimates and 95% confidence intervals) for relative changes in total expenditures before and after the displacement event (the vertical line indicates the displacement month). The black line displays estimates using all displaced workers (“unconditional” sample), including those who find a new formal job in the months after layoff. The red line displays estimates restricting the sample to displaced workers who remain without a formal job in each month after layoff (“survival” sample). The pattern around UI exhaustion is fuzzy because workers exhaust UI benefits between months 5 and 7 after layoff, but we present the results of an event analysis centered around UI exhaustion (rather than displacement) in the paper, showing that workers fail to smooth consumption in anticipation of the drop in income at UI exhaustion.