Ugandan fine coffee (Arabica): What is the opportunity?

Ugandan Arabica coffee is all but unknown among end consumers and underrated by traders. There are immediate opportunities to improve marketing methods as well as to raise farmers’ incomes by building a supply chain that emphasises quality, such as the presence of washing stations in the western regions.

When coffee production and revenues began to rise in Uganda in the 1990s, poverty levels fell markedly. From 1990, the percentage of Ugandans living on under $1.90 per day fell from 90% to 35% in 2012. During the same period revenues from coffee exports increased more than fourfold. With all caveats about cause and effect noted, coffee provides cash income for farmers. That makes interventions in the coffee sector an effective way to raise incomes and improve livelihoods.

The situation in Uganda

This is especially true in Uganda which has around 300,000 farmers growing Arabica coffee. 90,000 are on the border to Kenya in the east around Mount Elgon and at least 200,000 are in the west on the border with Congo.

Espresso drinkers in New York, Taipei or Berlin are unlikely to have heard of coffee from Uganda though. There have not been enough single origin roasts from the country to raise awareness. Not to mention not enough campaigns with George Clooney or Angelina Jolie. On top of that, traders tend to rate Ugandan coffee poorly – of low and inconsistent quality (Baffes, 2006).

Decade long change

There have been big changes in the last 10 years though, that have brought substantial volumes up to the quality of Kenyan and Ethiopian Arabica. For coffee experts that means cupping at 84 to 86. For non-experts that means coffee that is drinkable in a chain like Starbucks and sometimes reaching speciality coffee shops in the trendier parts of town.

A decade of investment in washing stations, drying facilities and the supply chain in the east of Uganda around Mount Elgon has made this possible. There is now large-scale formal coffee processing working with 90,000 farmers on quality-driven production.

IGC research

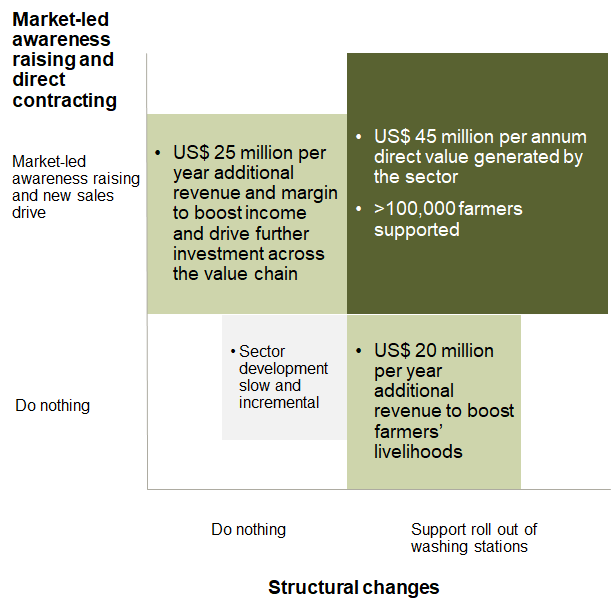

An IGC project set out to understand firstly, whether the value of Uganda’s Arabica could be increased through better marketing and pricing and contracting directly with roasters. Secondly, whether there was scope to expand the developments seen in the east to the west of the country.

For marketing, we found that value can be increased substantially by working and contracting directly with roasters, however this is highly linked to the consistency of the product and managing production to meet the needs of international buyers.

There is a need for a mediation and marketing agency to link local producers with international buyers. The role would be to help buyers find producers and communicate their needs to them and in reverse, to help producers understand those needs and manage their production to ensure they consistently meet them.

For western production, our initial calculations indicate $20 million per year additional revenue opportunity that can be secured for the coffee sector by formalising production. By converting from dry processing to washing production, this could improve quality and stability, reduce losses, optimise farm practices, and ultimately raise yields.

Underlying all of these changes is the need to make quality management of Arabica coffee a high priority. Coffee exporters and roasters have a main interest in accessing high quality coffee. The prices they pay reflect this. There can be a $60 difference in price between a 60kg bag of low quality dried Ugandan coffee from the west and a 60kg bag of high quality coffee from the east.

This means that by managing for quality and formalising production, for instance with washing stations, the value of western coffee could increase by more than a third. For smaller farmers with poor crop management practices and selling to traders, the benefit will be even greater.

The Arabica opportunity in Uganda (USD over 2017 base)

Source: Project team and authors’ calculations

Source: Project team and authors’ calculations

References

Baffes, J (2006), “Restructuring Uganda’s Coffee Industry: Why Going Back to Basics Matters,” World Bank Policy Research Paper 4020.