Growth Brief: The cost of violence - Estimating the economic impact of conflict

In recent years, there has been a substantial increase in rigorous research and evidence on the costs and consequences of armed conflict. This brief reviews the latest evidence and draws conclusions of relevance for policymakers.

-

IGCJ5023_Economic_Cost_of_Conflict_Brief_2211_v7_WEB.pdf

PDF document • 809.45 KB

Alongside its dire humanitarian costs, armed conflict poses a range of risks to a country’s economic growth and development. Measuring the economic impacts of violence matters because it can inform resilience strategies and drive resources toward conflict prevention.

Fragile states often struggle to maintain resilience to conflict and other shocks; conflict, economic instability, poverty, and fragility tend to feed each other in a negative cycle. Recurrence of violence is the largest threat to long-term growth and development in conflict-affected countries.

This brief reviews some of the latest research measuring the causal effects of violent conflict on a range of economic outcomes. It outlines the different channels and mechanisms through which conflict can affect growth. The aim is to help guide policymakers on what can be done before, during, and after conflict to mitigate its effects.

Key findings:

Accurately estimating the economic cost of violent conflict is hard: the very existence of a conflict make measurement of economic activity difficult, and conflict can interact with the economy through multiple, complex pathways. In addition to the immediate, direct effects of violence on the economy, there are a number of indirect effects that may last long after the violence has receded. Fragile states often struggle to maintain resilience to conflict and other shocks; conflict, economic instability, poverty, and fragility tend to feed each other in a negative cycle. Recurrence of violence is the largest threat to long-term growth and development in conflict affected countries.

This brief reviews some of the latest research measuring the causal effects of violent conflict on a range of economic outcomes. It outlines the different channels and mechanisms through which conflict can affect growth. The aim is to help guide policymakers on what can be done before, during, and after conflict to mitigate its effects.

Key Messages

1. Preventing violent conflict should be a key priority for development and growth policy.

Violent conflict disrupts economic activity through multiple channels – and its effects are large and persistent. Policymakers need to understand these different channels in order to better prioritise what can be done to minimise the impacts of violence on economic and human development.

2. The economic effects of civil war often last well beyond the conflict period and can spill over to other countries.

These effects include shocks to employment and investment, large outflows of refugees, and reductions in health and schooling levels. Alleviating the humanitarian crisis and preventing human capital losses is important for preventing long-term negative economic repercussions.

3. In the aftermath of conflict, restoring investor confidence and rebuilding trust should be high priorities.

One of the main ways conflict can cause economic damage is by influencing investors’ expectations about political risks and the potential for a future resurgence in violence. Inclusive political institutions can support economic regeneration by preventing the risk of inequality between groups fuelling further unrest.

Key message 1 – Preventing violent conflict should be a key priority for development and growth policy

Insecurity can disrupt economic activity through a number of channels, and the effects can be large and long lasting. Fear resulting from violence and destruction can hinder economic activity directly through an increase in transport costs, capital flight, or postponing of investments. There can also be indirect effects like the breakdown of political institutions and public services such as health and education, as well as effects that spill over into other countries, such as refugee crises. Insecurity and weak law enforcement can threaten property rights and suppress economic activity. Particularly in contexts of weak institutions, countries can become trapped in repeated cycles of violence that prevent economic development. Understanding and quantifying the different ways that conflict can impact the economy is critical to informing more effective conflict prevention strategies and enabling growth.

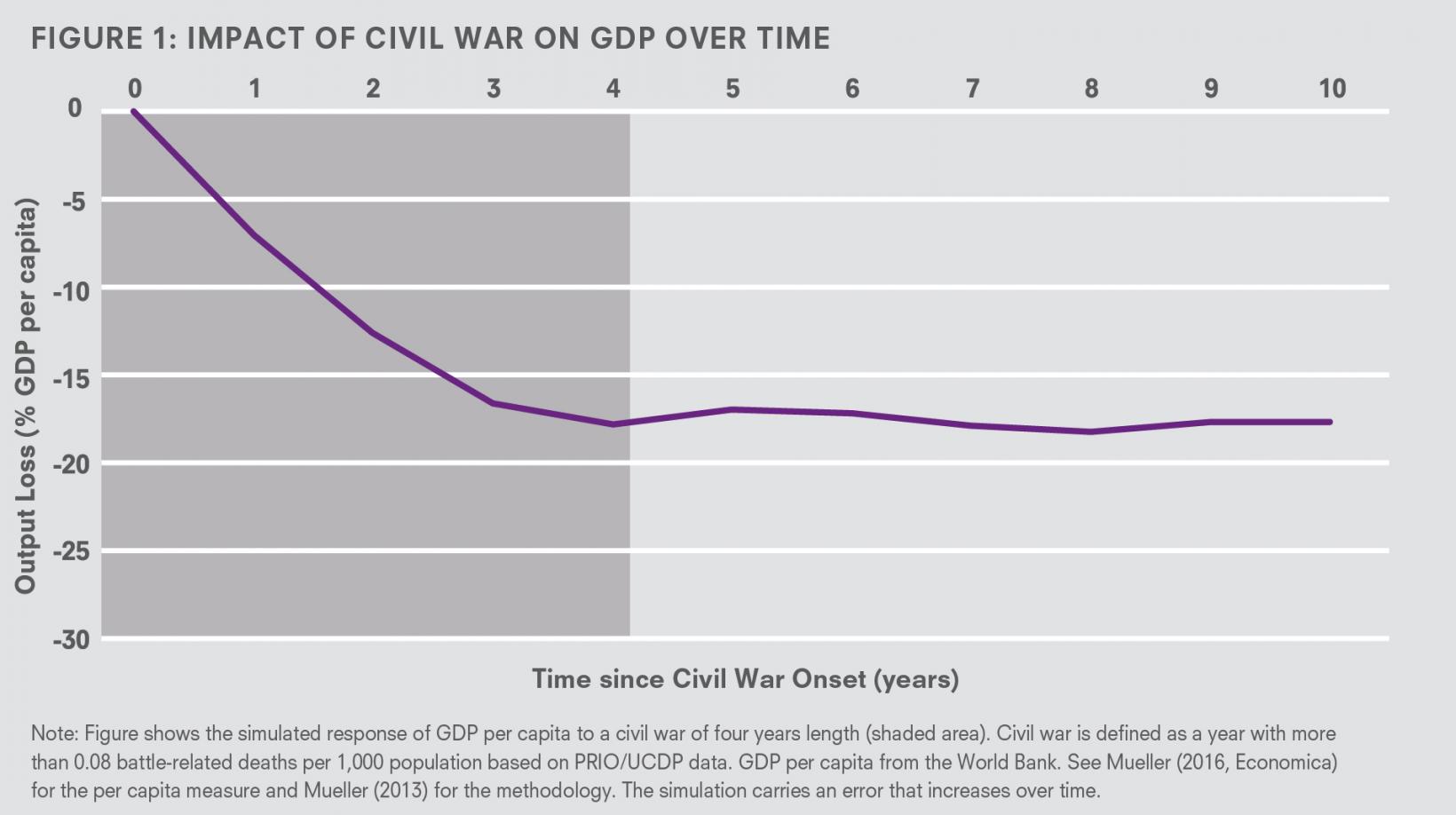

The impacts of a conflict on the economy depend on two key dimensions: its duration and intensity. Figure 1 provides a simulation of how a country’s Gross Domestic Product (GDP) per capita is affected, on average, when a civil war with a four-year duration breaks out.1 The dramatic decline in GDP per capita that countries experience during civil wars (shaded area) is clearly visible – GDP per capita is estimated to contract by about 18% over the four-year period. This is about twice as large as the collapse suffered by the Greek and Irish economies during the Great Recession of 2007–2011.

Importantly, it takes a long time to recover from this economic damage. Even six years after the end of the civil war, GDP per capita is still 15 percentage points lower on average than it would be without the war. It is the severe decline combined with the duration of the economic damage that makes civil war so costly.

Figure 1: Impact of civil war on GDP over time

Source: Mueller, 2013

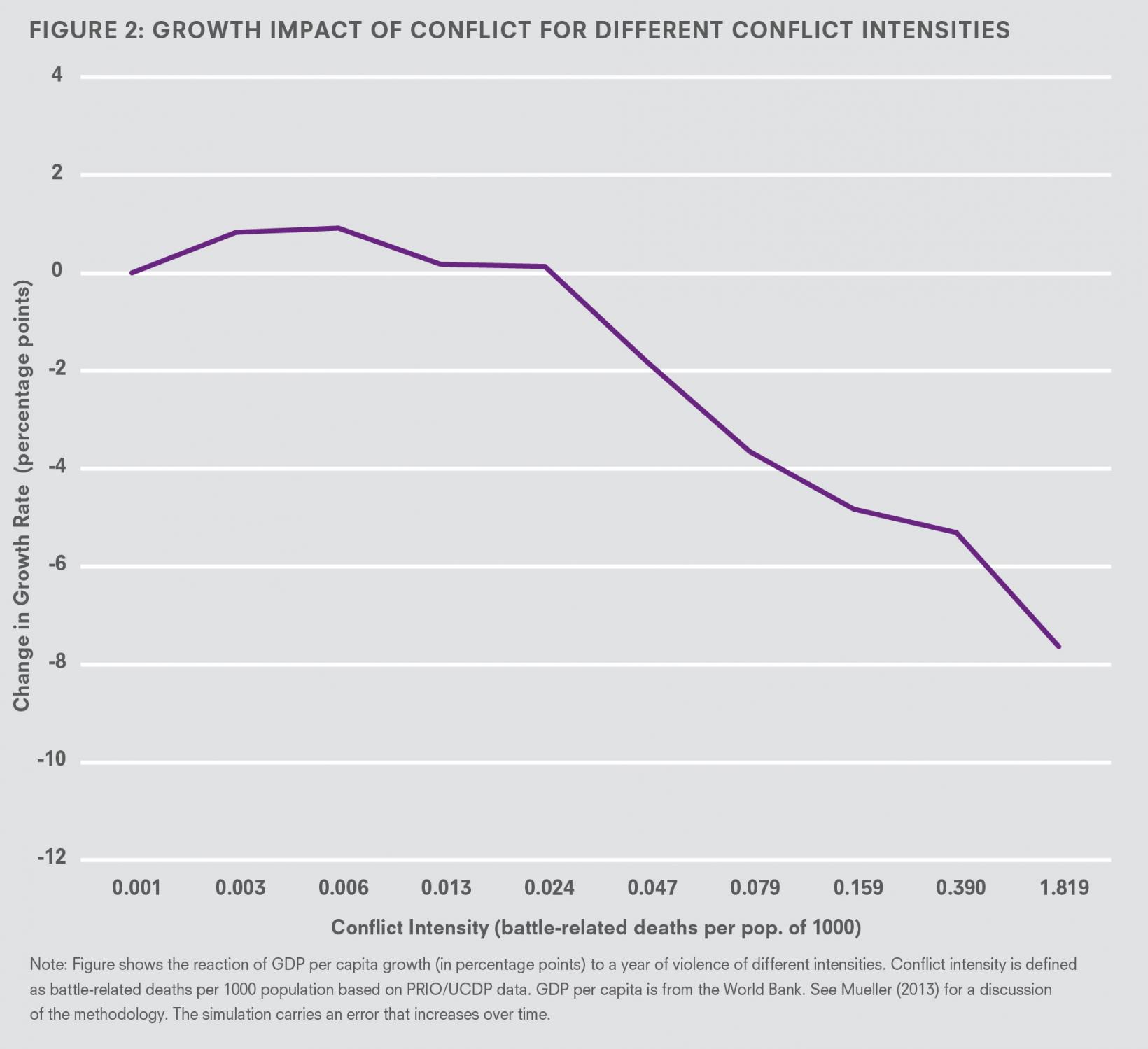

The intensity of violence also plays an important role in influencing how much the economy is affected at the macro level. Recent evidence emphasises the usefulness of measuring violence on a per capita basis – rather than looking at total casualties at the country or state level – as the share of the population affected locally is a crucial variable for understanding how conflict affects the economy (Mueller, 2016).

Figure 2: Growth impact of conflict for different conflict intensitites

Source: Mueller, 2013

Figure 2 illustrates with the latest data available that, at the aggregate level, the economic damage done by conflict has a visible effect on GDP only at high conflict intensities (See Mueller, 2013 for a discussion of the underlying statistical analysis). It shows the effect of one year of armed conflict on economic growth at different violence intensities, measured by battle-related deaths per capita. For example, a year of armed conflict with an intensity of around 0.079 battle-deaths per a population of 1000, leads to a decrease in the economic growth rate by about 3.5 percentage points. Violence below an intensity of 0.047 has no discernible effect on the macro-economy. However, for more intense conflicts the effect is quite dramatic. The highest intensity civil wars lead to a drop in the yearly growth rate by between 5 and 10 percentage points.

What does this imply for a country like Syria that has already suffered four years of high intensity violence? According to our estimates, Syria’s economy had lost 19–36% of its productive capacity by 2016 due to conflict. In absolute terms, this means that the Syrian economy produces 20–38 billion USD less in value added each year.

Violent conflict is a major cause of the reversals in economic growth that many developing countries have experienced in recent decades. Indeed, recessions experienced during periods of violent conflict are a key reason for much lower average growth rates over time in fragile countries.

That said, conflict does not always cause inevitable longer-term or permanent economic damage – an analysis of civil wars between 1960– 2003 showed that when the end of conflict marks the beginning of a lasting peace, recovery and improvement can be achieved (Chen et al., 2008). It is renewed outbreaks of conflict that prevent economic recovery, which is why it is so important to prevent conflict from re-occurring.

In summary, it is clear that preventing conflict, or at least containing its economic damage, is critical for long-term development, and thus understanding when and how recovery works is a priority.

Key message 2 – The economic effects of civil war often last well beyond the conflict period and can spill over to other countries

It is useful to understand the different channels through which violence impacts the economy to better prioritise what can be done before, during, and after a conflict to minimise economic losses. In addition to the immediate, direct effects of insecurity and armed violence on economic activity, there are indirect, longer-term impacts. This includes impacts that spill over to other countries – such as through trade and refugee flows. Other longer-term effects on human health and human capital can have a knock on impact on the economy.

GDP, employment, and trade

There is a large body of research that finds civil wars have large and significant aggregate impacts on macroeconomic indicators such as GDP and trade (e.g. Collier, 1999; Abadie and Gardeazabal, 2003; Martin et al., 2008). More evidence has emerged recently on the channels of this immediate disruption.

Recent microstudies have shown, for example, that the insecurity spread by violence can create large increases in labour and transport costs. For instance, a study on the 2007 Kenyan presidential election found that electoral violence drove labour costs up by 70% (Ksoll, Macchiavello, and Morjaria, 2009). Another study found that insecurity caused by Somali pirates in the Gulf of Aden and the Indian Ocean led to an increase in shipping costs of about 10% (Besley, Fetzer and Mueller, 2012).

Refugees and displacement

In addition to affecting trade, violence can drive large scale human displacement, which in turn can have destabilising regional and global impacts. In fact, the number of people running away from civil war violence is far larger than the number of fatalities globally.

During the average civil war, 600,000 people leave their country. About 80% of these refugees return within a year after the conflict ends, but 10% still have not yet returned even a decade after peace (Mueller et al., 2016, based on UNHCR statistics). Countries that neighbour states in civil conflict host about 11,000 refugees on average and considerably more in some cases: Pakistan hosts more than 1.5 million Afghan refugees, for example. According to UNHCR, over 50 million people are now either refugees or internally displaced, with an estimated 93 billion USD in associated costs.2 Refugee streams at this scale can destabilise whole countries or regions.

Health, education, and human capital

Avoiding a humanitarian crisis can be considered a long-term investment in human capital. Exposure to conflict during childhood or adolescence in particular can have large, persistent effects on health, education, and labour productivity outcomes for a generation. A study on the effects of Burundi’s civil war on health found that an extra month of exposure to the conflict reduced child height significantly (Akresh, Bundervoet and Verwimp, 2009). Similarly, a study on the long term impacts of the 1967–70 civil war in Biafra, Nigeria, which killed 1–3 million people, estimates that exposure to violence led to height reductions – an indication of poor health – in both children and adolescents (Akresh, Bhalotra, Lene and Osili, 2012). These effects are estimated to have reduced the income of those most affected by 1.5–3% per year of conflict exposure (Mueller, 2013, calculations based on Case and Paxson, 2008).

Like health, education also suffers during conflict. A study of abducted child soldiers in Uganda found they completed nearly a year less schooling than their peers on average (Annan and Blattman, 2010). The loss was not made up for later and led to a significant drop in earnings. Reduced education outcomes may translate into eventual impacts on wages similar to health deterioration. A study on political violence during the 1980s and 1990s in Peru found exposure to violence before school-age leads to about half a year less schooling per year of exposure (Leon, 2012). This implies a decrease in wages by 1.08–1.52%.3

In the aftermath of conflict, there is an important role for aid and redevelopment strategies to focus on children and adolescents to prevent human capital losses that can last a whole generation.

Key message 3 – In the aftermath of conflict, restoring investor confidence and rebuilding trust should be high priorities

Strengthening peace and building trust among different groups in society are key priorities once a conflict ends. Restoring investor confidence, as well as strengthening political stability and inclusiveness, should be important areas of focus to help prevent future negative cycles of conflict resurgence and economic shocks. These policy challenges are described below.

Restoring investor confidence

Conflict can increase risk perception of investors by increasing expectations about the potential for future outbreaks and instability. Political risk is transmitted to foreign investors in conflict-affected countries through three main channels: destruction of assets from the conflict; unavailability of inputs and adequate human resources; and sharp declines in domestic demand that lead to lasting impoverishment (Mueller et al., 2016).

A number of studies have tried to quantify the effects of conflict on investment-related indicators, including stock market evaluations and housing prices. Overall, this research shows that the political risk of a resurgence of violence can directly influence expectations, asset prices, and investment, emphasising the economic importance of sustained peace.

Evidence suggests that much of the economic impact of violent conflict comes from changes in expectations about future violence. Figure 3 shows that foreign investment inflows to countries during conflict (black line) are much lower than in post-conflict countries (purple line). Enterprise surveys show that both multinational and local firms react strongly to political instability.

Figure 3: Foreign investment during and after conflict

Source: Mueller et al., forthcoming

Micro-level evidence here includes a study showing that a shift from violence to peace in Belfast, Northern Ireland, after the 1993 Downing Street Declaration, led to a 6–16% increase in housing prices (Besley and Mueller, 2012). Another empirical study explores how conflict affects stock market evaluations (Zussman et al., 2006). Using data on Israeli-Palestinian conflict since the late 1980s, the researchers found that major escalations in violence led to significant declines in asset prices in both Israel and the Palestinian Authority (PA). Similarly, rocket attacks by Hezbollah during the 2006 Second Lebanon War led to a 6–7% decline in house prices and rents in the most severely hit localities – and these effects persisted until 2012 (Elster, Zussman and Zussman 2016).

Policies to de-escalate conflict and commit warring parties to stable peace once the fighting ends can thus help to attract investments needed to rebuild the economy. Countries should be poised to take advantage of the potential opportunity for large increases in foreign investment when there is a credible end to civil war. On average, investment inflows increase by 50% – amounting to 2–4 billion USD annually – when the violence stops (Mueller et al., 2016).

Building trust and inclusive political institutions

Conflict often has lasting effects on the political environment and social trust in a society. Inequality between groups along ethnic or other lines is a major potential source of conflict. Political exclusion can perpetuate the unequal distribution of economic resources, which may further fuel instability and conflict.

Inclusive political institutions and constraints on executive power can help to break the links between ethnic diversity, inequality, and conflict (Burgess et al., 2015; Besley and Persson, 2011; Mueller and Tapsoba, 2016). These institutions can help prevent conflict because they prevent ‘winner takes all’ dynamics where a loss of political power leads to economic decline.

Conversely, there is strong evidence of a link between conflict and weak political institutions. Chen et al, (2008) find that, compared to similar countries, conflict-affected states are slower to develop their political systems. Countries with a history of internal conflict manage to collect a much smaller share of taxes relative to GDP. One study suggests a tax take that is 7% lower than countries without conflict (Besley and Persson, 2008).

A related body of research focuses on societal trust and ethnic tensions. A study on civil conflict in Uganda in 2002–2004, for instance, suggests that intense conflict can disrupt trade and lead to a breakdown of inter-ethnic trust, particularly in areas with high ethnic fragmentation (Rohner et al., 2013). Using satellite night-time light data as a proxy for economic activity, this research finds that fighting in these areas is associated with a large and significant fall in living conditions.

An analysis of road-building in Kenya across five decades finds that democratic institutions can help to decrease ethnic favouritism in the provision of public goods (Burgess et al., 2015). Other research points to the importance of post-conflict justice institutions, such as the post-conflict trials in Rwanda, in helping to build inter-ethnic trust and also attract FDI (Bert and Marijke, 2015; Appel and Loyle, 2012).

A randomised study on the introduction of new ‘Alternative Dispute Resolution’ bodies for protecting property rights in Liberia, found that these informal institutions helped to inhibit violence (Blattman

et al., 2014). Finally, there is some evidence from Liberia on the effectiveness of community-driven reconstruction efforts and work training programs for ex-soldiers (Fearon et al., 2009; Blattman and Annan, 2015).

In summary, enhancing the stability and inclusiveness of political institutions is important to help build trust, mitigate the economic costs of conflict, and support lasting peace.

Photo: Getty Images | Eric Lafforgue

Policy recommendations

Global spending on violence containment is currently estimated at 7.16 trillion USD (GPI report, 2015). In countries such as Iraq, Syria, and Afghanistan, this spending represents 30–42% of GDP.

For international organisations and governments, the question of how to prevent the outbreak of armed conflict is extremely pressing and relevant. Yet, research that attempts to understand the causal impacts of different conflict intervention strategies remains relatively scarce. More research is needed to better understand the costs and impacts of different types of peacebuilding approaches and conflict interventions. Studies that focus on how weak and fragile states can escape the negative cycle of conflict and economic downturn would be particularly useful. In addition, preventive measures are dramatically under-researched.

This brief has argued that measuring and understanding the different types of economic costs associated with conflict, alongside its humanitarian toll, is important to help drive strategies and resource allocations toward conflict prevention. Understanding these costs is critically important for informing the approaches used by governments and international agencies to build peace.

To conclude, we summarise a few key recommendations for policymakers:

- Preventing violent conflict and addressing its root causes should be a key priority. The risk of recurrent cycles of violence poses the greatest economic threat to conflict-affected countries. The scale and duration of economic repercussions from conflict tends to be much lower where stable peace can be achieved.

- Humanitarian relief can play an important role in supporting post-conflict growth, especially efforts targeted at child development, which can have long term effects on the economy. Humanitarian crises on the scale experienced by Afghanistan or Syria can lower labour productivity irreversibly for a whole generation. Targeted interventions to address key points of vulnerability are important.

- The end of conflict provides a key opportunity to attract foreign investment.Policies that de-escalate conflict and commit the warring parties to peace in the period right after the violence stops can help to attract investment. Inclusive political institutions and policies that encourage refugees to return to their homes also appear to help support investment and economic regeneration.

References

Abadie, A. and Javier, G. (2003). ‘The economic costs of conflict: A case study of the Basque Country’. The American Economic Review.

Akresha, R., Lucchettia, L. and Thirumurthyb, H. (2012). ‘Wars and child health: Evidence from the Eritrean–Ethiopian conflict’. Journal of Development Economics.

Akresh, R., Bhalotra, S., Leone, M. and Osili, U. (2011). ‘War and stature: Growing up during the Nigerian Civil War’. The American Economic Review.

Appel, B. and Cyanne E, L. (2012). ‘The economic benefits of justice: Post-conflict justice and foreign direct investment’. Journal of Peace Research.

Bert, I. and Verpoorten, M. (2015). Inter-ethnic trust in the aftermath of mass violence: Insights from large-N life stories. Unpublished typescript.

Besley, T., Fetzer, T. and Mueller, H. (2012). One Kind of Lawlessness: Estimating the Welfare Cost of Somali Piracy. Working Papers 626, Barcelona Graduate School of Economics.

Besley, T. and Persson, T. (2008). ‘Wars and state capacity’. Journal of the European Economic Association.

Besley, T. and Persson, T. (2011). Pillars of Prosperity: The Political Economics of Development Clusters. Princeton University Press.

Blattman, C. and Hartman, A. and Blair, R. (2014). ‘How to promote order and property rights under weak rule of law? An experiment in changing dispute resolution behavior through community education’. American Political Science Review.

Blattman, C. and Annan, J. (2010). ‘The consequences of child soldiering’. The Review of Economics and Statistics.

Bundervoet, T., Verwimp, P. and Akresh, R. (2009). ‘Health and Civil War in Rural Burundi’. Journal of Human Resources, Spring.

Burgess, R., Jedwab, R., Miguel, E., Morjaria, A. and Padro i Miquel, G. (2015). ‘The Value of Democracy: Evidence from Road Building in Kenya’. American Economic Review.

Case, A. and Paxton, C. (2008). ‘Stature and Status: Height, Ability, and Labor Market Outcomes’. Journal of Political Economy.

Collier, P. (1999). On the economic consequences of civil war. Oxford economic papers.

Duflo, E. (2001). ‘Schooling and Labor Market Consequences of School Construction in Indonesia: Evidence from an Unusual Policy Experiment’. American Economic Review.

Elster, Y., Zussman, A. and Zussman, N. (2016). Rockets: The Housing Market Effects of a Credible Terrorist Threat. Ben-Gurion University of the Negev: Department of Economics.

Fearon, J., Macartan, H. and Weinstein, J. (2009). Evaluating community-driven reconstruction. World Bank.

Global Peace Index (2015). Global Peace Index: 2015. The Institute for Economics and Peace (IEP).

Ichino, A. and Winter-Ebmer, R. (2004). ‘The long-run educational cost of World War II’. Journal of Labor Economics.

Ksoll, C., Rocco, M. and Morjaria, A. (2009). Guns and Roses: The Impact of the Kenyan Post-Election Violence on Flower Exporting Firms. CSHE, WPS.

Leon, G. (2012). ‘Civil conflict and human capital accumulation: The long-term effects of political violence in Perú’. Journal of Human Resources.

Martin, P., Mayer, T. and Thoenig, M. (2008). ‘Civil wars and international trade’. Journal of the European Economic Association.

Mueller, H. (2016). Growth and Violence: Argument for a Per Capita Measure of Civil War. Economica, forthcoming.

Mueller, H. (2012). ‘Growth dynamics: The myth of economic recovery: Comment’. The American Economic Review.

Mueller, H. (2013). The Economic Cost of Conflict. International Growth Centre: Working Paper.

Mueller, H., Piemontese, L. and Tapsoba, A. Recovery from Conflict: Lessons of Success. World Bank Policy Research Working Paper, forthcoming.

Mueller, H. and Tapsoba, A. (2016). Access to Power, Political Institutions and Ethnic Favoritism. Barcelona GSE Working Paper.

Rohner, D., Thoenig, M. and Zilibotti, F. (2013). ‘Seeds of distrust: Conflict in Uganda’. Journal of Economic Growth.

Shemyakina, O (2011). ‘The effect of armed conflict on accumulation of schooling: Results from Tajikistan’. Journal of Development Economics, Elsevier.

Siyan, C., Loayaza, N. and Reynal-Querol, M. (2008). ‘The Aftermath of Civil War’. World Bank Economic Review.

Uppsala Conflict Data Program (UCDP) and International Peace Research Institute, Oslo (PRIO) (2009). Armed Conflict Dataset Codebook1 Version 4. Centre for the Study of Civil Wars.

Verwimp, P., Bundervoet, T. and Akresh, R. (2010). The Impact of Violent Conflict on Child Health: What Are the Channels? Policy Briefing 6, MICROCON – A Micro Level Analysis of Violent Conflict.

Zussman, A. and Zussman, N. (2006). ‘Assassinations: Evaluating the effectiveness of an Israeli counterterrorism policy using stock market data’. The Journal of Economic Perspectives.

Citation

Mueller, H. and Tobias, J. (2016). The cost of violence: Estimating the economic impact of conflict. IGC Growth Brief Series 007. London: International Growth Centre.