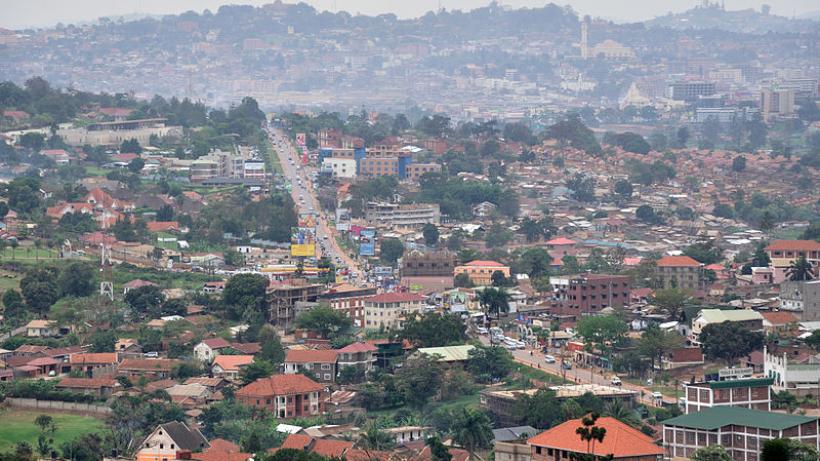

Local revenue reform with the Kampala Capital City Authority

Public finance remains a significant threat to economic development. Insufficient revenues limit infrastructure investments as well as the provision of basic services. Reforming the administration and collection of tax will be crucial for developing country governments. Since its establishment in 2011, the KCCA has implemented various reforms to tax policy; reforms are on track and may serve as a useful model to other African cities struggling to raise revenues.

An effective revenue administration that implements well-informed policies and raises sufficient revenues to fund infrastructure development and basic service provision is crucial for city authorities, particularly for rapidly urbanising developing countries. While city authorities administer numerous taxes and fees, property taxes remain one of the most important revenue sources.

Despite its impact on revenues, property tax administration is a notable challenge in cities where properties largely lack formal titling or accurate valuations, and where gazetting of some street names and assignment of property numbers is still needed. Rectifying deficiencies will enable effective property tax administration, a costly but worthy investment. Reforms will pay for themselves through greater revenue collection efficiency.

KCCA’s reforms could be replicated by other African cities

Recent work by Mihaly Kopanyi analyses the Kampala Capital City Authority (KCCA)’s revenue performance, capacities, and continuing plans for reform, paying particular attention to the KCCA’s Directorate of Revenue Collection (DRC). Kopanyi found that the KCCA’s reforms to date have achieved significant increases in own-source revenues, and have made the DRC a leading example of a revenue administration for other African cities, and for cities in developing countries more broadly. Drawing on international experiences, Kopanyi also provided the KCCA with actionable recommendations for further reform, which suggestions have been well received by the KCCA and implementation of some of these recommendations has already begun.

Since 2011, when the KCCA was established, the DRC unit has selectively and gradually invested in enhancing revenue databases, procedures, administration, and collection, attaining an increase of over 100% of own-source revenues as a result, from UGX41bn to UGX85bn (an increase of approximately US$13.2mn at the current exchange rate) between 2011/12 and 2014/15 fiscal years.

Examples of the DRC’s improved functioning include better administration, good and timely communication with tax payers, developing an improved revenue database, and introducing easy-to-use payment methods such as the e-Citie programme. An increase in own-source revenues as a share of transfers and total revenues was also achieved, and done so primarily through administrative reforms. Not only have these changes been large, they appear to be sustainable.

Comprehensive property registration and valuation programmes remain reform priorities

Reform efforts are ongoing, but certain significant challenges still remain, including completing a mass valuation of taxable properties and updating the property tax roll (which was last updated in 2005). In this regard, the DRC has adopted a comprehensive registry and valuation programme that combines developing a City Addressing Module (CAM) to map building locations and characteristics, and a Computer-Assisted Mass valuation/Appraisal (CAMA) programme to record current property values.

Kopanyi found that the KCCA’s reforms to date have achieved significant increases in own-source revenues, and have made the DRC a leading example of a revenue administration for other African cities

These developments are vital for the DRC to obtain valuations for properties in Kampala on which they can base property taxes and fees, and will be pivotal in enabling formal registration of property titles in Kampala.

Despite initial cost, integrating land and fiscal registries will pay future dividends to public revenues

Connected to this, developing an urban and a fiscal cadaster (public registries for property ownership, boundaries, and tax assessments) for the KCCA are also important future tasks, as the current cadastral map of land in Kampala does not including buildings, infrastructures, or superstructures. The urban cadaster would link the land and fiscal cadasters, and provide the basis for urban planning, land-use planning, zoning, construction permitting, and planning and developing infrastructure services. The fiscal cadaster would consist of a property tax register. Gazetting new street names and assigning property numbers, where this is still needed, will be crucial for these cadasters to be developed, and the KCCA continues to seek assistance in undertaking these tasks.

These projects will require substantial investment, estimated at about UGX10-20 billion (US$3-6 million), but these costs should soon be recouped through the improved revenue collection that completion of these projects will make possible. Indeed, a field survey of property samples compared the 2013 actual rental values to the 2005 property roll values of the same properties in five divisions in Kampala, and found a median increase in rental value in excess of 300%.

It is thought that completion of a new land valuation will increase the tax base so substantially that the KCCA may need to reduce rates initially in order to make the reform politically acceptable. In discussions on this issue, the possibility was also raised of zero-rating taxes and/or fees on low-value properties to make the improved revenue system more feasible.

More capacity is needed to complete registry and valuation programmes

Kopanyi found that the current policies, regulations, and procedures of the DRC are comparable to those of revenue administrations in more developed countries, yet the particular capabilities needed to complete the registry and valuation programmes with high quality and in a timely manner will require external assistance. This could be done through hiring a CAMA advisor to guide, train, and oversee DRC teams during this process or, alternatively, could be achieved by outsourcing initial CAMA design and implementation tasks to an external contractor that would then train DRC staff to undertake future CAMA phases unassisted. In addition to lacking some of the competencies required for the registry and valuation projects, the DRC has a shortage of revenue collection capabilities more broadly, and the unit is in the process of seeking out capacity training programmes for their revenue collectors in order to address this constraint.

It is thought that completion of a new land valuation will increase the tax base so substantially that the KCCA may need to reduce rates initially in order to make the reform politically acceptable

As with a number of reforms already initiated, Kopanyi noted that it is possible for the KCCA to achieve many of these future developments through enacting local bylaws and policies, rather than requiring revision of national legislation (which is a lengthy process likely to stall with upcoming national legislative elections). Therefore, particularly in the short term, it would be salient for KCCA to continue to focus on enhancing administrative procedures. Where national legislation must be amended to enable certain reforms, the KCCA could play a vital role in analysing impacts, proposing amendments, and lobbying for revisions in the national legislative framework.

Future opportunities for new taxes and fees could improve revenue efficiency

Kopanyi indicated that there is also room for the DRC to further improve the value of revenues and that there are several opportunities to levy new taxes or fees, including: i) taxing vacant urban land to incentivise development and efficient use of urban land; ii) charging urban property owners a development or participation fee to contribute to developing off-site infrastructure like roads, water and sewer services, and street lighting; and iii) apportioning part of the existing capital gains tax revenues to the KCCA once the property registry and valuations make administration of this tax possible, recognising that much of the increase in property values in Kampala is due to factors beyond the efforts of individual property owners.

Importantly, Kopanyi’s analysis of the KCCA’s revenue collection performance, capabilities, and reform plans found that the KCCA revenue reform is on track, and is being implemented by skilled and motivated staff and guided by top executives who have clear vision for future development. With capable personnel pushing forward a comprehensive and well-informed agenda for revenue reform, it is anticipated that the KCCA’s revenue administration will continue to go from strength to strength, providing the KCCA with the revenues needed to finance the considerable urban expansion anticipated in Kampala in the coming years.