3 policy lessons from Africa’s colonial railways

One of the key questions facing international development organisations is: How to promote economic development in Africa? A considerable chunk of the World Bank’s recent lending centres on financing transportation infrastructure projects. Yet little is known about the economic impact of roads and railroads

There has been a lot of focus on the institutions that impacted African economic development, but how have infrastructure investments shaped the geographic pattern of economic activity? Examining the impact of colonial-era railroads (the direct importance of which has all but disappeared today), we assess how those investments have influenced the economic activity and geography in the long-term. We found that the spatial arrangement of economic activity depends on these earlier infrastructure investments, and persists long after the investment itself has waned. Knowing the effect, and how it emerged, carries some important lessons as we plan future infrastructure investments:

Africa has suffered a massive infrastructure deficit. The World Bank estimates that sub-Saharan Africa has fewer than 16kms of road per 100 km2 of land surface; far below other developing regions such as India with 125kms. Indeed, in 2011, transportation infrastructure accounted for 20% of World Bank lending as many countries seek, often ambitiously, to modernise their infrastructure. Chinese investments and firms are also playing a leading role, with striking similarities to the European colonial endeavours at the turn of the 20th century; looking to unlock the continent’s resource potential. While these investment quanta continuously escalate, little is known about the economic impact of roads and railroads.

In our recent research, we examined the spatial effects of colonial African railroads over 100 years. Economic transformation is a long-term process; hence time is needed to assess whether these investments have durably transformed Africa’s economic geography. Railroads provided us with a natural experiment that allows for the identification of causal effects over the long-term, innovatively enabling us to study the emergence of a spatial equilibrium as well as its stability.

Our research explores this overarching question; did railroad investments transform Africa’s economic geography, i.e. were railroads so instrumental that without them the economic outcome would have been different and development delayed? This depends on whether there is only one spatial equilibrium, which is determined by locational fundamentals, i.e. geographic endowments such as soils, water, and access to markets.

Colonial railroads are especially interesting because the colonisers did not necessarily place the railroad by selecting locations of intrinsically high economic potential; but rather the cheapest or shortest route. For example, the purpose of the Kenya-Uganda railroad, built in 1901, was to connect Uganda to the coast at the lowest possible cost. Kenya was merely a transit territory; the railroad bypassed highly populated areas en route to Lake Victoria, unlocking East Africa. In Ghana, the purpose was to connect European owned mines and for military domination within West Africa.

Of course, the railroad itself provided an advantage to the locations it passed through. However, in the African context this advantage disappeared over time. Railroad systems collapsed after independence due to mismanagement, lack of maintenance and the adoption of new transportation technology – motor roads. Roads levelled the pure advantage of lower transportation costs and could have potentially re-configured the spatial equilibrium.

Ultimately, the long-term benefit of the railroads depends on whether there are strong local increasing returns. These may come from the co-location of factors and industries. In approaching this research there is a coordination problem as it is not necessarily obvious which locations should have accumulated these factors. Railroads could have solved the coordination problem and defined the economic geography in this way.

Alternatively, increasing returns may also have come from sunk cost of the investments. If transportation networks, schools, hospitals or buildings are expensive to construct, activities will not shift to the location with better underlying fundamentals. Overall, one would also expect increasing returns to be less important in poor and agrarian countries.

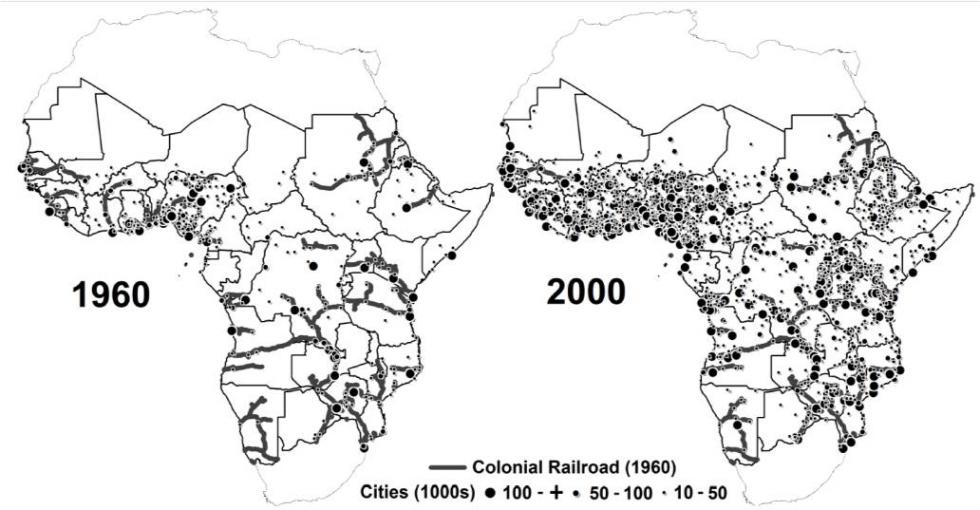

To test this we used previously unexploited panel data at a fine spatial level over one century, analysing Ghana and Kenya in detail. For Ghana, we find that the fall in trade costs made cocoa production for export markets profitable, and thus Ghana became the world’s largest exporter as early as 1911. The rural population increased along the railway lines because cocoa cultivation required more labour; creating villages. Cities also emerged because villages accessed towns as trading stations. At Independence (1957), locations along the railroad lines were more urbanised and economically developed, which persists today (2000), indicated by a higher night light density, and higher employment shares in manufacturing, services, trade and industries.

Railroad cities are qualitatively different; they are wealthier than non-railroad cities of similar sizes. The stability of the spatial equilibrium is remarkable. Locations along the railroad lines have lost their initial relative advantage not only in terms of transportation but also in terms of cash crop production. Cocoa production has disappeared from the old producing areas due to the shifting cultivation process, a characteristic of this crop. Colonial sunk investments (e.g., schools, hospitals and roads) partly contributed to urban path dependence, while evidence suggests that railroad cities mostly persisted because their early emergence served as a mechanism to coordinate contemporary investments for each subsequent period.

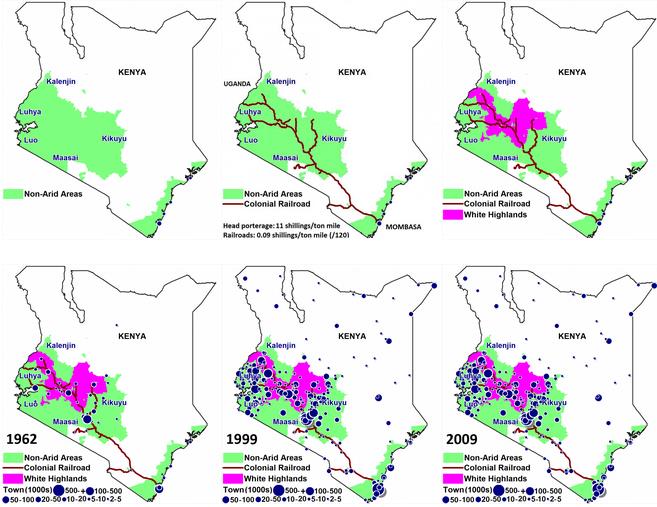

Kenya has important similarities. Colonial railroads causally determined the location of European settlers, which in turn decided the location of the main cities of the country at independence. Railroads declined and settlers left after independence. Most locations are now accessible by road. Coffee production was the main export of the colony and the engine of growth in the European areas, collapsing in the 1980s, owing to lower international prices. Locations along the railroad lines thus lost their initial advantage in terms of transportation, human capital and agriculture. Yet, the ranking of these cities persisted. Indeed, the ease of accessing a hospital, secondary school or a police station today depends on the colonial railway investment made more than a century ago.

The colonial railway, 'The Lunatic Line' in Kenya, and subsequent development and stability of the country's economic geography

What policy implications can we draw from those results? Firstly, infrastructure investments can produce economic change by reducing trade costs and integrating markets. The impact however, will primarily depend on whether the coordination failure of where cities and economic activities should be located was already solved. If solved, new investments - such as the road constructions in the 1960s - will only have a minor impact. Conversely, new infrastructure can transform the economic landscape in poor, remote regions with high trade costs. Finally, the effects of new investments in transportation infrastructure in poor, remote regions will likely depend on a region’s intrinsic economic potential. This is because at the beginning of the process, city growth is fuelled by agricultural activities and rents surrounding them.

Colonial railway investments and current economic geography

The results highlight the existence of multiple spatial equilibria. This is good news for the effectiveness of regional policies. It is much easier to provide infrastructure than it is to change institutions. As the infrastructure themes in African development policy intensify, we should not forget the lessons colonial era railways can teach us. They have come to define Africa’s economic geography and the future construction of infrastructure will do the same for generations to come. How will private and public investment consider the consequences of these economic and social shocks, and who will be winners or losers?