Parceling out prosperity? Tracking and evaluating the impacts of natural resource concessions in Liberia

How concerned would you be if a third of your country's land was granted to foreign investors?

Liberia has pinned its hopes for economic development on foreign direct investment, granting somewhere between 21% and 38% of the country's land to investors, or concessionaires, in the agriculture, forestry and mining sectors. However, a 2011 survey of nearly 1500 rural and urban households in Liberians revealed that 46% of the population strongly disagreed with the notion that their local community was benefiting from concessions granted to investors since 2008. Only 8% of surveyed households agreed with the statement, "[My] community is directly benefitting from the concessions agreements signed and ratified by the government since 2008."

Martha Togdbba of Kpaytno, Liberia, grows vegetables, including tomatoes and chili peppers. Photo by Laura Elizabeth Pohl and Bread for the World, licensed under CC BY-NC-ND 2.0.

Martha Togdbba of Kpaytno, Liberia, grows vegetables, including tomatoes and chili peppers. Photo by Laura Elizabeth Pohl and Bread for the World, licensed under CC BY-NC-ND 2.0.

Since its inception, AidData has focused its efforts on helping international development organizations more effectively track, target, coordinate, and evaluate their aid investments. However, as aid becomes a smaller fraction of financial flows to the developing world, we are turning to our attention to other types of development investments, including foreign direct investment (FDI) and corporate social responsibility (CSR) activities.

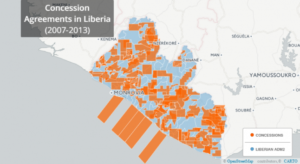

To this end, we have worked over the last several years with the Concessions Working Group in Monrovia to develop a first-of-its-kind database of all known natural resource concessions granted to investors in Liberia from 2004 to 2015. 95% of the FDI that Liberia receives is in the natural resource sector; therefore, this database closely approximates the known universe of FDI projects in Liberia. We have systematically categorized 557 concessions along 43 different dimensions, including the names and nationalities of the investors, the nature of the rights granted to these investors (exploratory or extractive), and the presence or absence of contractual commitments to undertake corporate social responsibility activities (e.g. building schools and health clinics). We have also developed a novel, polygon-based — rather than point-based — geocoding methodology that identifies the specific tracts of land granted to concessionaires to explore, develop, extract, or sell natural resources.

We collected these investment-level data by standardizing and synthesizing several official sources of information on concessions in Liberia (including the Liberia National Concessions Portal, the Mining Cadastre Administration System of the Ministry of Lands, Mines, and Energy, and long-form contractual agreements between concessionaires and the Government of Liberia made available through the Liberia Extractive Industries Initiative), and then supplementing these official data with open-source data. Once a final battery of quality control checks has been implemented, we will place this dataset in the public domain. We are also making an effort to make the dataset compatible with the Open Contracting Data Standard (OCDS) specification, and we hope to see it republished and reused by as many groups as possible.

Figure 1: Concession agreements in Liberia (2007-2013)

Figure 1: Concession agreements in Liberia (2007-2013)

"What we are doing in Liberia with our local partners is all about demonstrating the art of the possible,” said Brad Parks, Executive Director of AidData. “We are establishing proof-of-concept that it is possible to comprehensively track and geo-reference foreign direct investment and corporate social responsibility activities at the individual project level."

Going forward, AidData plans to merge this dataset of natural resource concessions with high-resolution satellite imagery and household survey data to conduct a geospatial impact evaluation (GIE). The International Growth Centre will fund AidData and its partners to investigate whether locations where the Liberian government has granted concessions to foreign investors experience faster rates of economic growth than areas where concessions are not present. This impact evaluation will provide the Government of Liberia, which wishes to learn from the mistakes of the past and maximize the growth and development benefits of incoming investment, with new insights that can inform its future interactions with concessionaires.

Since 2006, the Ellen Johnson-Sirleaf administration has made significant efforts to prevent the rise of so-called "concession enclaves" — which benefit investors but not local communities — by negotiating explicit contractual provisions that require concessionaires to invest in local infrastructure, hire local labor, source local materials, share revenue with the central government, and engage in corporate social responsibility efforts (e.g. building schools and health clinics). However, there is still no rigorous evidence of whether, when, and where incoming investments improve development outcomes. AidData will partner with Kanio Gbala, coordinator of the Concessions Working Group in Liberia, and Jonas Bunte, assistant professor of public policy and political economy at the University of Texas at Dallas, to fill this important evidence gap.

Beyond evaluating the overall impact of FDI on local economic outcomes, AidData and its partners will examine whether certain types of concessions deliver larger development benefits than others. Several of the most important questions that will be addressed through this geospatial impact evaluation include:

- Does incoming investment have a larger impact on the local economy when it is concentrated in particular sectors, such as agriculture, forestry, and mining?

- Are incoming investments more effective when they are sited in specific geographical locations, like near local markets?

- Do concession agreements that contain corporate social responsibility (CSR) provisions outperform those that lack such provisions?

- Are there significant differences in the local economic impacts of Western and non-Western investments?

This post was originally published on AidData - Open Data for International Development's blog.