Rental markets for mechanisation in India: Trends and current state

Agricultural landholdings and mechanisation levels vary considerably in the developing world. Whether smaller farmers adopt lower levels of mechanisation because returns to adoption are lower, or because there are barriers to adoption that are particularly detrimental to them remains unclear. Our project aims at estimating the impact of access to equipment rental markets on the adoption of mechanised practices, agricultural yields and income, as well as labour demand.

Agriculture remains central to the lives of a large proportion of the world’s population in developing countries, employing nearly 60% of the population in sub-Saharan Africa and 42% of the population in South Asia (World Bank 2018). Increasing agricultural productivity remains critical to alleviating poverty.

In India, land fragmentation has increased over time, with average landholdings declining from 2.8 hectares in 1970 to 1.1 hectares in 2010. Over the same period, tractor ownership has increased almost 30 times, from about 147 thousand in 1970 to more than 4 million in 2010 (FAO stats). These aggregate trends mask large heterogeneity: mechanisation levels and landholdings are much larger in richer states such as Punjab and Haryana than in poorer states like Karnataka or Bihar. Do smaller farmers adopt lower levels of mechanisation because returns to adoption are lower, or because there are barriers to adoption that are particularly detrimental to them? Our project aims at answering this question by studying rental markets for agricultural equipment.

Access to equipment rental markets

Rental markets facilitate mechanisation of smallholder farmers by circumventing the minimum scale that makes equipment ownership economically feasible. In the developing world, rental markets are predominantly informal. But recently, there has been an expansion of digital platforms that connect farmers demanding and supplying equipment rental services and that offer a formal alternative to those rental contracts. In India alone, there are at least three major equipment rental service providers operating at scale.

In collaboration with one of the largest providers of rental services of agricultural equipment in India, we have designed a randomised control trial that provides discounts for rental services. Our project aims at estimating the impact of access to equipment rental markets on the adoption of mechanised practices, agricultural yields and income, and labour demand. Our partner’s platform allows farmers to rent equipment (and a professional driver) through a phone call, with rented equipment including tractors and implements such as rotavators, cultivators, and ploughs. The study is in progress and covers two primary agricultural seasons, over 6,500 farmers, and more than 150 villages. Our experiment will also allow us to test to what extent and how informal rental agreements (e.g. farmers renting equipment to other farmers in the village) respond to the expansion of users of the formal rental market. Importantly, a component of our project studies the characteristics of these markets in the state of Bihar and the impact of subsidies for equipment on these rental markets.

Main patterns of the rental market for equipment

Combining detailed data on farmer outcomes and mechanisation with high-frequency data on equipment rentals from custom hiring centres (CHCs) allows us to document salient patterns of the rental market for equipment.

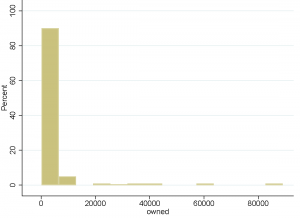

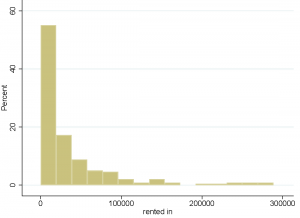

- The first fact relates to the pattern of equipment ownership and rentals. Using our baseline data, we construct a measure of equipment services owned and rented, adjusted by hours of usage and rental prices. The idea behind this measure of equipment services, or efficiency units, is that rental rates should reflect differences in the services provided by a good. Rental prices are directly observed in our data by custom hiring centre and implement. For rented equipment, we use average hours rented per farmer in a season. For owned equipment, we impute hours using the hours used in a season by the average farmer in the sample. Figure 1 plots histograms of owned (left) and rented (right) equipment services. We find that in our sample, ownership is concentrated in low “efficiency” stocks. The ability to rent out equipment from CHCs smooths out the distribution of ownership and allows farmers to access higher “efficiency” stocks.

Figure 1: Capital services per farmer

Capital ownership is positively correlated with the area cultivated by a farm, with a correlation of 0.3 between (the log of) owned capital services and (the log of) the area cropped. At the same time, equipment rentals are positively correlated with land and capital ownership (0.2 and 0.4, respectively). These correlations suggest, prima facie, that relatively richer farmers that already own equipment also have a higher demand for equipment rental services. By estimating the returns to mechanisation, we can assess whether this is the result of poorer farmers being rationed out (i.e. they would like to access the rental market but cannot), or poorer farmers having low returns to these services and therefore not demanding them.

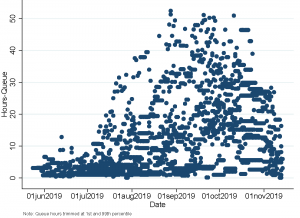

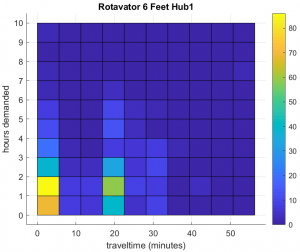

- While it is well-known that agriculture comprises highly time-sensitive activities, our data allow us to quantify the queuing for equipment that occurs at peak-demand periods, and relate it to productivity losses. Indeed, farmers in our baseline reported that delays in service provision for equipment rentals were a more prevalent problem when accessing mechanisation services than credit constraints. Using administrative data from our implementation partner, we were able to trace orders outstanding through the agricultural season by type of equipment. For one common piece of equipment – the rotavator –, Figure 2 shows how the number of outstanding hours for service vary over the season and that they peak between mid-August and mid-October post harvesting. We can also explore whether delays are more prevalent with smallholder farmers and whether changes in service delivery could unlock productivity gains in the sector. This is the object of ongoing work.

Figure 2: Hours outstanding for service, Rotavator 6 feet (Kharif 2019)

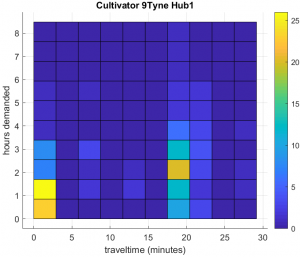

- Finally, we show that most equipment orders are fulfilled relatively close to the hub (Figure 3). This could be due to travel times and depreciation associated with equipment traveling long distances. To the extent that moving equipment in space is costly, management of CHC location as well as demand coordination may unlock productivity gains for those farmers that are currently too far to access these rental opportunities. Figure 3 also shows variation across implements in distances travelled to provide service for a given CHC.

Figure 3: Distribution of rentals by size (hours) and location (travelling time to the hub)

Structuring and targeting subsidies

Our data collection and experimental design will aim to inform best practices in scaling up the availability of equipment rental platforms, as well as in guiding government partnerships with private equipment providers. At present, different states have adopted different models to facilitate access to mechanisation, though most policies include some emphasis on promoting custom hiring (rentals), as well as subsidies for equipment purchases. By identifying the barriers to mechanisation, how formal rental opportunities mitigate these barriers and the role of informal rental markets, the project will aim at generating insights into the optimal structure of such subsidies. It will also generate knowledge on which segments of farmers (for instance, those cultivating small or medium holdings) benefit most from these formal rental opportunities, thereby providing information on how best to target these subsidies.