When a failure to diversify meets COVID-19: Implications for Nigeria

Africa’s most populous nation faces a greater challenge than most from COVID-19 with its government revenues decimated following the crash in oil prices.

As Africa’s largest economy with a population of close to 200 million, Nigeria is critical to the COVID-19 response in the region. One in five sub-Saharan Africans are Nigerians and the economic and social impacts of the COVID-19 in the country will have major ripple effects across the continent. With government revenues collapsing following the fall in oil prices, mitigating the health emergency and subsequent economic ramifications from COVID-19 will be an unprecedented challenge for Nigeria’s policymakers.

Fatalities from COVID-19 in Nigeria are currently relatively low in the global context, standing at 12, with 267 active cases. However, the Federal Government has warned that up to four million people could be infected after six months if social distancing measures are not well implemented and observed. This high burden of infectious disease is likely to put extra strain on an already underfunded health sector.

Medical tourism leading to a weak health system

Wealthy Nigerians have often preferred travelling abroad for medical treatment with the Minister of Health estimating that the country spends over $1 billion annually on medical tourism. But with borders shutting around the world, Nigeria’s elite must now confront using their country’s own healthcare facilities in battling COVID-19. They will be concerned by what they see.

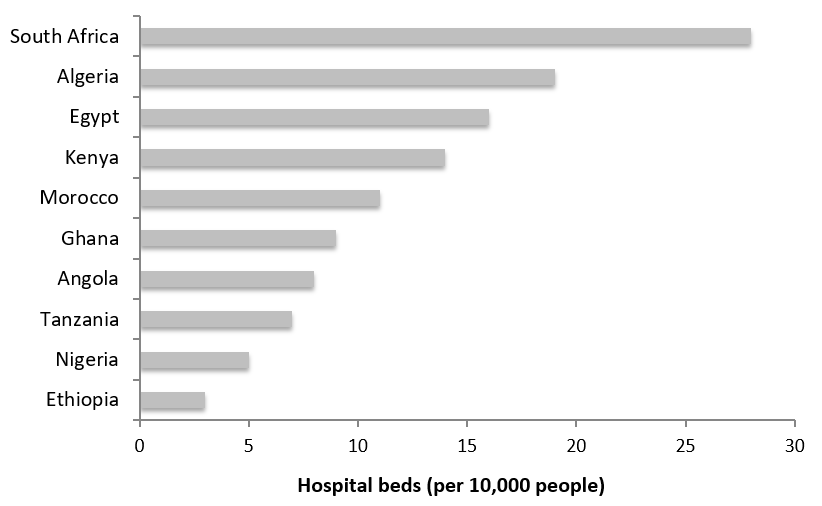

Latest data from Africa’s 10 largest economies show that only Ethiopia has fewer hospital beds per capita than Nigeria, as depicted in figure 1 below. The most recent WHO data puts the number of hospital beds at only five per 10,000 people in Nigeria.

Figure 1: Hospital beds per 10,000 people in Africa’s 10 largest economies (latest WHO estimates)

This low overall spending makes the healthcare system particularly fragile and at major risk of being overwhelmed. Without additional funding, demand for healthcare services, especially critical care services, will significantly exceed capacity. This is likely to have long-term consequences for the health sector, as well as spillover effects to the rest of the economy (loss of workforce, productivity losses etc.).

Relying on oil makes you vulnerable

On top of this dangerous health emergency developing in the country, the economic ramifications of COVID-19 have been especially profound for Nigeria. The crash in oil prices, following OPEC’s price war with Russia, has revealed significant fault lines in the nation’s economy.

Since independence in 1960, Nigerian governments have consistently relied on the exports of crude oil as their primary source of revenue. Oil exports currently account for over half of government revenue, and generate 87% of Nigeria’s foreign exchange. The collapse in oil prices by 60% since the start of the year to below $30 a barrel has therefore decimated government revenues, which could fall by as much as 45%.

The Federal Government had based its 2020 budget on a price of $57 a barrel, way above the prices we are witnessing today. This has forced a drastic restructuring of the budget. The capital investment budget has been cut by 20%, the recurrent budget by 25%, privatisation proceeds by 50%, and all recruitment has been halted. In total, the Federal Government has cut its budget by N1.5 trillion (1% of GDP).

A major economic downturn

The subsequent economic fallout for Nigerians will be severe. GDP forecasts are suggesting that if oil prices stay low, GDP growth will be -3.4% in 2020. Worryingly, this is the prediction if the outbreak is effectively contained in the country. By contrast, if it is not contained effectively, then Nigeria could see GDP growth in 2020 fall to -8.8%, driven by declining consumer spending.

This will have a profound impact on employment. For instance, Nigeria’s film industry, known locally as Nollywood, will face major challenges. The industry is the second largest source of jobs in the country, employing one million people and producing an estimated 1500 movies a year. Nollywood movies are popular across Africa, but with its production hub, Lagos, in lockdown, movie production is likely to plummet. Evidently, this will have a major knock-on effect on employment. Beyond Nollywood, there is a major concern for the country’s huge army of informal workers, over 80% of the workforce, who have seen wages evaporate overnight as restrictions are introduced.

How is the Federal Government responding to the crisis?

Following the lead of many other parts of the world, the Federal Government has put close to 30 million people in lockdown. This is in the commercial capital, Lagos and neighbouring Ogun State, as well as the Federal Capital Territory, Abuja. Other states, including the Northern economic hub, Kano, have also been placed in lockdown by their respective State Governments.

Despite cuts to the budget, the Federal Government has announced a fiscal stimulus support package. N15 billion ($38.6 million, 0.01% of GDP) was initially approved for the national response to fight COVID-19. This has been topped up with a further N10 billion ($25.7 million) grant to Lagos State Government and N5 billion ($12.9 million) to the Nigeria Centre for Disease Control.

- Guaranteeing food security

Ensuring food security in a country with the highest number of people living in absolute poverty in the world will prove extremely testing. Cash transfers of N20,000 ($51.75) have been designed covering four months. The Federal Government has identified 2.6 million households (11 million people) from the National Social Register as eligible, but there are aims to increase this to 3.6 million households in the coming weeks. However, given that an estimated 90 million people live in absolute poverty in Nigeria, many are likely to miss out.

Moreover, it is unclear how those without bank accounts, roughly 60% of the population, will access these transfers. Mobile money, the solution being touted across much of sub-Saharan Africa, is not widely used in Nigeria. The Federal Government began the distribution of the transfers with 5000 households in Abuja who were given the transfer in physical cash. Whether this form of distribution can effectively be scaled up, remains to be seen.

- Protecting businesses

Businesses have been supported through a directive from President Buhari that a three-month moratorium (a period where the borrower is not obligated to make a payment) is implemented immediately. This applies to loans given as part of the Government Enterprise and Empowerment Programme (GEEP), whose beneficiaries number over two million, as well as all other Federal Government-funded loans.

The Central Bank of Nigeria has also acted swiftly, reducing the interest rates on its interventions from 9% to 5%. It has created a N50 billion ($139 million, 0.03% of GDP) targeted credit facility and given a N3.6 trillion ($9.36 billion, 2.35% of GDP) liquidity injection into the banking system. In order to reduce the downward pressure on the Nigerian currency, the Naira, the official exchange rate has also been devalued by 15%.

- No indignity in asking for support

Nigerian governments have often been reluctant in asking for support from multilateral institutions such as the IMF. This is due to a combination of pride, seeing the country as Africa’s giant, and an unwillingness to adhere to the conditions such loans are attached to. It was therefore unprecedented when the Federal Government recently announced it was seeking to raise a total of $6.9 billion through support from the IMF, World Bank, and African Development Bank. But this crisis is unprecedented, and there should be no loss in pride from asking for help. These funds will prove critical in rolling out an effective response that both mitigates the health emergency, whilst also limiting the economic fallout from COVID-19.

Do not take away from other healthcare services

In the short-term, it is paramount that spending/resources to fight COVID-19 in Nigeria are supplementary and not diverted from existing healthcare services fighting other diseases. Studies of the Ebola crisis in West Africa from 2014-2016 have found that as many people died because of overwhelmed health systems’ inabilities to treat malaria, HIV, and tuberculosis than from Ebola itself. A similar trend can only be avoided in the fight against COVID-19 if funds are additional, and not diverted from other crucial healthcare services.

Diversify the export base

In the more medium-term, Nigeria’s wellbeing relies on economic diversification. This is no secret. Export revenues from agriculture and manufacturing must be increased to lessen dependence on oil. Nigeria has a comparative advantage in a huge array of products ranging from cocoa and sesame, to leather and cement. The country has to scale up production and begin taking advantage of this, especially with the African Continental Free Trade Area (AfCFTA) around the corner.

Nigerians are coming together but a social contract is needed

Beyond untapped export potential for other products, a reliance on oil has led to a weak social contract in Nigeria. Nigerians have come together during the crisis with numerous donations from wealthy Nigerians including Africa’s richest man, Aliku Dangote, and the Chairman of the United Bank of Africa, Tony Elumelu. Yet, the collection of taxes remains a major problem. Nigeria’s tax to GDP ratio is one of the lowest in the world, standing at 5.7% in 2017. By contrast, the average tax to GDP ratio in Africa is 17.2%. This has been a continuing problem in Nigeria but rather than tackling the issue, successive governments have simply used oil revenues to finance government expenditure.

Nigeria must develop an effective social contract where its citizens see where their tax revenues are going. Given the perception of corruption in the country, citizens are understandably sceptical about paying taxes. Research from Pakistan shows the importance of strengthening the link between local tax collection and local public services. Nigeria could benefit from the same.

Concluding remarks: Nigeria faces a monumental challenge

The COVID-19 crisis is like no other. It has exposed flaws in the response of governments to healthcare and social security in both the developed and developing world alike. Nigeria is therefore not unique in facing difficulties. Yet, its reliance on oil exports to fund government expenditure has made the country particularly vulnerable following the collapse in oil prices. It remains to be seen whether the aggressive steps the Federal Government has taken will be enough to successfully mitigate the effects of the crisis. A small silver lining is the belief that the oil price crash will act as a catalyst for the economic diversification that Nigeria requires. The country’s growing population, standing at close to 200 million already, is counting on it.

Disclaimer: The views expressed in this post are those of the authors based on their experience and on prior research and do not necessarily reflect the views of the IGC.