The long road towards supply chain trade in Africa

Low-cost inputs trade, simple rules-of-origin, and digital connectivity are key to regional trade integration and global value chain participation.

The recent Africa Continental Free Trade Area (AfCFTA), in force since May 2019, is an important opportunity to develop and deepen supply chain trade across Africa. Evidence shows that integration into production networks - Global Value Chains (GVCs) or Regional Value Chains (RVCs) - provides new opportunities for developing countries to participate in global trade and diversify their export baskets through hyper-specialisation in fragmented production processes.

Without an ecosystem of supply chain trade, a country needs to produce a complete product before entering a new line of business. By allowing countries to specialise in a part of a production process, supply chain trade can position a country to move rapidly from labour-intensive to capital-intensive, skill-intensive, and information-intensive activities. The World Development Report 2020 estimates that a one percent increase in GVC participation boosts per capita income growth by more than one percent, about twice as much as standard trade.

The East African Community and regional trade integration

The East African Community (EAC) has travelled furthest towards integration among African Regional Economic Communities (RECs) and is keen to develop RVCs as part of its regional industrialisation strategy. Since 2018, negotiations have been underway to review the EAC’s four-band Common External Tariff (CET).

One of the proposals on the table is to adopt a longer tariff band structure to “facilitate production processes with strong forward and backward linkages, in particular, products of ‘strategic’ regional interest” (EAC 2018, p.xii).

Recent estimates over the period 1990 - 2015 show that African RECs have increased their participation in supply chain trade, but that this increase in participation has been almost entirely with partners outside the region, rather than with geographically close partners. These trends raise a challenge for the EAC and ultimately, the ACFTA’s goal of increasing RVCs.

We argue that encouraging low-cost trade for intermediate inputs, harnessing affordable and reliable digital connectivity, and moving towards simpler and more transparent rules of origin are key steps for encouraging stronger supply chain trade and global value chain participation (de Melo and Twum, 2020). The EAC should also resist the pressure to put high tariffs on intermediates in its revised CET.

Supply chain trade in sub-Saharan Africa

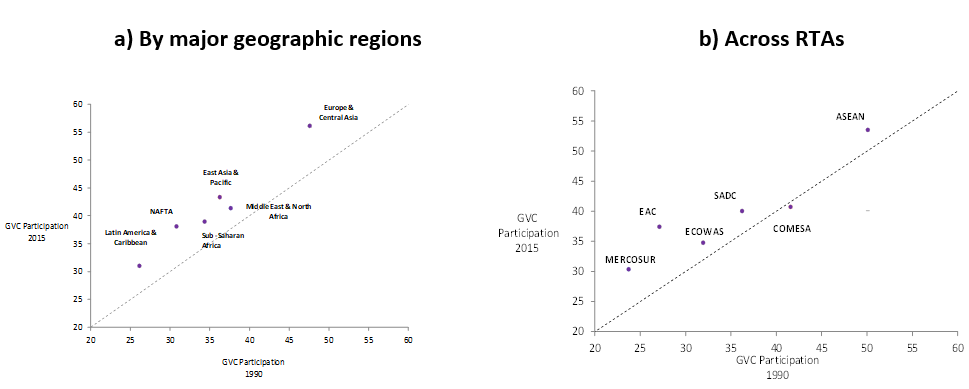

A country’s (or a region’s) participation in supply chains is high when foreign imports are a high share of a country’s gross exports (backward participation) and/or its exports are inputs into another country’s downstream exports (forward participation). Over the period 1990 - 2015, all regions have increased their participation in supply chain trade.

Sub-Saharan Africa (SSA) kept up with other regions, raising its participation slightly more than the Middle East and North Africa (MENA), a region closer to the European hub. By 2015, SSA had raised its participation rate by five percentage points from 1990 levels: Around 40 percent of its gross exports either embodied foreign imports or went into further processing in destination countries (figure 1a).

By extending reduction in trade costs beyond those negotiated at the World Trade Organisation (WTO) (e.g. including behind-the-border measures like harmonisation of standards and reduction to barriers on the movement of factors), one can expect Regional Trade Agreements (RTAs), like the RECs, to see increased participation in supply chain trade.

The evolution of GVC participation across African RECs shows that the EAC’s GVC participation has risen most rapidly (figure 1b), now surpassing the Economic Community of West African States (ECOWAS) and closing in on the Southern African Development Community (SADC) and the Common Market for Eastern and Southern Africa (COMESA).

Figure 1: GVC participation Source: de Melo and Twum (2020, figures 3 and 6) from the UNCTAD-Eora multi-regional input-output tables. The definitions of regions follow the World Bank classification.

Source: de Melo and Twum (2020, figures 3 and 6) from the UNCTAD-Eora multi-regional input-output tables. The definitions of regions follow the World Bank classification.

Note: GVC participation is the sum of backward and forward participation, both expressed as a share of gross exports. Points above 450 indicate an increase in GVC participation.

Supply chain integration: Regional versus global linkage patterns

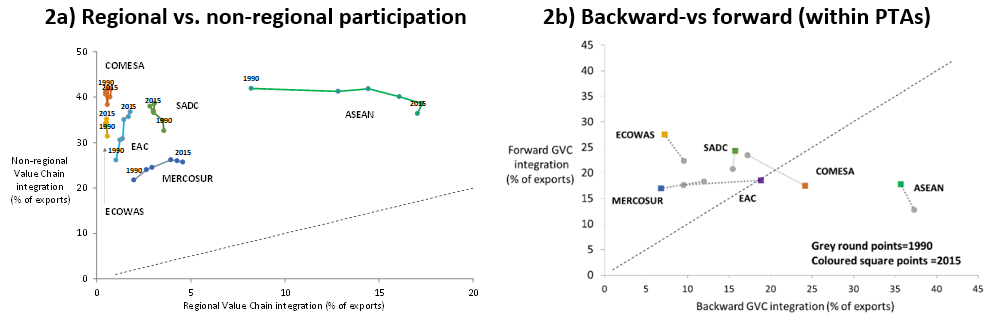

Three patterns stand out in a decomposition of supply chain trade by regional vs. non-regional GVC participation (figure 2a):

- For all RECs, development of production networks with extra-regional partners dominate those with regional partners (all points are above the 450 line for all RECs).

- The non-African trading blocs have moved towards developing regional networks.

- There is a striking absence of RVC growth for all African RECs.

Even though comparator groups have higher per capita income memberships and larger industrial bases than African RECs, the striking difference between the RECs and comparator RTAs suggests that intra-membership trade costs are still high across African RECs.

Although only a conjecture, the large increase in non-regional value chain participation for the EAC might reflect a stronger reduction in trade costs (or a greater response to an equal reduction in trade costs) with partners outside the EAC.

Figure 2: Patterns of RVC participation across regions and within RECs

Source: de Melo and Twum, 2020, figure 7.

Source: de Melo and Twum, 2020, figure 7.

Note: Measures (computed at five to six year intervals) are weighted by each country’s share in the corresponding region total trade. Points above 450 indicate an increase in GVC participation. Figure developed using data from Borin and Mancini (2015, 2019).

Patterns of GVC participation differ across the five African RECs (figure 2b): The share of intermediate imports in gross exports of SADC and ECOWAS have not increased during the period. By contrast, the EAC and COMESA have increased their share of imported intermediates in gross exports, an indication of a reduction in trade costs, probably reflecting a reduction in policy-imposed barriers to trade.

Backward GVC integration is low across the RECs. Except for ASEAN (Association of Southeast Asian Nations), where supply chain trade has grown with extra-regional partners, an indication of still high intra-regional trade costs.

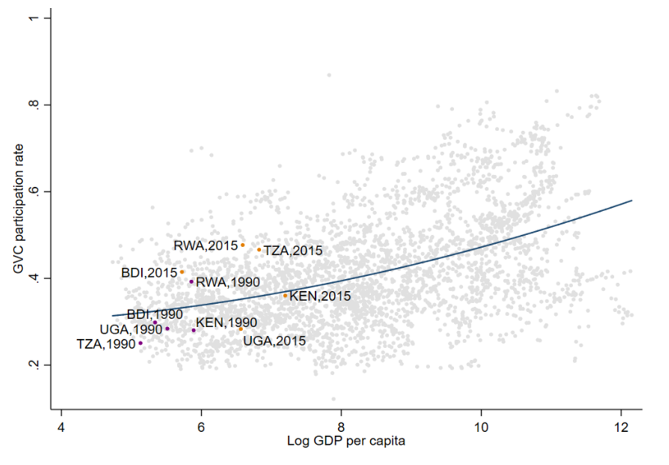

Yet, the share of imports in the EAC is still only half the rate in ASEAN. Among EAC members, Rwanda and especially Tanzania have shown the greatest increase in overall participation in GVCs, while Kenya and Uganda have remained below average (figure 3).

Figure 3: GVC Participation of EAC members

Source: Authors calculations using GVC the database from Borin and Mancini (2019).

Source: Authors calculations using GVC the database from Borin and Mancini (2019).

Note: GVC participation measures the share of a country’s exports that either makes use of value-add imported from another country or is exported to another country for further processing. Points above the line represent an increase in GVC participation.

Challenges: Deepening supply chain trade in Africa

Three obstacles impede progress to greater participation in supply chain trade:

- High tariffs on intermediate inputs

Africa still lags in the reduction of tariff protection relative to other regions, notably for intermediate inputs: The average tariff on intermediate inputs is around ten percent, still around twice the average rate for other developing-country regions. High tariffs on intermediates are a brake on participation in GVCs as the cost of delivery to the final consumer increases exponentially when production stages take place across tariff-ridden borders.

The evidence shows that lower tariffs on intermediates stimulate production of final goods and raise productivity. In Indonesia, they were found to have a greater impact on the productivity of manufacturing firms than increases in the tariff of final products of those firms (Amiti and Konings, 2007). In the EAC, Rwanda’s ascent to the customs union saw firms facing lowers tariff on intermediate inputs, which was found to have resulted in an increase in exports of between five to ten percent for exporting firms (Frazer, 2012).

Most recently, Trump’s trade war with China led to significantly higher tariffs on inputs and final products. However, the impact of these tariff hikes did not lead to stronger industry. Domestic consumers ended up paying more for goods (Amiti et al., 2019), while exporters hardest hit by tariffs on their imports of intermediate goods experienced a two percentage point lower export growth relative to products with no exposure to tariffs (Handley et al., 2020).

- Complicated rules-of-origin

Rules-of-origin (RoO) differ across the RECs. For example, value-content requirements, certification and verification, as well as tolerance and absorption rules differ across RECs. RoO at the product-level also differ greatly across RECs. The challenge facing the AfCFTA negotiations on RoO is to design rules that are simpler and easier to apply so that RoO are not a brake for growth of RVCs.

These rules will satisfy no one partner, but they are necessary for the development of RVCs if this continues to be an overarching objective of the AfCFTA. These RoO will have to be harmonised to a common set as part of the completion of Phase I of the AfCFTA negotiations.

- Expensive and unreliable digital connectivity

Digital connectivity matters. Firms in GVCs need to communicate with both their suppliers and their customers through internet-based technologies. Countries with a higher share of the population using the internet exhibit stronger backward GVC integration.

The East Africa Single Digital Market (SDM) initiative aims to bring East Africa on board by: (i) a single connectivity market; (ii) a single data market; and (iii) a single online market to access digital content and information seamlessly.

The successful development of an SDM would add between 0.57 percent and 1.6 percent to gross domestic product (GDP) growth and create between 1.6 million and 4.5 million new jobs. Existing internet users would capture between US$ 1.2 billion and US$ 4 billion in consumer surplus as a result of falling broadband prices (World Bank, 2019).

The road ahead: Overcoming supply chain trade challenges

The current renegotiation of the EAC’s tariff structure and the ongoing negotiations of the AfCFTA are two major developments in trade policy that will redefine trade within the EAC and across the continent and the prospects for the hoped-for development of RVCs.

So far, EAC member states have agreed to a longer tariff band structure at a rate above 25 percent. Moving forward, member states need to be cautious about proposals for tariff increases on intermediates and consensus must be based on a clear understanding of such increases in tariffs on the development of supply chain networks.

Pro-EAC industry sentiments must be tempered with a recognition that EAC exporters are themselves, major importers, through backward integration, and therefore any increases in the costs of their imports will reduce their participation in supply chains.

For the AfCFTA, success will also hinge on the implementation and management of the trade area’s rules of origin framework. Liberalisation is only a first step. If countries are unable to trust and verify the origin of a product, borders will become concrete obstacles to trade in intermediate products.

Additionally, if firms find it expensive and difficult to navigate the process of obtaining certificates of origin, they will forgo the benefits of the free trade area and simply trade under most favoured nation (MFN) tariffs, thus undermining the foundational goals of the AfCFTA.