Reducing the gender financing gap: Getting more capital for women-led startups

Women-led startups – startups with one or more women founders – receive a fraction of the venture capital funding that goes to men-led startups. New research shows that the way investors evaluate startups is one of the reasons why. This gender financing gap is a missed opportunity for both investors and entrepreneurs, but research also shows that there are simple steps investors and accelerators can take to improve their evaluation frameworks and close the gender financing gap.

Entrepreneurship plays a vital role in fuelling economies and addressing critical issues. Oftentimes, the growth of startups is dependent on their ability to access capital. Research shows that a significant determinant of a startup's access to capital is the gender of the entrepreneur who is seeking funding. Venture capital is the predominant funding source for nurturing tech and tech-enabled startups. In 2021, only 14.5% of global venture capital went to women-led startups – those with at least one woman on the founding team, including mixed gender founding teams. This means that men-led founding teams collectively secured 85.5% of all venture capital. This picture in notably worse in emerging markets, where women-led startups receive just 7%. Additionally, acceleration programmes aimed at assisting and supporting early-stage startups to grow their companies increase the amount of equity raise by men-led startups by 2.6 times more than women-led startups.

The gender financing gap, as it’s commonly called, implies both entrepreneurs and investors are missing out. For investors, focusing on a small subset of all entrepreneurs means they leave significant opportunities for returns on the table. For entrepreneurs, this gap means promising and innovative ventures cannot access the resources they need to scale.

Village Capital and academic researchers Amisha Miller at New York University and Saurabh Lall at the University of Glasgow teamed up to identify several strategies for closing the gender financing gap. We tested these with the support of the SGB Evidence Fund – in partnership with the IFC (International Finance Corporation), the Women Entrepreneurs Finance Initiative, the World Bank Gender Innovation Lab. With the support of a research coalition that also includes Visa Foundation, Moody’s, ANDE Advancing Women’s Empowerment Fund, and Sasakawa Peace Foundation, we have identified several promising interventions to help reduce the gender financing gap.

Addressing discrepancies in investment evaluations

This research builds on over a decade of research on the gender financing gap in venture capital. In previous Village Capital research, we ruled out any possible meaningful differences in startup or founder as explanations for the post-acceleration gap between startups. Because of this, we hypothesised that investor behaviour – particularly the discrepancies in how they evaluate startups – may be part of the explanation behind the gender financing gap.

To address this, we set out to provide actionable strategies that investors and accelerators can incorporate to reduce disparities in evaluation and unlock more capital for women founders.

Testing strategies through an RCT to foster more objective evaluation

Village Capital tested strategies to reduce disparities in evaluation by conducting a Randomised Controlled Trial (RCT) in eight of its global accelerator programmes. In the Village Capital accelerator programmes, proxy investors (people who are trained to evaluate startups using the same framework as investors) meet and score startups (read our in-depth methodology here) multiple times over the course of three months.

Participants were randomised into control or treatment groups. In the treatment group, we adjusted the evaluation framework in three ways by adding more structure to how investors predefine their evaluation criteria, collect information about the startup’s risks and growth opportunities, and assess a team’s potential, which is a critical evaluation criterion for early-stage investors. We then measured the effect that doing so had on the investors’ evaluations by analysing over 30,000 data points occurring over the course of 1,503 evaluations, made by 65 investors on 69 startups.

Evaluation frameworks need to (and can) be improve

We found that how investors evaluate startups plays a key role in determining if they accurately identify promising startups in two ways:

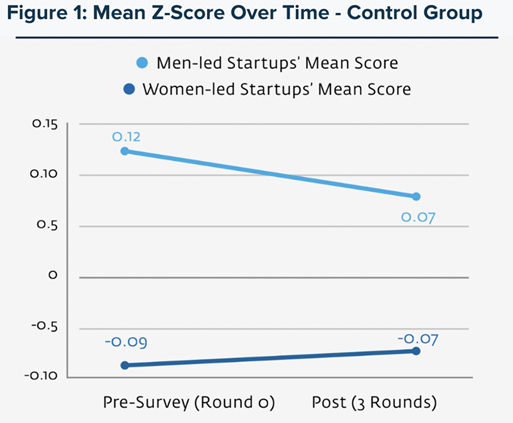

1. When investors used an evaluation framework to score startups, the scores they gave men-led startups decreased in comparison to when they scored them without one (see Figure 1). This suggests that investors unconsciously favour men-led startups, and this preference is reduced when investors evaluate all startups consistently using an evaluation framework. However, simply using an evaluation framework was not enough to reduce the underevaluation of women-led startups.

Figure 1: Scores awarded to women-led and men-led startups

Notes: The graphs (figure 1 and 2) show the mean z-score over time for men-led startups and women-led startups. The z-score is a statistical measure of how many standard deviations a data point is away from the mean, and it allows for the comparison of the evaluations of men-led startups and women-led startups on a common scale, regardless of the different levels of variance in their evaluations. In this context, the z-score represents the difference between the mean evaluation of men-led startups and women-led startups, expressed in standard deviations. This graph shows that the mean z-score for men-led startups was consistently higher than the mean z-score for women-led startups. It illustrates that men-led startups were valued, on average, higher than women-led startups. The gap between the mean z-scores for men-led startups and women-led startups narrowed over time but remained significant. Before the survey, the mean z-score for men-led startups was 0.12, while the mean z-score for women-led startups was -0.09. This means that the average men-led startup was evaluated 0.21 standard deviations higher than the average women-led startup.

2. Improving evaluation frameworks to mitigate discrepancies can lead to more accurate assessments of all startups. Village Capital found that adding these three steps helped investors make more consistent, comprehensive, data-driven assessments:

- Collecting information on each startup’s risk and growth opportunities to ensure a comprehensive understanding of both

- Assessing a team’s potential by evaluating their demonstrated ability to improve their startup

- Predefining what criteria will most heavily determine the assessment of a company

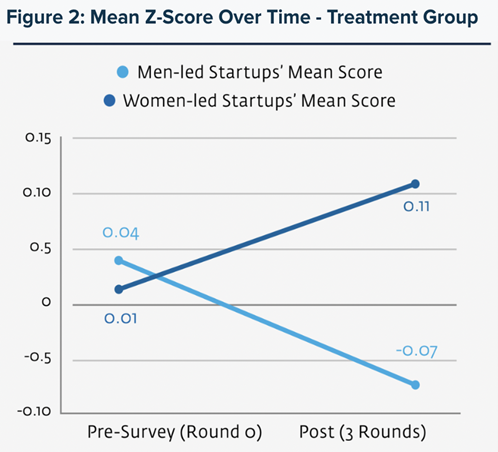

As shown in Figure 2, when investors integrated the three key steps, they mitigated and reduced the tendency to overvalue men-led startups and improved their evaluation of women-led startups. Specifically, women-led startups saw a fivefold increase in their evaluation scores compared to a control group, a notable and statistically significant improvement.

Figure 2: Scores awarded to women-led and men-led startups over time

Notes: This graph shows that in the pre-survey, collecting information on each startups’ risk and growth narrowed the gender gap between the mean z-scores compared to the control group. Treated investors evaluated men-led at 0.04 on average, compared to 0.01 for women-led startups. However, the mean z-score for men-led startups remained higher the mean z-score for women-led startups. Before the post evaluation, we implemented all three steps. This resulted in women-led startups receiving higher evaluation than men-led – 0.11 compared to -0.07. This suggests that our intervention may have flipped the gender gap in this evaluation, which could have a positive impact on reducing the overall gender funding gap in venture capital.

This underscores the profound influence of how investors appraise startups, encompassing the frameworks they employ and their data collection methods, on the decisions to allocate funding. These outcomes underscore that achieving fairness in startup evaluations and pinpointing the most promising ventures are not mutually exclusive objectives. The challenge lies not in the eligibility of women-led startups for funding, but rather in the existing evaluation processes that inadvertently sideline numerous exceptional opportunities.

How startups are evaluated affects how often women engage in the startup ecosystem

An unexpected yet insightful finding is that the changes to the evaluation process positively impact how women entrepreneurs engaged throughout the programme. In the meetings leading up to the first evaluation round, women presented their startups to investors at similar rates to men. However, by the last evaluation round, there was a statistically significant gap, with more women in the treatment group presenting their startups to investors than in the control group.

This highlights that equitable evaluations are not only important for their impact in moving ventures further along in investor pipelines, but also because of their effect on how often women engage and participate in the startup ecosystem.

Taking action to address the gender financing gap

Building on this research, we developed two action-oriented open-source implementation guides: one for individual and institutional investors (such as venture capital firms, angel groups, among others) and one for incubator/accelerator leaders. These guides include tangible steps and tools investors and accelerators can adopt in their own investment evaluation processes and programmes to evaluate more objectively.

Our hope is that this research and these toolkits can help unlock more capital for innovative women-led startups–and enable investors to identify more promising investment opportunities.

Author’s note: Village Capital and academic researchers Amisha Miller (NYU) and Saurabh Lall (University of Glasgow) are actively seeking research partners that aim to assess their own investment evaluation processes and outcomes by founder demography. Please contact Nathaly Botero if you are interested to find out more: [email protected].