Saving microfinance through innovative lending

The traditional microfinance model has had limited impact on the income and productivity of borrowers. More innovative and flexible lending models can boost entrepreneurship and welfare.

-

IGCJ6958-Growth-Brief-190313-WEB.pdf

PDF document • 7.57 MB

Introduction

A growing body of research shows adapting and relaxing aspects of the traditional microfinance model improves the effectiveness of loans and increases positive effects on the lives of borrowers. Using community networks to identify productive borrowers and lending for activities beyond entrepreneurship, such as supporting migration during ‘lean seasons’, can lead to substantial welfare gains.

Microcredit is frequently touted as an effective policy tool to fight global poverty. In 2006, Muhammad Yunus and the Grameen Bank won the Nobel Peace Prize for pioneering microcredit, elevating its global profile. Over the past 15 years, the microfinance industry has been estimated at $60–100 billion with 200 million clients (World Bank, 2015). The industry has successfully targeted female clients and made credit available to them, while achieving overall repayment rates exceeding 90% (World Bank, 2017). Microfinance has been acknowledged globally as an effective approach for making credit accessible to the poor and unleashing their productive capacities.

However, multiple large-scale experimental evaluations have found no evidence that the classic microfinance product increases borrower income or production (Kaboski and Townsend, 2011; Banerjee et al., 2015). This is true for both joint and individual liability loans (Giné and Karlan, 2014; Attanasio et al., 2015). This brief presents results from new International Growth Centre (IGC) and non-IGC research on the traditional microfinance model and variations on this model – such as more flexible loans and lending for purposes beyond entrepreneurship – and discusses the impacts these models have on the lives of borrowers.

Key messages

- Traditional microfinance typically has small and uncertain effects on borrower welfare.

Recent literature shows the average effects of access to microcredit on welfare indicators are small and uncertain, with a moderate to high probability of zero impact. - Flexibility can boost entrepreneurial activity but also increase risk‑taking and defaults.

Research shows some simple changes to loan contract design could significantly

enhance the effectiveness of microfinance. However, there is an important caveat of higher default rates being associated with more flexible contracts. - Screening borrowers using local information can lead to better targeting and improved welfare.

The knowledge friends, family, colleagues, and local leaders have about one another can be highly predictive of clients’ marginal returns to capital and can be used for improving microcredit products. - Broadening the use of microcredit beyond entrepreneurial activities could increase economic activity and borrower welfare.

Microcredit has the potential to be used for a broader variety of purposes such

as supporting borrowers to migrate, find jobs, or smooth consumption during difficult seasons. Recent studies show lending for such purposes could lead

to increased household welfare.

Key message 1 – Traditional microfinance typically has small and uncertain effects on borrower welfare.

The celebration of microfinance 1 as a success in the early 2000s, particularly its success in increasing lending to poor borrowers who were previously ignored and labelled as not creditworthy by traditional lenders, motivated multiple randomised evaluations of microfinance institutions and products. A large number of these studies show little or limited impact of microfinance on household welfare in developing countries.

Banerjee et al. (2015) analysed six studies that expanded microcredit through seven different lenders in six countries – Bosnia, Ethiopia, India, Mexico, Morocco, and Mongolia – during 2003–2012, and found a lack of evidence of microfinance’s transformative effects on the average borrower. Importantly, they find this is not due to lack of investment in microfinance but due to the model itself.

While numerous evaluations of microfinance have been conducted, consensus on the overall effects across different contexts has been limited by concerns about generalisability. Meager (2018) aims to overcome this concern by creating a model that accounts for the variability found across seven major studies and provides estimates of the average impact of microcredit, as well as how much impact differs between different microcredit programmes.

She studies the impact of access to microcredit on six indicators: household business profits, business expenditures, business revenues, consumption, spending on consumer durables (e.g., household appliances), and spending on temptation goods (e.g., alcohol and tobacco). She finds the average effects of access to microcredit on these outcomes are small and uncertain, at around a 5% increase. She also finds moderate to high probability of zero impact, both within and across studies.

Recent literature has suggested several possible reasons for the inability of traditional microfinance to achieve significant income impacts. Fischer (2013) highlights one possible cause: strict peer and institutional monitoring requirements prevent borrowers from using loans to invest in high-return, high-risk investments. Recent studies discussed in this brief explore other weaknesses of the classic microfinance model: short loan duration combined with high-frequency repayment requirements and inability to target productive borrowers.

Hence, an outstanding question: are all of the features of the traditional microfinance model necessary, or can some be relaxed to obtain better outcomes? The next three key messages explore changes that can be made to improve the effectiveness of microfinance loans.

Handicraft workshop financed by a FATEN microfinance loan in Palestine. Photo credit: Philippe Lissac / Godong / Getty

Key message 2 – Flexibility can boost entrepreneurial activity but also increase risk‑taking and defaults.

One of the major challenges within the traditional microfinance model is immediate and strict payment obligations, making it difficult for borrowers to use the money for productive investments. An IGC study by Field et al. (2013) examines whether immediate repayment obligations of the classic microfinance contract inhibit entrepreneurship and therefore diminish the potential impact of microfinance. The study compares the traditional contract, which requires that the repayment of microcredit loans begins immediately after loan disbursement, to a new contract that includes a two-month grace period.

The study finds the introduction of a grace period led to a significant change in economic activity: microenterprise investment was higher and the likelihood of starting a new business was more than double among clients who received a grace period contract. Moreover, nearly three years after receiving the loan, weekly business profit and monthly household income for grace period clients remained significantly higher than for traditional contract clients. However, the study also finds evidence of heightened risk-taking among grace period clients, and they were three times more likely to default than regular clients in the short run. Given such high risk-taking, an open question is whether subsidising microfinance institutions (MFIs) offering grace period contracts can encourage higher returns but riskier investments among poor borrowers 2.

In a companion study, Field et al. (2012), explored the impact of switching from weekly to monthly repayment frequency. The change more than doubled business income, increasing household income by 84–88%, and caused no increase in the default rate during the study period. The same study also found that clients were 51% less likely to report feeling “worried, tense, or anxious” and substantially more likely to report feeling confident about repaying.

These results suggest some simple changes to loan contract design could significantly enhance the effectiveness of microfinance. In particular, products providing higher flexible capital and loosening credit constraints at the start of the loan appear to effectively boost the entrepreneurial capacity of poor clients. However, there is an important caveat of higher default rates being associated with more flexible contracts. It is therefore important to know whom to offer the loans and flexible contracts to.

Why do most MFIs not offer a grace period or flexible contract at higher interest rates given the likelihood of bigger business profits for clients? It appears that lack of information about creditworthiness and the entrepreneurial qualities of clients plays an important role.

A market in Dhaka, Bangladesh. Photo: Getty | Munir Uz Zaman

Key message 3 – Screening borrowers using local information can lead to better targeting and improved welfare

In addition to the multiple restrictions in the traditional microfinance model, like regular meetings and saving obligations, which might affect the performance of these loans, the traditional model is also unable to screen out unproductive borrowers. Given their greater likelihood of defaulting, unproductive borrowers pay high-interest rates in the informal credit market. As a result, such borrowers have a strong incentive to apply for microcredit loans. Since microfinance loan officers lack fine-grained information about the risk and productivity of poor borrowers, as discussed in the previous section, they cannot screen these unproductive borrowers with sufficient precision.

Against this backdrop, an IGC study by Maitra et al. (2017) designed an alternative mechanism to leverage the information about borrower characteristics that exists within the local community, called agent-intermediated lending. The study was conducted with potato-growing farmers in the Indian state of West Bengal,where the authors tested two types of agent‑intermediated lending:

- Trader-agent intermediated lending (TRAIL): The agent is a private trader/shopkeeper with considerable experience in lending within the community.

- Gram panchayat-agent intermediated lending (GRAIL): The agent is appointed by the local government (village council).

The authors relaxed norms, such as those pertaining to meetings and saving, for both the intermediated lending schemes, and the duration of the loan cycle was increased to match that of the cropping cycle. The TRAIL and GRAIL schemes were tested against each other as well as against a more traditional group‑based lending (GBL)3 scheme.

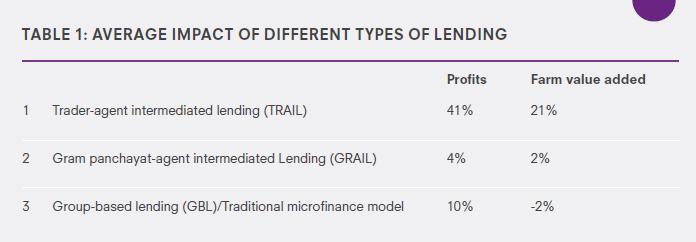

The results showed that recipients in the TRAIL scheme were particularly successful in increasing potato cultivation and output. Their farm incomes increased significantly, without any off-setting decline in income from other sources (See Table 1). Furthermore, TRAIL increased the amount of land under potato cultivation and net profits of TRAIL borrowers.

Table 1: Average impact of different types of lending

Community members need to be incentivised to provide accurate information about borrowers’ creditworthiness

Eliciting reliable information from community members in a high-stake setting is not a straightforward task. In the Maitra et al. (2017) study, while the farm incomes of borrowers identified by TRAIL agents (economic agents) increased significantly, the outcomes of GRAIL (political agents) borrowers did not change. This was despite all features of both the TRAIL and GRAIL schemes being the same and identical financial incentives offered to the agents under both schemes.

In the case of Hussam at el. (2017), the study was designed to investigate whether community members distort their reports if they are provided with different incentives. It found that they did distort their reports when told that their information would influence the distribution of grants.

Both the studies showed that while community information can be quite valuable for targeting, its accuracy is sensitive to the conditions under which it is elicited. Both studies identified a natural tendency for respondents to favour their friends, fellow political affiliates, voters, and family members. The studies also showed that a variety of techniques, in particular small monetary payments for accuracy, eliciting reports in public rather than in private, and accessing information from non-political agents can all improve the accuracy of information.

The outcomes of borrowers in GRAIL and GBL did not change appreciably. This is despite the fact that all loans were provided at below-market-average interest rates, had repayment durations that matched local crop cycles, and included insurance against local yield and price shocks.

Another study by Hussam et al. (2017), similarly uses community information to identify productive entrepreneurs and assess credit risk. In an experiment in the Indian state of Maharashtra, the authors asked entrepreneurs to rank their peers on various metrics of business profitability, growth, and entrepreneur characteristics. The authors then assessed the validity of the information in an experiment where one‑third of these entrepreneurs randomly received a cash grant of about $100 for their businesses.

The study found that community members can identify high-return entrepreneurs with stunning accuracy. While the average marginal return to the grant was about 8% per month, entrepreneurs ranked in the top third of the community earned returns between 17–27%. Had the authors distributed their grants using community reports on predicted marginal returns instead of random assignment, they could have more than tripled the total return on investment. The findings suggest that community information is valuable above and beyond information that can be predicted through machine learning techniques using observable information about clients.

The idea that social networks – friends, family, colleagues, and local leaders – are a rich source of information has deep roots in development economics literature. However, there have been relatively few studies on exacting this information and using it. Both Maitra et al. (2017) and Hussam at el. (2017) show that the knowledge neighbours have about one another is highly predictive of clients’ marginal returns to capital and can be used for improving microcredit products. Both these studies also show that community information can lead to better targeting and increased profits, without affecting defaults.

SKS Microfinance loan recipient in a village outside Ahmedabad, India. Photo credit: Sam Panthaky/ AFP/Getty Images

Key message 4 – Broadening the use of microcredit beyond entrepreneurial activities could increase economic activity and borrower welfare

Microcredit has the potential to be used for a broader variety of purposes, such as supporting borrowers to migrate, find jobs, or smooth consumption during difficult seasons. There are likely many more ‘employees’ than entrepreneurs’ in the world – those who would prefer a job with a stable income over the risk of starting a business – and those who could use microcredit for smoothing consumption during bad days and months. Recent studies how that lending for such purposes could increase household welfare.

Microcredit for migration

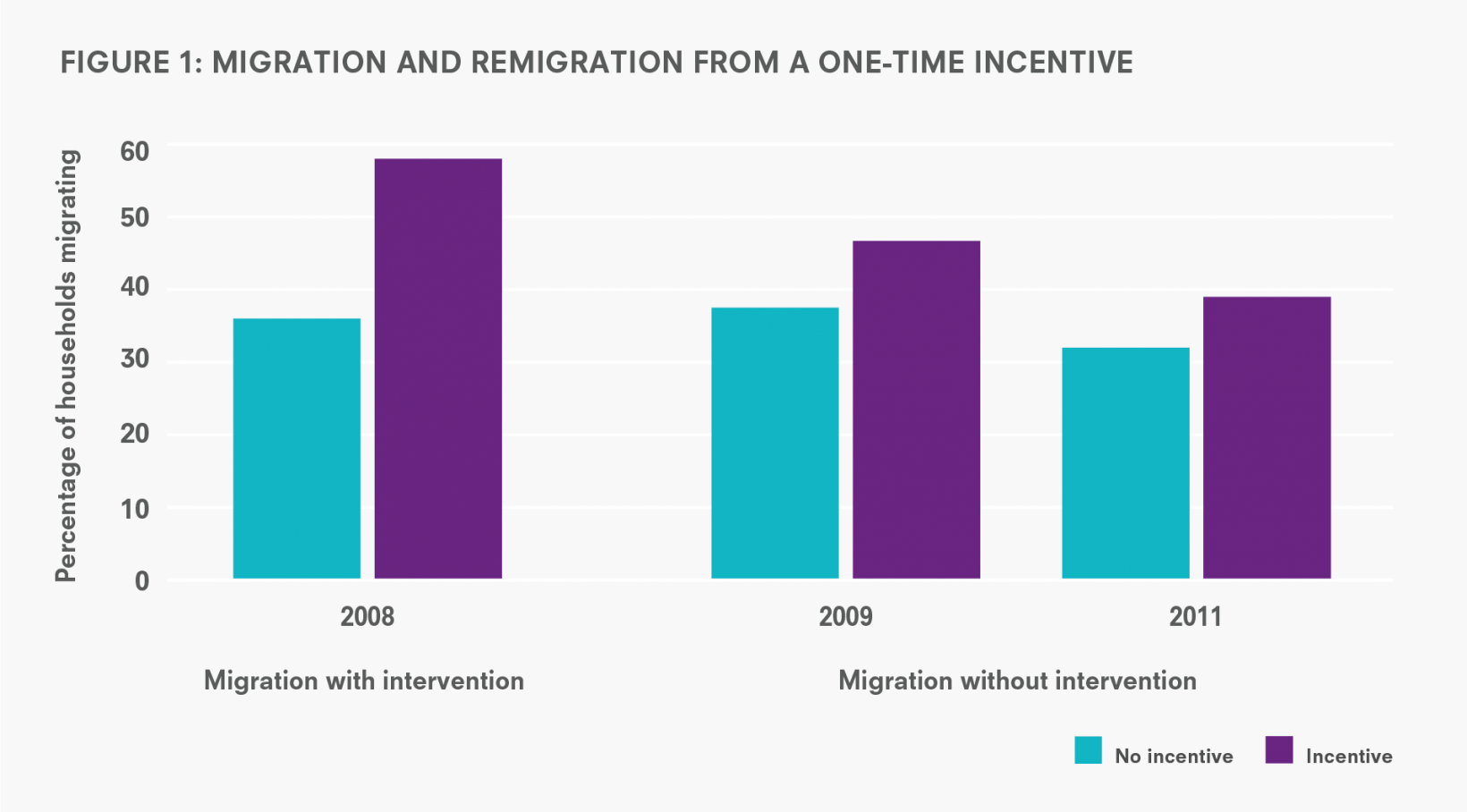

In an IGC study in Bangladesh, Bryan et al. (2014) measured the impact of information, microcredit loans, and small cash grants on migration, food security, and income. Hunger during pre-harvest ‘lean’ seasons is widespread in the agrarian areas of Asia and Sub‑Saharan Africa. From 2008–2011, researchers randomly assigned incentives – about $8.50 in cash or credit to cover the cost of a round‑trip bus fare – to households in rural Bangladesh to encourage them to temporarily migrate to urban areas during the lean season. They hypothesised that enabling labour mobility would increase economic activity and incomes.

Researchers found that the loan and grant had a significant impact on migration during the 2009 lean season and remigration during the following two seasons (see Figure 1). This also led to increased food and non-food spending and calories consumed by migrants’ families.

The study reveals microcredit can overcome the barriers preventing poor rural households from taking advantage of seasonal migration. Notably, there is no effect in the group only given information, indicating the reluctance to migrate is not because the poor are misinformed about the profitability of migrating.

Figure 1: Migration and remigration from a one-time incentive

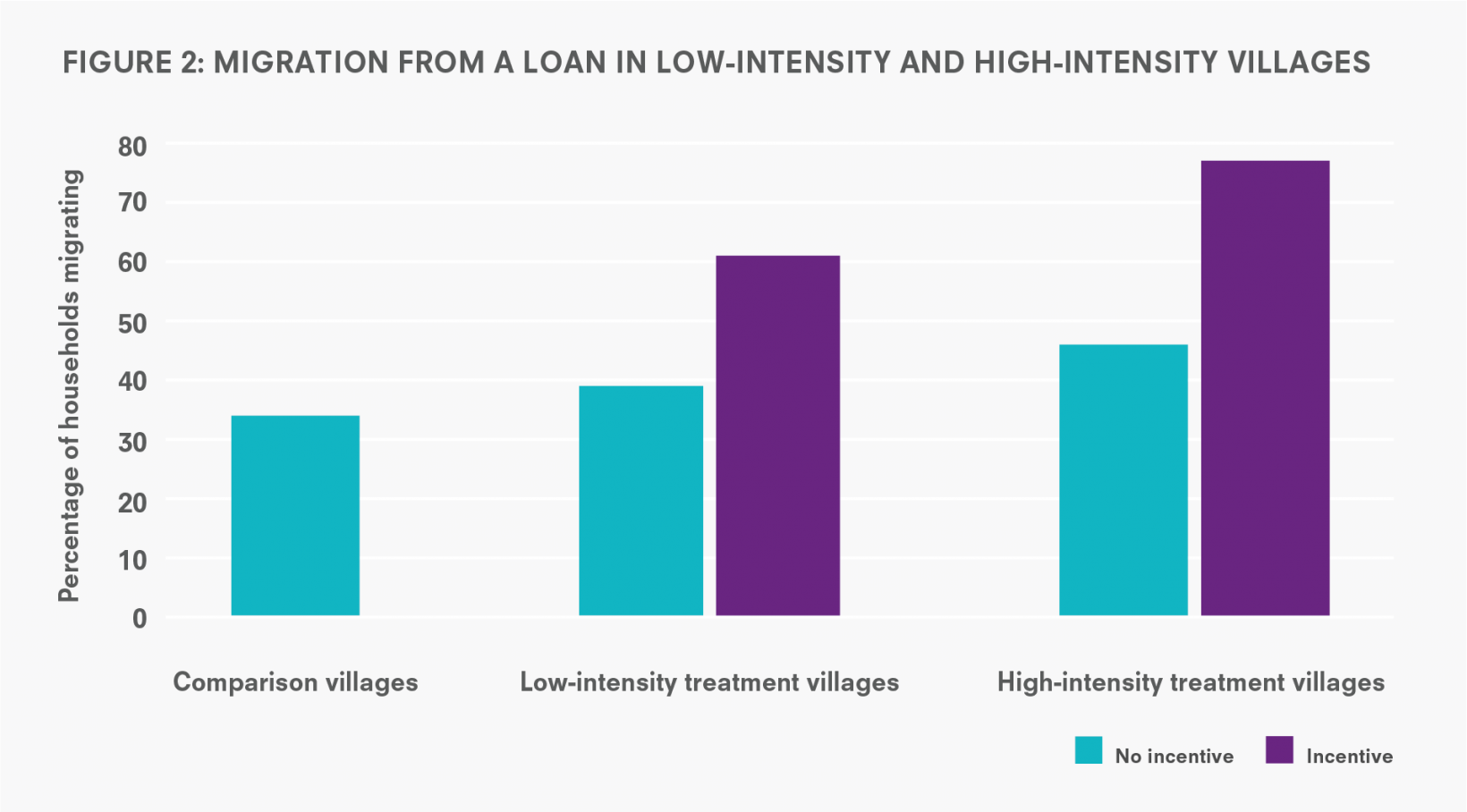

In the 2014 lean season, the same researchers conducted a second experiment that randomly assigned villages to one of two groups: a ‘lowintensity’ treatment in which 10% of the landless population were offered a loan, or a ‘high-intensity’ treatment where 50% of the landless population were offered the same loan. Again, offering the loan substantially increased seasonal migration (Figure 2) and income increased by an average of 19% during the lean season for households offered the loan in high-intensity villages. The increase in migration was higher in high-intensity villages, indicating some benefits of coordinated travel when many neighbours simultaneously receive job offers.

Microcredit for consumption smoothing with productive consequences

Fink et al. (2018) develop a model to show that seasonal cash constraints during lean seasons not only undermine households’ ability to smooth consumption over the cropping cycle, but also affect labour markets if cash‑constrained farmers sell family labour to meet short-run cash needs. They found providing access to subsidised microcredit during the lean season reduces aggregate labour supply, drives up wages, and reallocates labour from less to more cash-constrained farms – but also increases consumption.

Additionally, due to a credit crunch, small-scale farmers are commonly observed to ‘sell low and buy high’, rather than the reverse. In an experiment in Kenya, Burke et al. (2018) show that providing timely access to credit allows farmers to buy at lower prices and sell at higher prices, increasing farm revenues and generating a higher return on investment.

Microcredit can also be useful for smoothing consumption after natural shocks. In a recent experiment Lane (2018), microfinance clients were randomly pre-approved for loans made available in the event of local flooding. The study showed this unique type of microcredit improved household welfare through two channels: a ‘pre‑event’ insurance effect, where households increased investment in productive but risky production, and a ‘post-event’ effect, where households were better able to maintain consumption and asset levels.

Findings from these studies suggest large potential welfare gains from using microcredit for a broader variety of useful purposes beyond promoting entrepreneurship.

Figure 2: Migration from a loan in low-intensity and high-intensity villages

Challenges of scaling up

Based on the research findings, the migration support programme in Bangladesh was delivered and tested at scale for the first time in 2017 by the non-governmental organisation (NGO) Evidence Action. Performance monitoring revealed mixed results: programme operations expanded substantially, but there were some implementation challenges and programme take-up rates were lower than expected.

The evaluation found the programme did not have the desired impact on inducing migration and consequently did not increase income or consumption. The programme has since addressed implementation issues, namely delivery constraints and ineffective targeting, believed by the researchers to be the primary obstacles to impact. Data from monitoring the ongoing 2018 programme suggest these issues have been substantially resolved. The real test will be the results of the second evaluation emerging in 2019.

Policy recommendations

- Relaxing some aspects of the traditional microfinance model, targeting microcredit products better, and lending for activities beyond entrepreneurial activities can lead to substantial welfare gains.

- Some simple changes to the contract design for loans – in particular, products providing more flexible capital and loosening the credit constraint – can effectively boost the entrepreneurial capacity of poor clients.

- Policymakers should use existing economic links within communities to identify productive borrowers and better target microfinance products. Institutions could incentivise local intermediaries to cooperate, while ensuring checks and balances to prevent them from exploiting the borrowers.

- Policymakers should encourage the use of microcredit for a broader variety of purposes, such as supporting borrowers to migrate, find jobs, or smooth consumption during lean seasons.

- Policymakers should encourage loan durations to be extended to match crop cycles and shift focus from group to individual liability. The savings in administrative costs eliminating meeting requirements would allow lenders to charge substantially lower interest rates.

References

Attanasio, O., Augsburg, B., De Haas, R., Fitzsimons, E. and Harmgart, H. (2015). “The impacts of microfinance: Evidence from joint-liability lending in Mongolia”, American Economic Journal: Applied Economics. 7 (1), 90–122.

Banerjee, A.V., Karlan, D. and Zinman, J. (2015). “Six randomized evaluations of microcredit: Introduction and further steps”, American Economic Journal: Applied Economics. 7 (1), 1–21.

Bryan, G., Chowdhury, S. and Mobarak, A.M. (2014). “Underinvestment in a profitable technology: The case of seasonal migration in Bangladesh”, Econometrica, 82 (5), 1671–1748.

Field, E., Pande, R., Papp, J. and Park, Y. J. (2012). Repayment flexibility can reduce financial stress: A randomized control trial with microfinance clients in India, Plops ONE 7 (9).

Field, E., Pande, R., Papp, J. and Rigol, N. (2013). “Does the classic microfinance model discourage entrepreneurship among the poor? Experimental evidence from India”, American Economic Journal: Applied Economics. 103 (6), 2196–2226.

Fink, G. B., Jack, K. and Masiye, F. (2018). “Seasonal liquidity, rural labor markets and Agricultural production”, National Bureau of Economic Research, Working Paper 24564. Gene, X. and Karlan, D. (2014). “Group versus individual liability: Long-term evidence from Philippine microcredit lending groups”, Journal of Development Economics, 107, 65–83.

Kaboski, J.P. and Townsend, R.M. (2011). “A structural evaluation of a large-scale quasi experimental microfinance initiative”, Econometrica, 79 (5), 1357–1401.

Lane, G. (2018). Credit Lines as Insurance: Evidence from Bangladesh, Job Market Paper.

Maitra, P., Mitra, S., Mookherjee, D., Motta, A. and Visaria, S. (2017). “Financing smallholder agriculture: An experiment with agent-intermediated microloans in India”, Journal of Development Economics, 127, 306–337.

Meager, R. (2018). Understanding the Average Impact of Microcredit Expansions: A Bayesian Hierarchical Analysis of Seven Randomized Experiments, AEJ: Applied, forthcoming.

Nobel Prize (2014). The Nobel Peace Prize 2006, Nobelprize.org, Nobel Media AB 2014.

World Bank (2018). Does Microfinance Still Hold Promise for Reaching the Poor?, World Bank.

*Note: Bolded text denotes IGC-funded studies.

Citation

Dimble, V., & Mobarak, A.M. (2019). Saving microfinance through innovative lending. IGC Growth Brief Series 017. London: International Growth Centre.