How does profit shifting enable tax avoidance in developing countries?

An effective tax system is critical for sustainable economic development, and states need revenue to finance this development. However, developing countries disproportionately rely on tax revenue from multinational companies (MNCs), who avoid paying taxes through profit shifting.

States need revenue to fund public goods and services for the growth and wellbeing of their citizens. However, tax systems in developing countries suffer from low tax collection due to the size of informal economies and limited state capacity. For example, 5,000 out of 4.1 million registered taxpayers in Tanzania pay 80% of tax.

Base erosion and profit shifting (BEPS) is a form of tax avoidance where a company with subsidiaries in low- and high-tax countries shifts its profit from the high- to the low-tax subsidiary. This is legal, unlike tax evasion, which is illegal. Profit shifting undermines revenue collection and could lead to continued reliance for developing countries on unsustainable financing or aid.

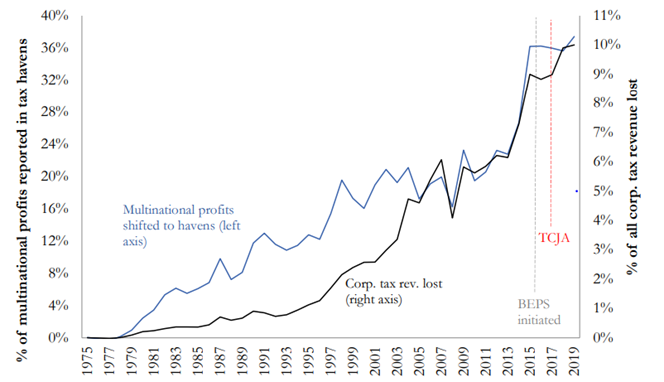

Up to 10% of global corporate tax revenues, totalling US$ 200 billion annually, are lost due to profit shifting. Most firms engaging in profit shifting are headquartered in high-income countries, with 10% of firms doing 98% of the shifting. Profit shifting has increased significantly since 1975 (see Figure 1). Through profit shifting, a company can record billions in revenue while paying almost no tax.

Figure 1: Profits reported in tax havens versus corporate tax revenue lost

Notes: The blue line measures the share of multinational profits reported in tax havens, and the black line measures the share of corporate tax revenues lost as a share of total revenue. Profits reported by multinationals in tax havens increased dramatically from 1975, accompanied by a loss of corporate tax revenue. Figure generated by Ludvig Wier and Gabriel Zucman in their paper here.

Profit shifting occurs in three main ways:

- Firms manipulate export and import prices within the group of companies. Subsidiaries in high-tax countries export goods and services at low prices to their tax haven subsidiaries and import from these havens at high prices.

- Firms in high-tax countries borrow money at high interest rates from affiliates in tax havens since interest is often a deductible expense for tax purposes.

- MNCs move intangible goods, such as patents, financial portfolios, and algorithms, from high- to low-tax firms within the group. This means that returns from these intangibles (such as royalties) are ‘taxable’ in the tax haven.

Profit shifting and developing countries

The ability to effectively collect tax is an indication of state capacity and can contribute to building a social contract between citizens and the state. Done well, citizens are happy to pay taxes because they can see where their taxes are spent – on clean streets, schools, and hospitals.

Profit shifting leeches money out of the economy, meaning fewer resources for governments to leverage and fewer services for citizens to enjoy. Citizens, seeing MNCs pay little tax in their country, could feel betrayed when asked to pay their share.

Given the already low tax-to-GDP ratios of developing countries, corporate income tax is an important source of revenue. Since revenue authorities in developing countries have limited capacity, they are reliant on taxes from a few MNCs which are bigger and more formalised. When MNCs shift their profits to a tax haven, authorities in developing countries are forced to play catch up to collect the tax due on the profit generated in-country.

What can be done about it?

Profit shifting can be eliminated through enforcement of the “arm’s length principle.” This states that transactions between related companies (such as between the high- and low-tax subsidiaries above) should be valued in the same way as transactions between unrelated companies.

However, as the OECD notes, “transfer pricing is not an exact science.” The correct arm’s length price is often unclear – what is the true value of an intangible like “intellectual property?” Furthermore, transfer pricing rules are typically enforced through audits performed by specialist units within revenue authorities. Audits are long and time-consuming, even in countries with ample enforcement capacity such as Denmark. Where does this leave developing countries? With limited resources and state capacity, more must be done to limit losses.

Possible solutions

- Multilateral efforts – although there have been significant efforts to curb profit shifting in recent years with the introduction of the OECD/G20 Inclusive Framework, because of the low tax rate imposed (15%) and the scope being limited to MNCs with revenue exceeding EUR 750 million, this is a significant step but unlikely to solve the problem.

- Unilateral actions – countries can change existing tax laws by imposing higher taxes on profits in tax havens (CFC-rules). Recent research in Ecuador shows a reform that imposed a 5% tax on dividends or corporate profits being paid to a bank account in a tax haven significantly reduced outflows to these tax havens and led to higher income tax being reported by individual taxpayers who received this income in Ecuador. However, Chile, which was a leader in the implementation of the OECD Transfer Pricing guidelines, saw no increased revenue after implementation.

- Investing in enforcement – given the complexity of transfer pricing regulations, investing in enforcement capability through hiring more auditors and using AI is crucial. The use of AI to conduct automatic cross-checks is massively underutilised and is excellent value for money – for the cost of a few thousand dollars of programmer time, millions of dollars in tax revenue could be recovered. An algorithm that automatically flags when a company prices a product differently in related and unrelated transactions could be a simple starting point.

Conclusion

Profit shifting is increasing in size and significance – massive amounts of revenue are foregone each year. This disproportionately affects developing countries which lose out. Although there have been multilateral efforts to curb this phenomenon in recent years, developing countries should take action to limit the risk of being shortchanged. Countries should tighten their existing tax laws and invest in the capacity to enforce these laws by expanding their ability to audit (by hiring more auditors) and leveraging technology to improve the targeting of audits. Existing research in developing countries is thin and more evidence needs to be generated so we can ensure a more equitable tax system.