Why does Bangladesh tax so little?

Corruption has significant negative impacts on tax revenue collection - lowering the tax to GDP ratio and causing long-term economic damage by repressing investment, distorting tax structures and encouraging tax evasion. This reduces an economy’s long-term revenue generating potential.

In their seminal paper Why do developing countries tax so little?, Besley and Persson (2014) showed how weak economic development and tax are correlated. Bangladesh seems to struggle to raise revenue to fund its development, even more than comparable countries in the same income bracket. Bangladeshis are highly averse towards taxes. In the financial year 2022, only 1.4% of people filed tax returns. The number is 5.8% in neighbouring India. Recently, under-invoicing by importers to avoid tariffs has been gaining traction while firms evading corporate taxes is almost an open secret. All this has resulted in an extremely low tax-to-GDP ratio of around 7.5%-9%, the lowest in South Asia and, on average, almost 5% less than lower-middle income countries.

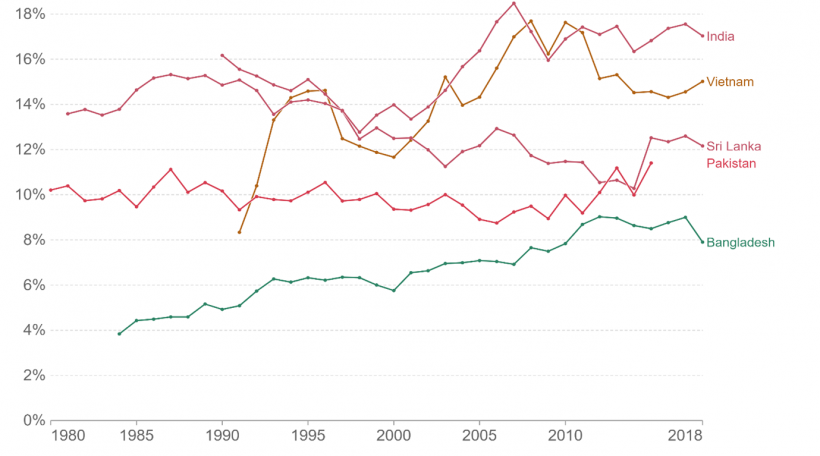

Figure 1: Total tax revenues in select South and South-East Asian countries, 1980 – 2018

Notes: Comparator countries in South and South-East Asia all raise more tax revenue than Bangladesh. This illustrates total revenue from social contributions, direct, and indirect taxes given as a share of GDP. Source: ICTD/UNU-WIDER Government Revenue Dataset and generated using Our World in Data.

Tax morale - citizens’ willingness to pay taxes - depends on the trust they have in the government and the quality of services they receive. Corruption, especially extreme levels of corruption can significantly erode people’s trust in the system leading to tax evasion. On the other hand, corruption in tax administration can also create opportunities to evade taxes. Corruption, therefore, can be both a reason and a tool for tax evasion. It depresses tax morale and discourages people from paying taxes, and then provides a cost-effective way to do so.

Corruption and taxes around the world

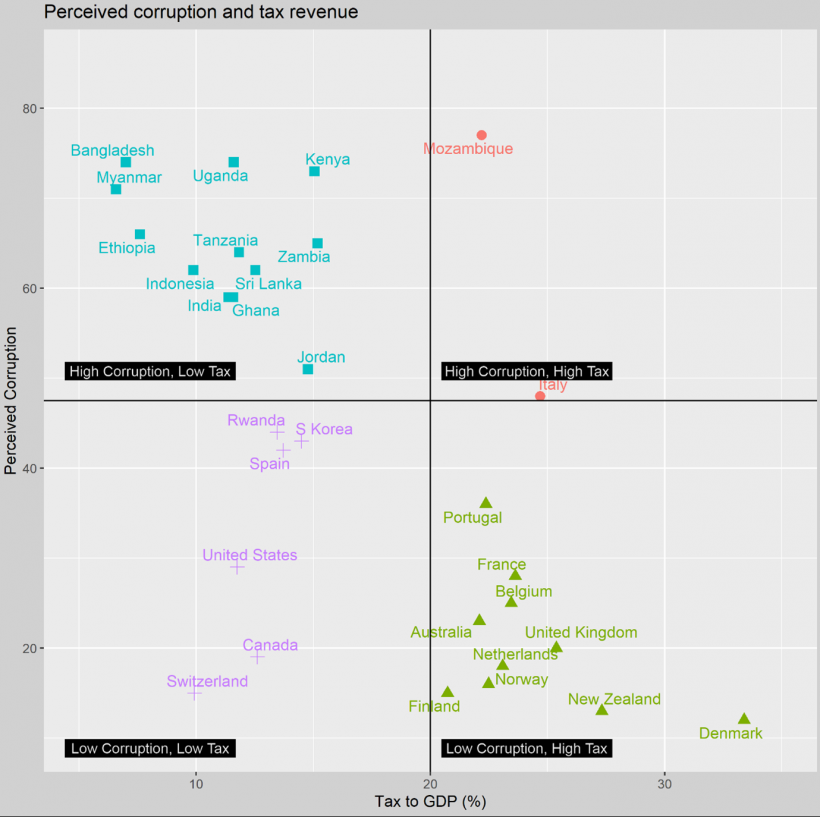

Corruption is correlated with tax to GDP ratio (Figure 2). When taxpayers believe they are living in a corrupt state, their willingness to comply with tax authorities decreases. The level of informality in an economy is also seen as a major reason behind the disparity in tax levels among economies at a similar level of development.

Figure 2: Corruption and tax to GDP ratio for selected developed and developing countries

Notes: It is unlikely for a country to generate high tax revenue if it is also perceived as corrupt. This is evidenced by the presence of only two countries (Mozambique and Italy) in the upper right quadrant (high corruption-high tax). Figure generated by author using the World Bank tax data and Transparency International’s Corruption Perception Index.

Corruption suppresses tax morale in Bangladesh

Bangladesh has a reputation as an endemically corrupt country. For five consecutive years between 2001-05, Bangladesh was ranked as the most corrupt country in the world. The situation has not improved much as Bangladesh remains one of the more corrupt countries. This sticky reputation for corruption is not without reason and high-profile corruption scandals raise questions over the appropriation and use of taxpayer’s hard-earned money.

|

The mysterious pillows of Rooppur The Rooppur Nuclear Power Plant is a 2400 megawatt nuclear-fuelled power facility in Rooppur, Rajshahi. It is Bangladesh’s largest government project costing nearly US$ 12 billion to build a 2400 megawatt nuclear-fuelled power plant facility. In 2019, allegations related to the construction of a residential area for the workers at a cost of US$ 3.1 million began to surface. The government was procuring pillows for this residential area at a cost of US$ 64 each while the market rate will was somewhere around US$ 3-4. Each of these pillows were reportedly transported for US$ 10 from the manufacturer to the site. Further investigation revealed that a contractor who provided sub-standard goods was also popularly affiliated with lawmakers. This incident is now frequently used as an example of government corruption in projects. It is cases like this that undermine public morale and trust essential for tax revenue collection. |

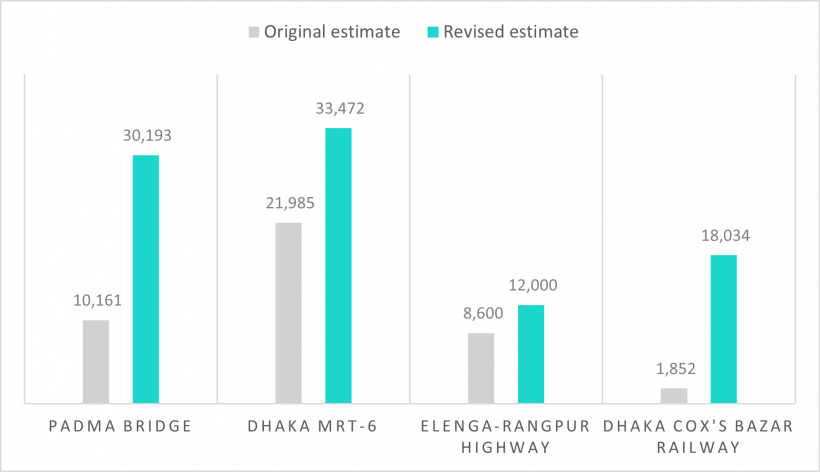

Cost overruns in government projects is a common phenomenon in Bangladesh. Figure 3 shows such instances in four large government projects. The government justifies such cost overruns, which could be as high as 10 times the original budget, citing depreciation of the local currency and various design changes. However, one major reason behind depreciation of local currency is the delay in implementing projects. Bangladesh Taka (BDT) tends to lose value against US$ with time. This means delays make the projects costlier. For example, Padma bridge, a project which ended up costing almost US$ 3 billion instead of around US$ 1.2 billion. It was inaugurated in 2022 although the original project completion date was 2014.Such overruns are not limited to large projects. This is common among projects with costs ranging from US$ 10 million to US$ 12 billion.

The push to raise taxes in Bangladesh is contemporaneous with these excesses in government spending. Unsurprisingly, people are reluctant to forego their earnings only to see them squandered, pushing taxpayers to seek out ways to evade taxes.

Figure 3: Cost overruns on different government projects

Notes: Projects are approved based on a rate of return derived using original estimates while the cost may end up as much as 10 times of that. Costs are expressed in Bangladeshi Taka crores (BDT). Figure generated by author based on newspaper reports. See here, here, and here.

Corruption as a tool to evade taxes

A corrupt tax administration and citizens’ unwillingness to pay taxes is a dangerous combination and a hotbed for collusion. An IGC-funded study in Punjab, Pakistan showed efforts to empower tax collectors to increase property taxes were thwarted by collusion between tax-collectors and tax-payers where collectors were taking payments to value properties at lower than market rate. This is a typical illustration of the Allingham and Sandmo (1972) model which posits that taxpayers evade tax payment when the cost of evasion is smaller than the benefits from it. Taxes are evaded because paying the bribe along with the small chance of getting caught are much less costly than paying the requisite level of tax. Similarly, the tax collectors may find it more rewarding to get paid by the taxpayers than waiting to be rewarded by the authorities for recording and collecting the correct tax payments.

Even though there is no dedicated study on this in Bangladesh, such incidents have come to light amidst the government’s push to increase property tax. Tax inspectors have been reported to promise reductions in tax amounts in exchange for bribes. This illustration of collusion to avoid taxes is not limited to ordinary citizens and field level officials. It took Bangladesh seven years to implement a curtailed version of the 2012 VAT Act amidst protests from businesses represented by the Federation of Bangladesh Chambers of Commerce and Industries (FBCCI), the country’s apex business chamber. Ultimately, the VAT Act that was passed was more similar to the 1991 VAT Act rather than the 2012 one. The failure of tax authorities to implement a newer version of the law streamlined with best practices shows that businesspeople – many of whom are involved in politics – hold more sway than the relevant government agencies.

Reducing corruption to raise tax revenues

Recommendations to increase tax revenue can be multifaceted and may address a variety of issues on both the taxpayer and tax collector side. , We focus on the recommendations related to corruption.

Reduce corruption in major government projects: Bangladesh has completed some major infrastructure projects in the last decade. These projects provided an opportunity for the government to leverage them as symbols of achievement with taxpayer’s money, thereby rebuilding trust. It is important that projects are implemented in a time-efficient manner to foster citizens’ ownership which they can in turn reciprocate by paying taxes. Admittedly, this is a long-term and gradual process requiring consistency but it is much needed

Reduce corruption in tax authority: Corruption is rampant in different agencies of Bangladesh government and the National Board of Revenue (NBR) may not be any different. However, to expect compliance from the general public, the NBR must establish itself as an exceptionally sincere and forthright government agency. To realise this, the NBR must undergo capacity building. Bangladesh is over-reliant on trade taxes and VAT which is easier to collect than income taxes. There has been a recent push to increase direct taxes which will require NBR to perform at a much higher level to identify untapped sources and properly audit the known ones.

Raising tax revenue is tricky for any government, and corruption makes that task even tricker. Corruption can both depress tax morale and encourage tax evasion. If Bangladesh wants to reach a level of tax revenue similar to its counterparts, it is imperative for the government to address irregularities affecting tax revenue with a strong hand.