Expanding trade opportunities for Uganda

Trade is a powerful driver of economic growth. In the context of Uganda, it not only represents an avenue for development but to increased prosperity for its citizens. Hence, the need to foster strategies and policy actions to boost export-oriented activities while building resilience to future shocks through diversification, regional integration, regulatory regimes, and investment across the country.

Since 1990, economic growth underpinned by trade has lifted more than a billion people out of poverty, increasing incomes globally by 24%. It has also proven a powerful means for innovation, job creation, and competitiveness. Most African countries have structural adjustment programmes to facilitate their integration into the world economy. Uganda, particularly, implemented a trade liberalisation regime in 1987,eventually joining other regional and international agreements such as WTO, COMESA, EAC, to name a few. This has opened significant opportunities for the country, alongside challenges that demand prompt attention and swift action in today’s fast-paced environment.

IGC Uganda collaborated with the Ministry of Finance, Planning, and Economic Development to deliver the 7th Economic Growth Forum (EGF) in Kampala. A section of the conference focused on trade, delving into both international and local perspectives from Bernard Hoekman and Isaac M.B Shinyekwa.

Persistent trade deficits

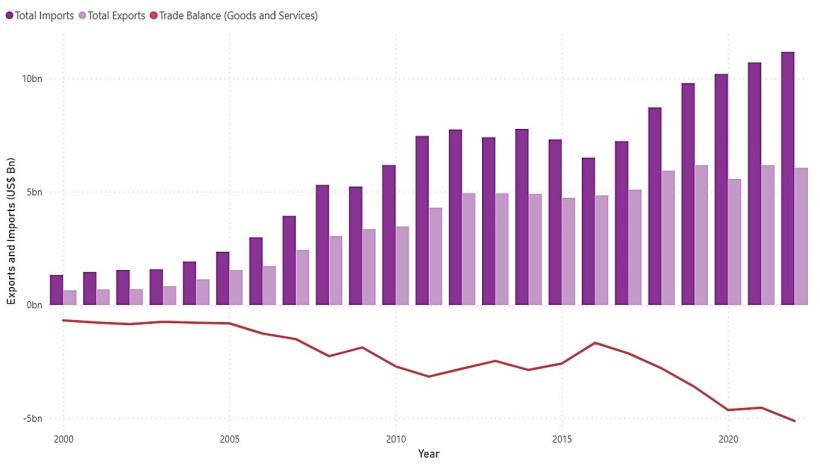

Over the last 40 years, Uganda has exhibited a systemic trade deficit accountable to real differences in growth rates between exports and imports. In 2021, this deficit reached -10.15% (as a percentage of GDP), registering a total value of exported goods and services of US$ 6.2 billion and imports of US$ 10.7 billion (see Figure 1).

Figure 1: Uganda’s total exports and imports of goods and services from 2000 to 2022

Note: Figure 1 illustrates the total value of goods and services exported and imported in Uganda between 2000 and 2022, expressed in US$ billions. Both exports and imports have increased steadily over the past few years though Uganda has a trade deficit. Exports are also more volatile than imports and are more likely to fluctuate from year to year. Source: Figure created by author using selected macroeconomic data from Bank of Uganda (BoU).

On one hand, Isaac M. B. Shinyekwa noted that the country’s export base has historically been driven by agricultural commodities such as coffee (Robusta and Arabica varieties), tea, fresh fruits (bananas and pineapples), and cocoa beans;minerals such as gold have also played a notable role. In recent years however, exports have experienced an increasing participation ofthe manufacturing industry, including cement and steel In an effort for diversification, the biggest change has come from the growth in services – particularly tourism and information technology (IT). Research indicates that services not only have the potential to account for a larger share of employment and value added, but also for faster productivity.

On the other hand, he argued that imports which have been primarily propelled by China (US$ 1.02 billion amounting to a partner share of 16.39% in 2020), India (US$ 959 million), and Kenya (US$ 773 million) showcase Uganda’s needs and strategic partnerships. Refined petroleum constitutes a significant portion (15%) of the total landscape, addressing the country’s energy requirements and fuel transportation; Machinery, equipment, and pharmaceutical-related products (vaccines, antisera, blood) play a crucial role too.

Both prevailing trade dynamics have undergone changes given unforeseen disruptions such as COVID-19 pandemic, geopolitical tensions arising from the Ukraine-Russia conflict, climate-related shocks, among others. These have imposed challenges as well as opportunities for enhancing robustness, resilience, and flexibility. Challenges ahead, Uganda faces multiple constraints that undermine its export potential and strengthen its overdependency on imports:

Reliance on primary commodities results in exposure to price volatility

Export dependency on primary commodities exposes Uganda’s economy to price volatility in international markets. These fluctuations can generate unpredictable swings in export revenue, macroeconomic instability, budget deficits, and high indebtedness. Furthermore, the cyclical nature of agricultural prices and reliance on weather conditions hinder the country’s long-term planning, investment, diversification, and access to risk management tools.

Low quality assurance and infrastructure limits access to international markets

Uganda National Bureau of Standards (UNBS) estimates that the country’s quality infrastructure capacity is at 40% (as presented by Isaac M. B. Shinyekwa at the 7th EGF).. Underdevelopment is attributable to a low laboratory capacity for supporting the growing demand by the private sector, absence of legislation and an accreditation body, alongside a weak framework for coordination and collaboration. Inefficiency in trade, transportation, energy, and even communication infrastructure leads to increased exportation costs, making goods less competitive in international markets. Besides affecting quality and standards, compliance which is crucial for maintaining a positive reputation internationally it limits the access to new markets both intra- and extra-regionally.

Limited productivity and value chains hinder higher profits

High input costs, limited access to financing, competition from imported substandard or counterfeit products, weak institutional capacity, decentralised market information, outdated technology, and scarce innovation, are some of the key factors that constrain productivity across Uganda’s small- and large-scale firms. This results in the establishment of value chains which lack diversification and robust value addition processes, thereby restricting the nation’s ability to maximise its potential and capture higher profits.

Non-tariff barriers (NTBs)

Uganda is part of the East African Community (EAC) Customs Union; a regional intergovernmental agreement that promotes economic growth by eliminating tariffs and non-tariff barriers (NTBs) among member states. Despite continuous efforts, NTBs have persisted throughout the years, including administrative and bureaucratic inefficiencies; unharmonised standards and technical requirements; poor infrastructure and communication networks; cumbersome sanitary and phytosanitary conditions, among others. These jointly undermine regional integration and the free flow of goods and services. Nevertheless, amidst these challenges lie numerous opportunities awaiting exploration.

Opportunities and policy implications

Reducing trade costs

To strategically reduce trade costs a two-way approach is suggested. First, simplifying customs procedures, digitising documentation, and improving the efficiency of clearance mechanisms, are essential for reducing the time and resources that firms expend in within the sector, encouraging local entrepreneurs to explore trade opportunities. Second, inward Foreign Direct Investment (FDI) should be attracted through a stable and business-friendly environment for developing export processing zones (EPZs) with special trade incentives and efficient infrastructure, as well as for increasing productivity and international market access opportunities.

Strengthening domestic supply chains

Focusing resources on strengthening current supply chains in Uganda could boost the economy by reducing imports, increasing value added activities and diversification, creating jobs, and transferring technology. The country should foster inclusivity by connecting micro, small, and medium-sized enterprises (MSMEs) to national and regional value chains, thereby exploiting opportunities under current trade agreements. To overcome the challenge of market information asymmetries while ensuring compliance and enforcement, it is necessary to reduce transaction costs for creating and operating value chains and to encourage research and innovation at the base across industries.

Unlocking the potential of services as driver of productivity

Bernard Hoekman emphasised that efficient services as inputs are fundamental for increasing productivity in diverse sectors. Therefore, bolstering their availability through cross-border trade, regional integration, and FDI, whilst streamlining their regulatory burden in Uganda, ensuring alignment with public policy objectives and fostering the private sector capacity is key to enhancing the country’s competitive advantage.

Services are emerging as a dynamic source of exports. Tourism, IT, and education, for example, have shown wide potential for earnings. Consequently, rising marketing efforts, investment in infrastructure, availability of a young and tech-savvy workforce, combined with the government’s efforts to contribute to higher value-added activities, are suggested.

Enhancing and amplifying the export base

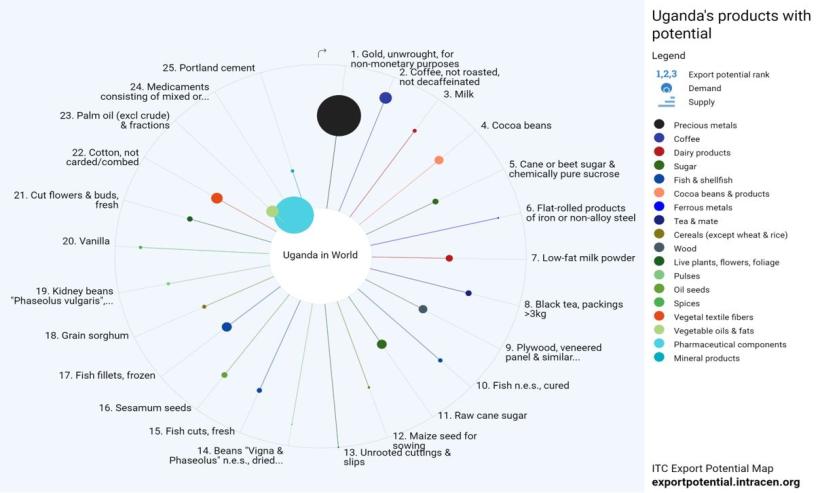

Isaac M. B. Shinyekwa highlighted that Uganda has a big, unexplored export potential, estimated at over US$ 1.1 billion. In presenting Uganda’s Export Potential Map (Figure 2), he argued that precious metals (particularly gold), coffee, dairy products, cocoa beans, as well as cane or beet sugar are products that the country could take advantage of. Opportunities to diversify into jute, cashew nuts and legumes are present. According to him, enhancing Uganda’s productive capacity for domestic and export markets, fostering inclusiveness, and developing strong response mechanisms to implementation risks, and logistical constraints are potential strategies for strengthening and amplifying the current export base.

Figure 2: Uganda’s export potential

Note: The diagram is an International Trade Centre (ITC) Export Potential Map It suggests that Uganda has the potential to increase its trade activities in new products and markets. Source: Isaac M.B Shinyekwa’s presentation at the 7th edition of the EGF.

Balancing the scale and the road ahead

Uganda faces significant challenges that explain its systemic trade deficit over the past decades. Reliance on primary commodities, low quality assurance and infrastructure, limited productivity and weak value chains, alongside NTBs and increasing informality, are some of the prevalent constraints which undermine the country’s export potential whilst enhancing its overdependency on imports.

The country requires innovative trade policies which adapt to today’s volatile scenarios and stochastic shocks, embracing opportunities for growth. These policies should reduce trade costs, strengthen domestic supply chains, and actualise the services sector as a driver of productivity and exports.